Understanding the Importance of Stock Market Holidays

In the fast-paced world of finance, knowing whether tomorrow is a US stock market holiday is crucial for investors, traders, and financial professionals. A stock market holiday can significantly impact trading schedules, investment strategies, and financial planning. In this article, we'll delve into the factors that determine stock market holidays, the impact of such holidays, and how to stay informed about upcoming breaks.

What is a Stock Market Holiday?

A stock market holiday refers to a day when the stock exchanges in the United States are closed for trading. This can occur for various reasons, including national holidays, weekends, and other special occasions. During these days, investors and traders cannot buy or sell stocks, bonds, or other financial instruments.

Common Reasons for Stock Market Holidays

National Holidays: The US stock market typically observes several national holidays, such as New Year's Day, Independence Day, Thanksgiving, and Christmas. These holidays commemorate significant events in American history and culture.

Weekends: The stock market is closed on Saturdays and Sundays by default, as these days are traditionally reserved for personal and family activities.

Special Occasions: Occasionally, the stock market may be closed for special occasions, such as presidential inaugurations or other significant events.

Impact of Stock Market Holidays

Stock market holidays can have several implications for investors and traders:

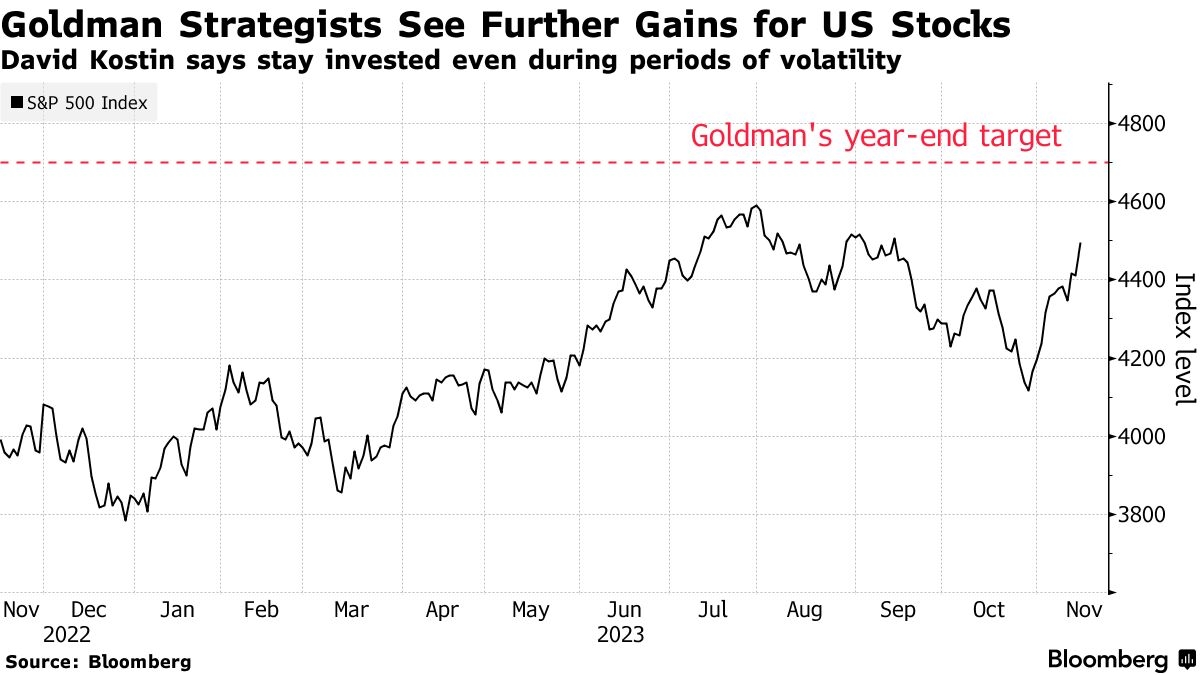

Trading Schedules: The absence of trading on holidays can affect the timing of trades and investment strategies. Investors may need to plan their trades in advance to ensure they are executed on the desired dates.

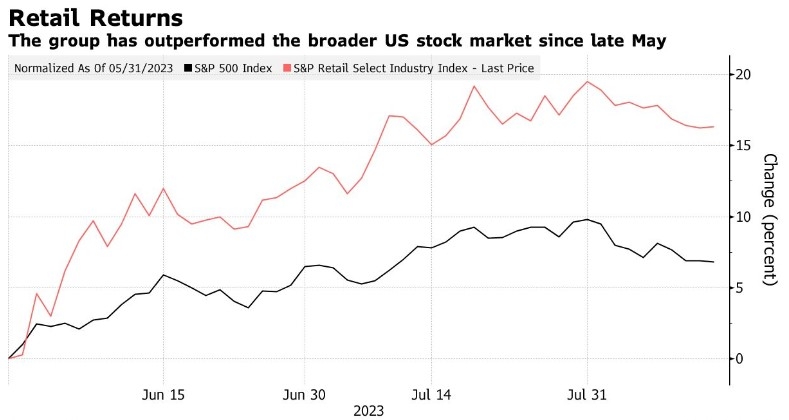

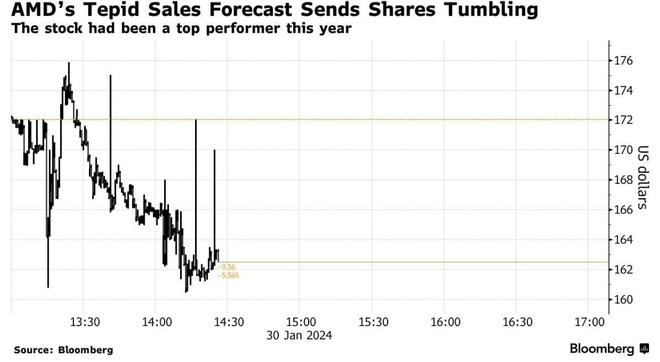

Market Volatility: The opening of the stock market after a holiday can sometimes be accompanied by increased volatility, as traders and investors react to news and events that occurred during the holiday period.

Financial Planning: Investors must be aware of stock market holidays when planning their financial goals and timelines.

Staying Informed About Stock Market Holidays

To stay informed about upcoming stock market holidays, consider the following resources:

Stock Exchange Websites: The major stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, provide calendars of stock market holidays on their websites.

Financial News Outlets: Financial news websites and publications often provide updates on stock market holidays and their potential impact on the market.

Financial Planning Tools: Many financial planning tools and software offer features that allow users to track stock market holidays and their impact on their investments.

Case Study: The Impact of a Stock Market Holiday

Imagine an investor who planned to sell a large position in a particular stock just before the upcoming holiday. However, due to the holiday, the investor was unable to execute the trade until the market reopened. This delay could have resulted in a significant loss if the stock's price dropped during the holiday period.

By staying informed about stock market holidays and their potential impact on investments, investors can better manage their portfolios and minimize risks.

In conclusion, knowing whether tomorrow is a US stock market holiday is essential for investors and traders. By understanding the reasons behind stock market holidays and their implications, investors can make informed decisions and plan their investments accordingly.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....