In the wake of the recent market downturn, investors are eagerly awaiting the stocks rebound. The stock market has been volatile, but there are signs of a recovery on the horizon. This article delves into the factors contributing to the market's recovery and provides insights for investors looking to capitalize on this trend.

Understanding the Stock Market Recovery

The stock market's recovery is driven by several key factors. Firstly, economic indicators are showing signs of improvement. As the global economy begins to stabilize, companies are reporting better-than-expected earnings, which is boosting investor confidence. Additionally, central banks around the world are implementing measures to stimulate economic growth, which is further supporting the market's rebound.

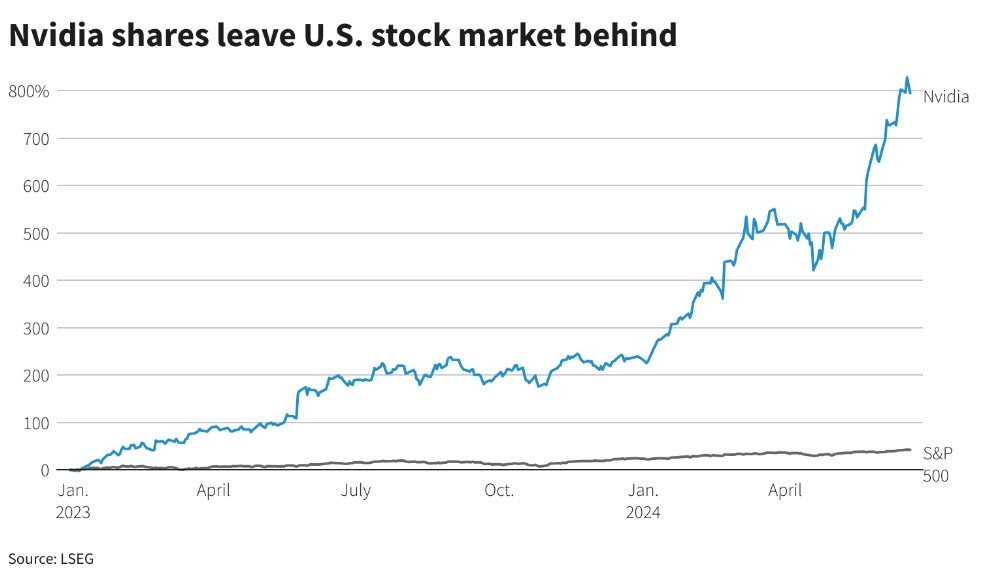

Technological Advancements and Innovation

Another crucial factor in the stocks rebound is the rapid pace of technological advancements. Innovations in various sectors, such as artificial intelligence, biotechnology, and renewable energy, are creating new opportunities for investors. Companies at the forefront of these advancements are seeing significant growth, contributing to the overall market recovery.

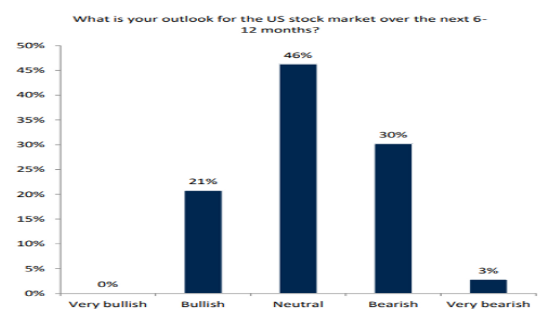

Market Sentiment and Consumer Confidence

Market sentiment and consumer confidence play a vital role in the stock market's performance. As the economy improves and consumer spending increases, companies see higher demand for their products and services. This positive outlook leads to higher stock prices and a rebound in the market.

Case Study: Tech Stocks Leading the Recovery

One sector that has been leading the stocks rebound is the technology industry. Companies like Apple, Microsoft, and Amazon have seen significant growth in recent months. These companies are not only benefiting from the increasing demand for their products and services but are also investing heavily in research and development, ensuring their long-term growth potential.

Diversification and Risk Management

As investors look to capitalize on the stocks rebound, it is crucial to focus on diversification and risk management. Diversifying your portfolio across various sectors and asset classes can help mitigate the risk of market volatility. Additionally, staying informed about market trends and economic indicators is essential for making informed investment decisions.

Conclusion

The stocks rebound presents a promising opportunity for investors. By understanding the factors contributing to the market's recovery and focusing on diversification and risk management, investors can navigate the market's volatility and capitalize on this trend. As the economy continues to stabilize, the stocks rebound is expected to continue, offering investors a chance to grow their portfolios.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....