As we approach the end of 2020, investors are already looking ahead to what the US stock market might hold for 2021. The past year has been tumultuous, with the market experiencing unprecedented volatility. However, despite the challenges, many experts are optimistic about the potential for growth in the coming year. In this article, we'll explore some of the key predictions for the US stock market in 2021.

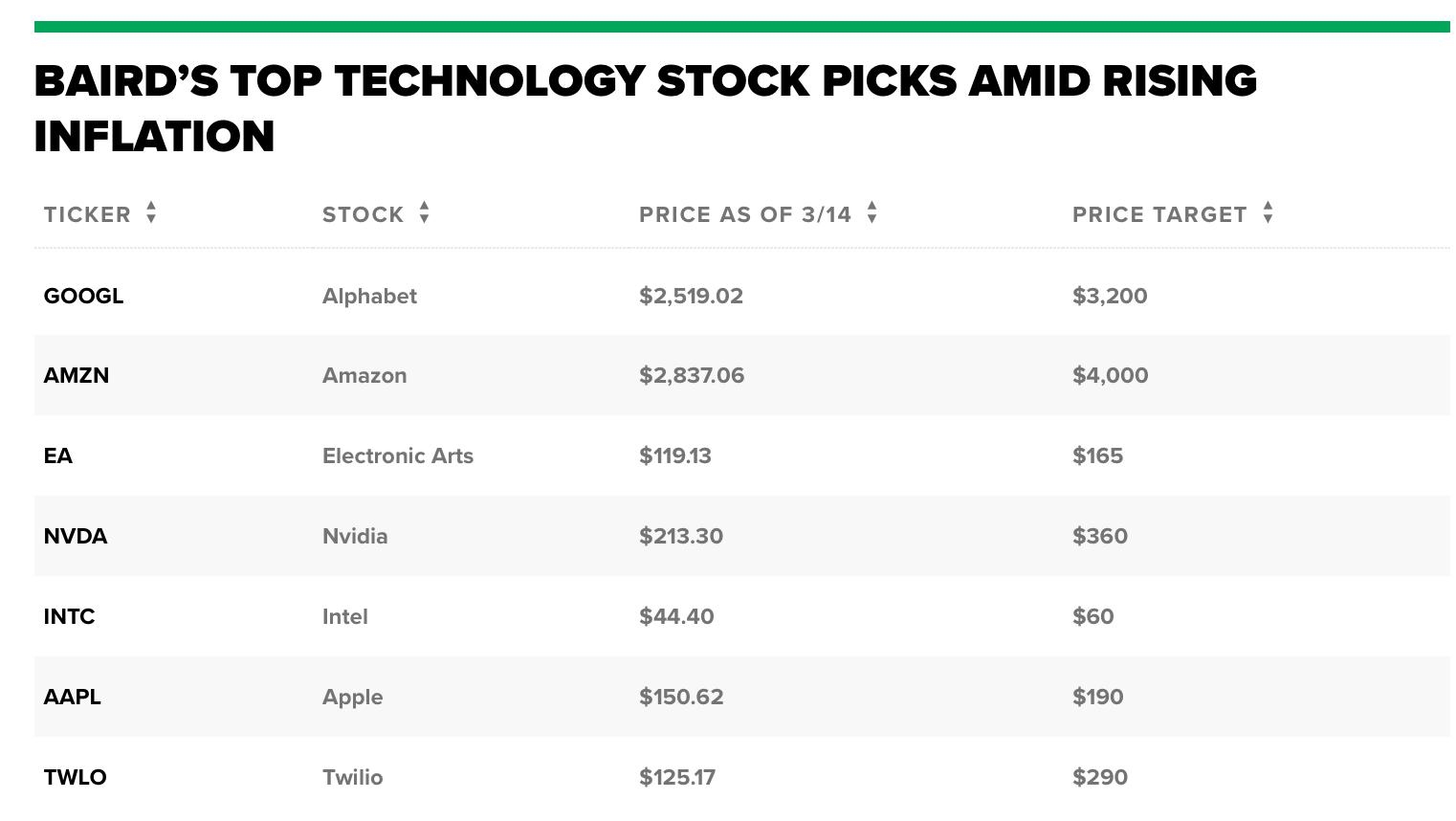

1. Technology Stocks to Remain Strong

Technology stocks have been a major driver of the US stock market's growth in recent years, and this trend is expected to continue in 2021. Companies like Apple, Microsoft, and Amazon are likely to see continued growth as the demand for their products and services remains strong. Cloud computing, artificial intelligence, and 5G technology are expected to be key areas of focus for these companies, further driving their stock prices higher.

2. Healthcare Stocks to Benefit from Pandemic

The COVID-19 pandemic has had a significant impact on the healthcare industry, and this impact is expected to continue into 2021. Biotech and pharmaceutical companies have been at the forefront of the fight against the virus, and their efforts have paid off in the form of strong stock performance. As the pandemic continues to evolve, these companies are likely to see further growth as they work on vaccines and treatments.

3. Energy Sector to Rebound

The energy sector has been hit hard by the pandemic, but many experts believe that it is poised for a rebound in 2021. As the global economy recovers, demand for oil and natural gas is expected to increase, leading to higher prices and improved profitability for energy companies. ExxonMobil, Chevron, and Schlumberger are among the companies that could benefit from this trend.

4. Small-Cap Stocks to Outperform

While large-cap stocks have been the stars of the market in recent years, many experts believe that small-cap stocks could outperform in 2021. Small-cap companies tend to be more agile and innovative, and they often have more growth potential than their larger counterparts. As the economy recovers, these companies could see significant gains as they capitalize on new opportunities.

5. Diversification is Key

Given the uncertain nature of the market, diversification is more important than ever. Investors should consider adding a variety of asset classes to their portfolios, including stocks, bonds, and alternative investments. This can help mitigate risk and protect against potential market downturns.

Case Study: Tesla

A prime example of a company that has defied market expectations is Tesla. Despite the challenges posed by the pandemic, Tesla's stock has continued to rise, driven by strong sales of its electric vehicles and growth in its energy storage business. This is a testament to the resilience and innovation of the company, and it serves as a reminder that even in a turbulent market, there are opportunities for significant growth.

In conclusion, while no one can predict the future with certainty, these predictions provide a glimpse into what the US stock market might hold for 2021. As always, investors should do their research and consult with a financial advisor before making any investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....