As we approach October 2025, investors are keen to identify large-cap momentum stocks that could potentially offer significant returns. This article delves into the technical analysis of these stocks, providing insights into their potential performance. By examining key metrics and patterns, we aim to offer valuable insights for investors looking to capitalize on the momentum of these high-profile companies.

Understanding Large Cap Momentum Stocks

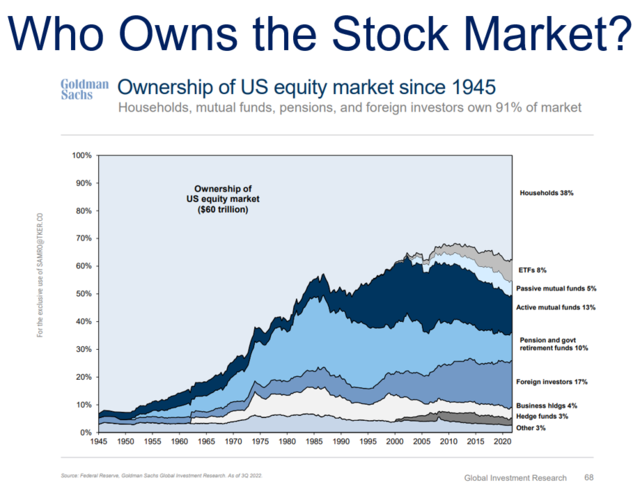

Large cap momentum stocks are typically characterized by their high market capitalization and strong upward price momentum. These companies are often leaders in their respective industries and have a significant presence in the stock market. Identifying these stocks involves analyzing their technical charts, identifying patterns, and understanding the underlying factors driving their momentum.

Key Technical Indicators

To analyze the momentum of large-cap stocks, several technical indicators are commonly used:

Relative Strength Index (RSI): This indicator measures the speed and change of price movements. An RSI above 70 indicates that a stock is overbought, while an RSI below 30 suggests it is oversold.

Moving Averages: These indicators help identify the trend direction and potential support or resistance levels. For example, a 50-day moving average can indicate a long-term trend, while a 200-day moving average can indicate a long-term outlook.

Bollinger Bands: These bands provide a range of expected price movements based on historical volatility. A stock trading outside the upper band may be considered overbought, while trading below the lower band may be considered oversold.

Stocks to Watch

In October 2025, several large-cap momentum stocks are worth considering:

Apple Inc. (AAPL): As the world's largest technology company, Apple continues to dominate the market with its innovative products. Its strong earnings reports and growing consumer base have contributed to its upward momentum.

Microsoft Corporation (MSFT): Microsoft's diverse portfolio of products and services, including cloud computing and gaming, has propelled it to become a market leader. Its consistent earnings growth and increasing market share make it a compelling investment.

Amazon.com Inc. (AMZN): Amazon remains a dominant force in the e-commerce and cloud computing sectors. Its expansion into new markets and continuous innovation have fueled its momentum.

Tesla, Inc. (TSLA): Tesla's position as a leader in electric vehicles and renewable energy solutions has driven its upward trajectory. Its commitment to innovation and continuous growth makes it an attractive investment opportunity.

Technical Analysis Examples

Let's consider a hypothetical scenario involving Apple Inc. (AAPL):

RSI: The RSI for AAPL is currently at 65, indicating that the stock is slightly overbought but still within a healthy range.

Moving Averages: The 50-day and 200-day moving averages are both trending upwards, suggesting a long-term bullish outlook.

Bollinger Bands: AAPL is currently trading above the upper Bollinger Band, which could indicate potential selling pressure in the short term.

Conclusion

In October 2025, large-cap momentum stocks like Apple, Microsoft, Amazon, and Tesla offer promising investment opportunities. By utilizing technical analysis and examining key indicators, investors can gain valuable insights into these stocks' potential performance. However, it is crucial to conduct thorough research and consider various factors before making investment decisions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....