In the ever-evolving landscape of the stock market, understanding the current market sentiment is crucial for investors and traders alike. By October 2025, the US stock market is poised to offer valuable insights into investor psychology and market dynamics. This article delves into the prevailing market sentiment surrounding US stocks during this pivotal month, offering a comprehensive overview of the key trends and factors influencing the market.

1. Economic Indicators and Policy Decisions

Economic indicators play a pivotal role in shaping market sentiment. In October 2025, investors are likely to be closely monitoring key economic indicators such as GDP growth, unemployment rates, and inflation. These indicators provide a glimpse into the overall health of the economy, which in turn affects investor confidence and stock market performance.

Additionally, policy decisions made by the Federal Reserve and other regulatory bodies can significantly impact the market sentiment. The Fed's interest rate decisions, for instance, can influence borrowing costs, consumer spending, and corporate earnings, ultimately affecting stock prices.

2. Sector Performance and Market Trends

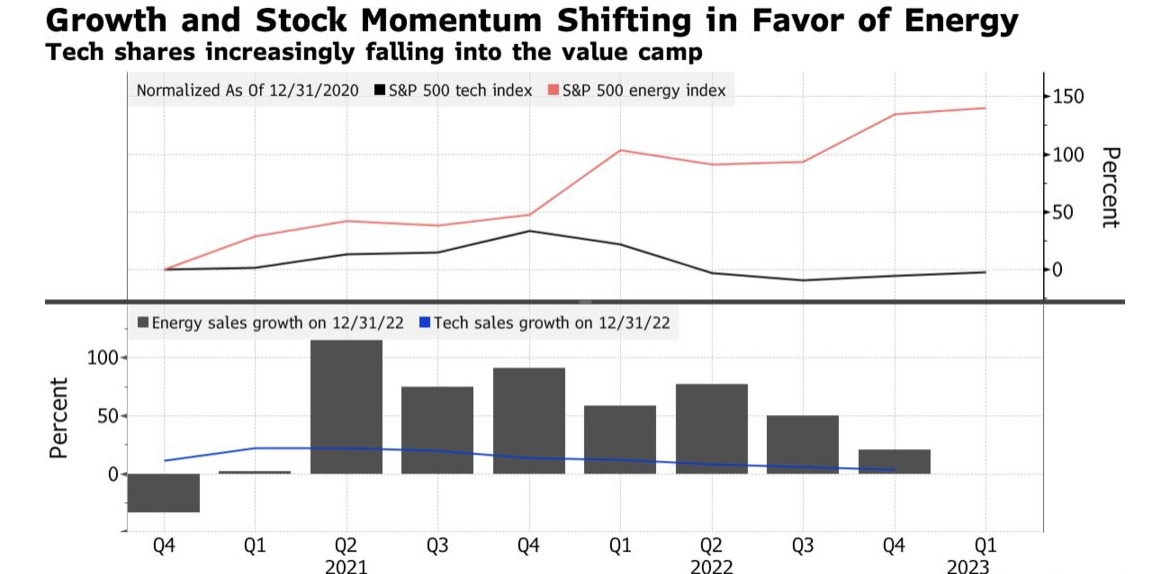

Analyzing sector performance is another critical aspect of understanding the current market sentiment. In October 2025, certain sectors may outperform others due to various factors such as technological advancements, regulatory changes, or shifts in consumer preferences.

For instance, the technology sector has historically been a significant driver of market growth. As advancements in artificial intelligence, cloud computing, and 5G continue to gain traction, investors may turn their attention to companies within this sector. Conversely, sectors such as energy and healthcare may experience challenges due to regulatory hurdles or economic uncertainties.

3. Geopolitical Factors and International Influence

Geopolitical events and international trade relations can also exert a substantial impact on the US stock market. In October 2025, investors may be concerned about geopolitical tensions, trade disputes, or political instability in key regions such as Europe, Asia, or the Middle East.

These factors can lead to increased volatility in the stock market, as investors react to changing global dynamics. Understanding the potential risks and opportunities presented by geopolitical events is crucial for making informed investment decisions.

4. Case Studies: Key Stock Performances

To illustrate the current market sentiment, let's examine a few case studies involving key stock performances in October 2025.

- Apple Inc. (AAPL): Apple's strong performance in the technology sector is attributed to its continued innovation and market leadership. The company's robust product lineup, including the iPhone, iPad, and Mac, has propelled its stock to new heights. Investors are optimistic about Apple's growth prospects, particularly in emerging markets and the services sector.

- Tesla Inc. (TSLA): Tesla's stock has experienced significant volatility due to its position at the forefront of the electric vehicle (EV) revolution. While the company faces challenges related to production and supply chain issues, investors remain bullish on its long-term potential. The growing demand for EVs and Tesla's expanding global footprint contribute to the company's positive market sentiment.

- Microsoft Corporation (MSFT): Microsoft's dominant position in the software and cloud computing industries has made it a stable investment choice for many investors. The company's diversification into areas such as gaming, AI, and cloud services has further bolstered its market sentiment. With a strong track record of innovation and financial performance, Microsoft continues to be a favored stock among investors.

Conclusion

Understanding the current market sentiment surrounding US stocks in October 2025 requires a comprehensive analysis of economic indicators, sector performance, geopolitical factors, and key stock performances. By considering these factors, investors can gain valuable insights into the market dynamics and make informed decisions. As the stock market continues to evolve, staying informed and adaptable is key to navigating the complex landscape of investing.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....