The year 2024 marks a pivotal moment in the United States stock market, with numerous flows and trends shaping the landscape. In this article, we will delve into the key factors influencing the US stock market in 2024, including technological advancements, regulatory changes, and global economic conditions.

Technological Advancements and Their Impact

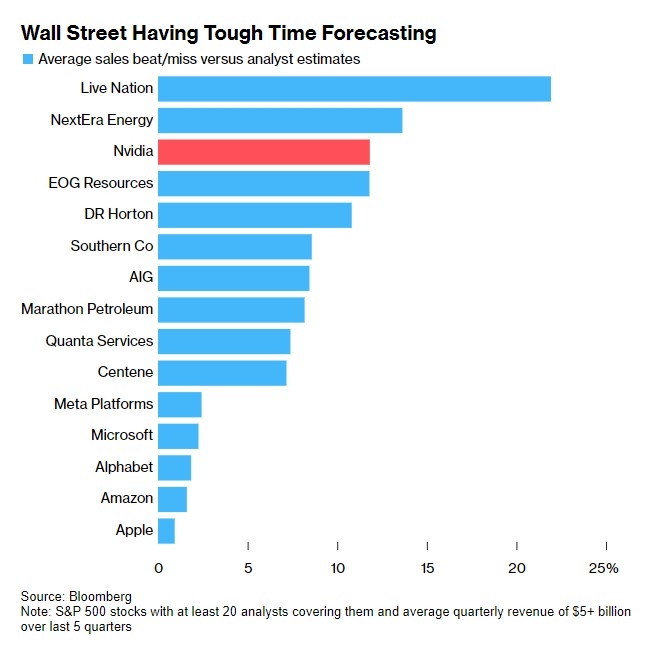

One of the most significant factors shaping the US stock market in 2024 is the rapid pace of technological advancements. Artificial intelligence, machine learning, and blockchain are revolutionizing various sectors, including finance, healthcare, and retail. Tech giants such as Apple, Google, and Amazon continue to dominate the market, while startups and small-cap companies are leveraging technology to innovate and disrupt traditional industries.

For instance, Tesla has been at the forefront of the electric vehicle (EV) revolution, with its market capitalization soaring in 2024. The company's commitment to sustainable energy and cutting-edge technology has made it a darling of investors, leading to substantial stock market flows.

Regulatory Changes and Their Implications

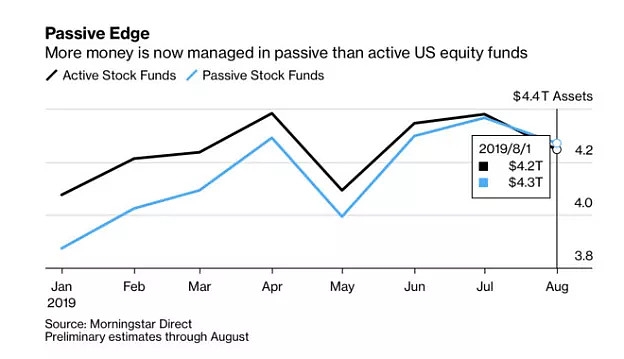

The US government has been actively implementing regulatory changes to ensure the stability and fairness of the stock market. In 2024, SEC (Securities and Exchange Commission) has been focusing on corporate governance, market structure, and market integrity.

One of the key regulatory changes in 2024 is the introduction of stakeholder capitalism, which emphasizes the importance of environmental, social, and governance (ESG) factors in corporate decision-making. This shift has led to increased investment in sustainable companies and ESG-focused funds, thereby impacting stock market flows.

Global Economic Conditions and Their Influence

The global economic landscape has been volatile in 2024, with geopolitical tensions, inflation, and interest rate hikes posing challenges to the US stock market. Emerging markets such as China and India have experienced slowdowns, which have had a ripple effect on the global economy.

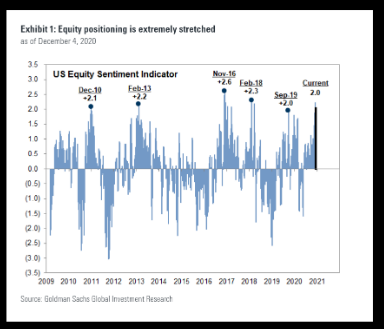

Despite these challenges, the US stock market has remained relatively resilient. The Fed's accommodative monetary policy and strong economic growth have supported investor confidence. However, risk-off sentiment has led to increased volatility in the market.

Case Studies: Sectors Driving Stock Market Flows

Several sectors have been driving stock market flows in 2024. Here are a few notable examples:

Healthcare: With the aging population and advancements in medical technology, the healthcare sector has seen significant stock market flows. Companies like Moderna and Regeneron have seen their stocks soar due to their successful COVID-19 vaccines and treatments.

Energy: The energy sector has experienced a renaissance in 2024, driven by the increasing demand for clean energy and the transition to renewable sources. Companies like Tesla and SolarEdge have seen substantial stock market flows.

Technology: The technology sector remains a major driver of stock market flows, with companies like Apple, Google, and Amazon leading the charge. The rapid pace of technological advancements continues to fuel investor interest in this sector.

In conclusion, the year 2024 has been a year of significant changes and challenges for the US stock market. From technological advancements to regulatory changes and global economic conditions, numerous factors have shaped the market landscape. As investors navigate these trends, it is crucial to stay informed and adapt to the ever-evolving market dynamics.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....