In the rapidly evolving landscape of the global economy, the United States has emerged as a powerhouse in the electric industrials sector. With a vast array of companies specializing in electrical equipment, energy, and infrastructure, investors are constantly seeking opportunities to capitalize on this dynamic market. This article delves into the world of US electric industrials stocks, providing an insightful overview of the key players, trends, and potential investment strategies.

Understanding Electric Industrials Stocks

Electric industrials stocks encompass a diverse range of companies involved in the design, manufacturing, and distribution of electrical equipment and systems. This includes everything from power generation and transmission to lighting and automation solutions. The sector is characterized by its resilience, as demand for electricity and related products remains steady across various industries.

Key Players in the US Electric Industrials Sector

Several companies have established themselves as leaders in the US electric industrials sector. Here are some notable examples:

- General Electric (GE): As one of the largest electrical equipment manufacturers in the world, GE has a significant presence in power generation, aviation, healthcare, and renewable energy.

- Siemens: A German multinational conglomerate, Siemens has a strong footprint in the US electric industrials market, offering a wide range of products and services in power generation, transmission, and distribution.

- ABB: A Swiss-Swedish multinational corporation, ABB specializes in power and automation technologies, with a substantial presence in the US market.

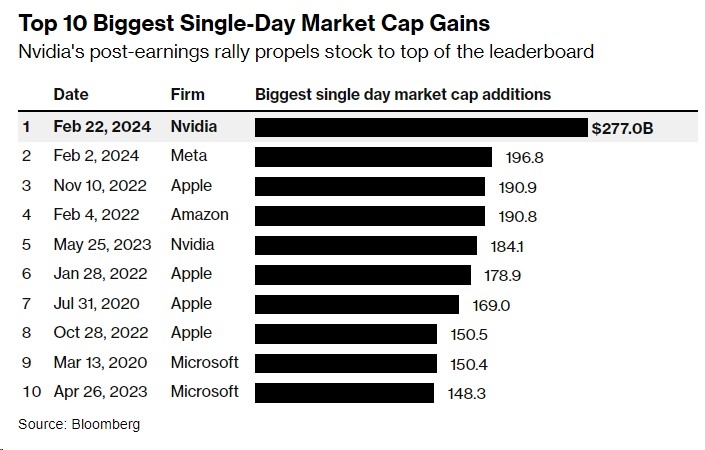

- NVIDIA: While primarily known for its graphics processing units (GPUs), NVIDIA has expanded its offerings to include data center, automotive, and electric vehicle (EV) solutions, making it a key player in the electric industrials sector.

Trends in the Electric Industrials Sector

Several trends are shaping the US electric industrials sector:

- Renewable Energy: With the increasing focus on sustainability, renewable energy sources such as wind, solar, and hydroelectric power are becoming more prevalent. This trend is driving demand for electric industrials stocks involved in the development and maintenance of renewable energy infrastructure.

- Smart Grid: The smart grid is a network of power generation, distribution, and consumption systems that use digital technology to enhance the efficiency, reliability, and sustainability of electricity delivery. Companies involved in the smart grid sector are poised for significant growth.

- Energy Storage: As renewable energy sources become more widespread, energy storage solutions are crucial for ensuring a stable and reliable power supply. Electric industrials stocks focused on energy storage technologies are experiencing rapid growth.

Investment Strategies for Electric Industrials Stocks

Investing in electric industrials stocks requires a careful analysis of various factors, including:

- Company Financials: Assess the financial health of the company, including revenue growth, profitability, and debt levels.

- Market Trends: Stay informed about the latest trends in the electric industrials sector to identify potential opportunities and risks.

- Industry Position: Evaluate the company's position within the industry, considering factors such as market share, competitive advantage, and technological innovation.

Case Study: Tesla's Impact on the Electric Industrials Sector

Tesla, Inc. is a prime example of how a company can disrupt the electric industrials sector. By revolutionizing the electric vehicle (EV) market, Tesla has driven significant growth in the demand for related products and services. This has benefited electric industrials stocks involved in battery manufacturing, EV charging infrastructure, and related technologies.

In conclusion, the US electric industrials sector presents a wealth of investment opportunities. By understanding the key players, trends, and investment strategies, investors can make informed decisions and capitalize on this dynamic market.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....