Investing in the stock market can be a daunting task, especially for beginners. One of the most critical aspects of stock investing is understanding the earnings calendar for US stocks. This calendar outlines when companies are expected to release their financial reports, which can significantly impact stock prices. In this article, we will delve into the importance of the earnings calendar, how to use it effectively, and provide you with a comprehensive guide to stay ahead of the market.

Understanding the Earnings Calendar

The earnings calendar is a schedule that lists the dates when publicly-traded companies are expected to release their financial reports. These reports include earnings per share (EPS), revenue, and other financial metrics that investors use to evaluate the company's performance. The calendar typically includes the following information:

- Company Name: The name of the company releasing the report.

- Report Date: The date when the report is expected to be released.

- Time: The time the report will be released.

- Estimated EPS: The expected earnings per share for the quarter or year.

- Revenue Estimate: The estimated revenue for the quarter or year.

Why the Earnings Calendar is Important

The earnings calendar is a crucial tool for investors for several reasons:

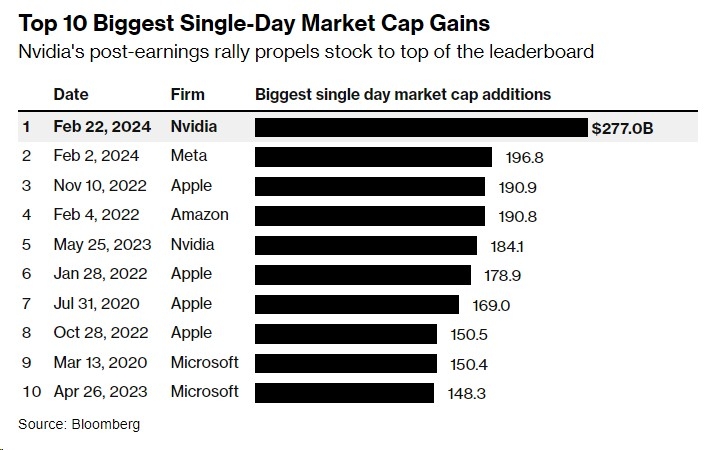

- Market Impact: Earnings reports can have a significant impact on stock prices. Positive reports can lead to a surge in share prices, while negative reports can cause them to plummet.

- Investment Decisions: By knowing when companies are expected to release their earnings reports, investors can make informed decisions about their portfolios.

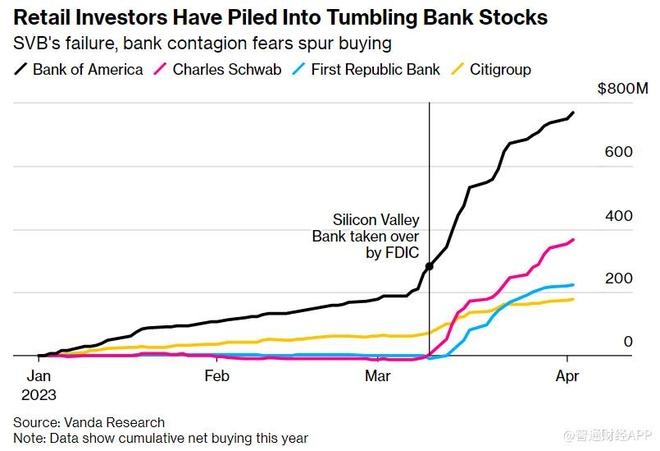

- Sector Analysis: The earnings calendar allows investors to analyze the performance of specific sectors and industries.

How to Use the Earnings Calendar

To use the earnings calendar effectively, follow these steps:

- Find a Reliable Source: There are several websites and platforms that provide earnings calendars, such as Yahoo Finance, Google Finance, and Zacks.

- Filter by Date: Sort the calendar by the report date to focus on the upcoming earnings reports.

- Analyze the Reports: Read the reports and analyze the financial metrics to understand the company's performance.

- Compare with Estimates: Compare the actual results with the estimated EPS and revenue to identify any discrepancies.

Case Study: Apple Inc.

Let's take a look at a real-life example with Apple Inc. Apple is one of the most closely watched companies in the tech industry, and its earnings reports are eagerly anticipated by investors.

- Report Date: Apple typically releases its earnings reports after the close of the market on the first Tuesday of each quarter.

- Financial Metrics: Investors closely watch Apple's EPS, revenue, and product sales figures.

- Market Impact: Apple's earnings reports have historically had a significant impact on the stock market, with share prices often moving sharply after the release.

Conclusion

The earnings calendar for US stocks is a valuable tool for investors looking to stay ahead of the market. By understanding the importance of the calendar and how to use it effectively, investors can make informed decisions about their portfolios and capitalize on market trends. Stay tuned for more insights into the world of stock investing.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....