In the world of investing, the US Small Cap Stocks Index is a vital tool for investors looking to diversify their portfolios. This index, which tracks the performance of small-cap companies, can offer significant growth potential but also comes with its own set of risks. In this article, we will delve into what the US Small Cap Stocks Index is, how it works, and why it matters to investors.

What is the US Small Cap Stocks Index?

The US Small Cap Stocks Index is a benchmark that measures the performance of small-cap companies in the United States. These companies are typically classified as those with a market capitalization between

How Does the US Small Cap Stocks Index Work?

The US Small Cap Stocks Index is calculated using a market capitalization-weighted approach. This means that the weight of each company in the index is determined by its market capitalization. As a result, larger companies with higher market capitalizations will have a greater influence on the index's performance.

The index is typically composed of a diverse range of industries, ensuring that the performance of the index reflects the broader trends in the small-cap market. However, it's important to note that the index is not a guarantee of individual stock performance. While the index can provide a good indication of the overall trend in the small-cap market, individual companies within the index can still experience significant volatility.

Why Does the US Small Cap Stocks Index Matter?

The US Small Cap Stocks Index is important for several reasons. First, it provides investors with a benchmark for evaluating the performance of their small-cap investments. By comparing their returns to the index, investors can gain insight into how their investments are performing relative to the broader market.

Second, the US Small Cap Stocks Index can be a valuable tool for diversifying a portfolio. Small-cap companies often offer growth potential that may not be available in larger, more established companies. By investing in a diversified portfolio of small-cap stocks, investors can potentially achieve higher returns while also reducing their exposure to market volatility.

Case Study: The Impact of the US Small Cap Stocks Index on Investment Returns

Let's consider a hypothetical scenario where an investor decides to invest

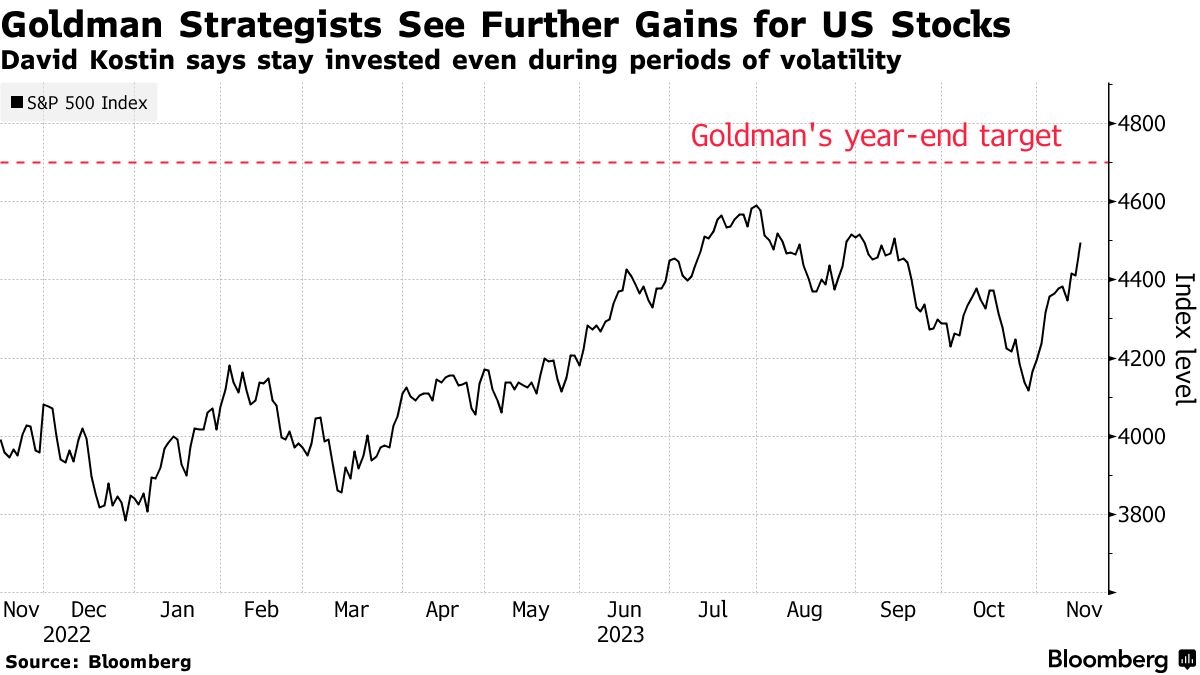

In contrast, if the investor had chosen to invest the same amount in a large-cap index, such as the S&P 500, the return might have been lower. This highlights the potential for higher returns in the small-cap market, as seen through the US Small Cap Stocks Index.

Conclusion

The US Small Cap Stocks Index is a valuable tool for investors looking to gain exposure to the small-cap market. By understanding how the index works and its potential benefits, investors can make informed decisions about their investments. While small-cap stocks offer the potential for higher returns, they also come with increased risk. As with any investment, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....