Understanding the Difference

When it comes to retirement planning, one of the most crucial decisions involves where to invest your savings. Many investors often weigh between investing in U.S. stocks and exploring international stock markets. But what are the differences, and which option might be better for your retirement portfolio? In this article, we'll delve into the nuances of both and help you make an informed decision.

U.S. Stocks: The Domestic Market

The U.S. stock market is the largest and most diversified in the world. It encompasses a wide range of industries and companies, from small startups to large multinational corporations. Investing in U.S. stocks provides several advantages:

- Diversification: The U.S. market includes various sectors, such as technology, healthcare, finance, and consumer goods. This diversity can help reduce the risk of your portfolio.

- Economic Stability: The U.S. has a stable political environment and a strong economy, which can attract investors from around the world.

- Access to Information: The U.S. markets are highly regulated, ensuring that investors have access to transparent and reliable information.

However, investing in U.S. stocks also has its downsides:

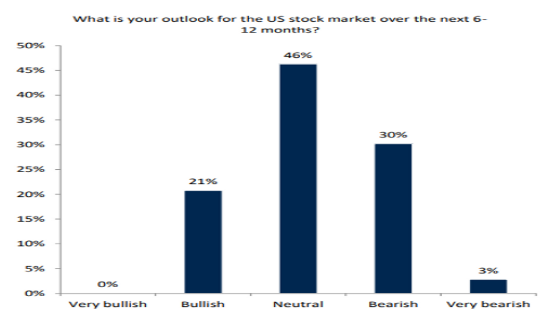

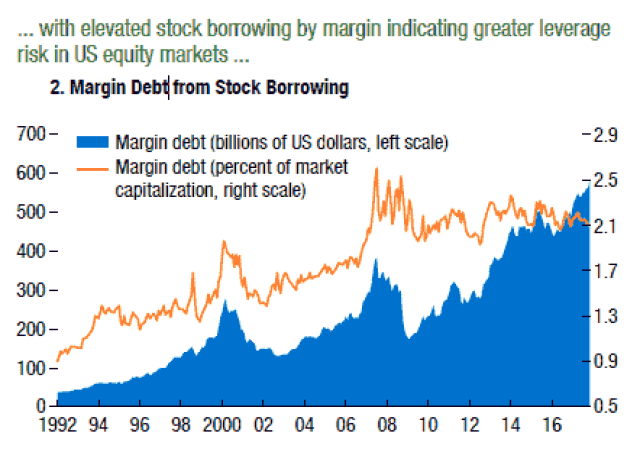

- Volatility: The U.S. market can be highly volatile, with rapid price fluctuations.

- Market Saturation: Some sectors may be overvalued, leading to potential risks.

International Stocks: Exploring Global Opportunities

Investing in international stocks allows you to diversify your portfolio by accessing markets and industries that may not be available in the U.S. This approach can offer several benefits:

- Global Exposure: Investing in international stocks can help you capitalize on the growth potential of emerging markets and established economies.

- Currency Diversification: When investing in foreign stocks, you gain exposure to different currencies, which can help offset the risk of currency fluctuations.

- Unique Opportunities: International markets offer unique opportunities in sectors and companies that may not be available in the U.S.

Despite these advantages, there are also risks involved in investing in international stocks:

- Political and Economic Risk: Some countries may face political instability, economic turmoil, or high inflation, which can impact your investments.

- Regulatory Challenges: Investing in foreign markets may involve navigating complex regulatory frameworks and tax laws.

Case Study: Apple vs. Tencent

To illustrate the difference between U.S. and international stocks, let's consider the case of two major companies: Apple Inc. (AAPL) and Tencent Holdings Ltd. (0700.HK).

- Apple: As a U.S.-based company, Apple is well-known for its innovation and strong brand presence. Its products, such as the iPhone and iPad, have become household names worldwide. Investing in Apple provides exposure to the U.S. market and its stability.

- Tencent: Based in China, Tencent is one of the world's largest technology companies, with a significant presence in social media, gaming, and financial services. Investing in Tencent offers exposure to the rapidly growing Chinese market and its unique opportunities.

Conclusion

Deciding between U.S. and international stocks for your retirement portfolio depends on your investment goals, risk tolerance, and market preferences. While U.S. stocks offer stability and diversification, international stocks provide exposure to global growth opportunities. By understanding the differences and considering case studies like Apple and Tencent, you can make a more informed decision for your retirement planning.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....