Are you a Canadian investor looking to expand your investment portfolio? Have you considered trading stocks through US stock brokers? This article delves into the feasibility of Canadian investors trading stocks via US stock brokers, exploring the benefits, limitations, and steps involved in this process.

Understanding the Basics

What is a US Stock Broker?

A US stock broker is a financial intermediary that facilitates the buying and selling of stocks on US stock exchanges. These brokers are licensed by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) to operate in the United States.

Canadians and US Stock Brokers

Canadians can indeed trade stocks via US stock brokers. However, there are certain regulations and considerations to keep in mind.

Benefits of Trading Stocks via US Stock Brokers

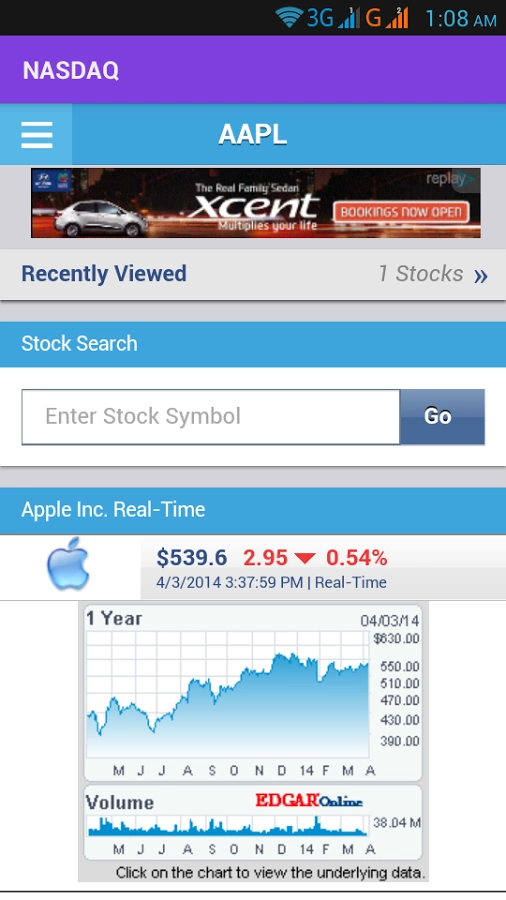

- Access to a Broader Market: US stock brokers provide access to a diverse range of stocks, including those listed on major US exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ.

- Potentially Higher Returns: Some Canadian investors may find that certain US stocks offer higher returns compared to their Canadian counterparts.

- Tax Advantages: Certain tax treaties between Canada and the United States can provide tax advantages for Canadian investors trading stocks via US stock brokers.

Limitations and Considerations

- Currency Exchange Rates: Trading stocks via US stock brokers involves dealing with currency exchange rates, which can impact the overall investment returns.

- Regulatory Differences: The regulatory framework for stock trading in the United States may differ from that in Canada. It's crucial for Canadian investors to familiarize themselves with these differences.

- Brokerage Fees: US stock brokers may charge higher brokerage fees compared to Canadian brokers, so it's essential to consider these costs when making investment decisions.

Steps to Trade Stocks via US Stock Brokers

- Choose a US Stock Broker: Research and select a reputable US stock broker that offers services suitable for Canadian investors. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

- Open an Account: Complete the account opening process, which typically involves providing personal and financial information.

- Fund Your Account: Transfer funds from your Canadian bank account to your US stock broker account.

- Research and Analyze Stocks: Conduct thorough research and analysis before making investment decisions.

- Place Orders: Use your US stock broker platform to place buy and sell orders for stocks listed on US exchanges.

Case Study: John's US Stock Trading Experience

John, a Canadian investor, decided to trade stocks via a US stock broker to diversify his portfolio. He opened an account, funded it, and started researching US stocks. After careful analysis, he invested in a technology stock that appreciated significantly, resulting in substantial returns.

Conclusion

Trading stocks via US stock brokers can be a viable option for Canadian investors looking to diversify their portfolios and potentially achieve higher returns. However, it's crucial to research and understand the regulations, costs, and risks involved before making investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....