In the ever-evolving world of financial markets, US stock futures indices play a pivotal role in providing investors with a glimpse into the potential direction of the stock market. These indices are financial derivatives that track the performance of a basket of stocks, giving traders and investors a way to gauge market trends and make informed decisions. This article aims to demystify the concept of US stock futures indices, exploring their significance, how they work, and their impact on the stock market.

What Are US Stock Futures Indices?

US stock futures indices are a type of financial instrument that allow investors to trade contracts based on the future value of a stock index. These contracts are agreements to buy or sell the underlying index at a predetermined price on a future date. The most popular US stock futures indices include the S&P 500, Nasdaq 100, and Dow Jones Industrial Average.

Understanding the S&P 500 Futures

The S&P 500 futures are based on the Standard & Poor's 500 index, which represents the performance of 500 large companies listed on stock exchanges in the United States. This index is widely regarded as a benchmark for the U.S. stock market and is often used to gauge the overall health of the economy.

Trading the Nasdaq 100 Futures

The Nasdaq 100 futures track the performance of the 100 largest companies listed on the Nasdaq stock exchange, which includes technology, healthcare, and retail sectors. This index is particularly popular among tech investors due to its heavy representation of technology companies.

The Impact of US Stock Futures Indices on the Stock Market

The movement of US stock futures indices can have a significant impact on the stock market. When the futures indices are rising, it often indicates a positive outlook for the market, leading to increased investor confidence. Conversely, when the futures indices are falling, it can signal investor concern and lead to a sell-off in the stock market.

Case Studies: The Role of US Stock Futures Indices

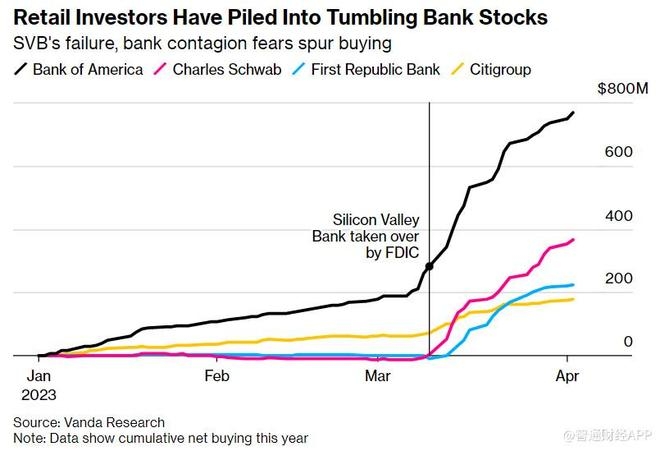

One notable example is the 2018 stock market correction. The S&P 500 futures dropped sharply in early February 2018, signaling investor concern about trade tensions and slowing economic growth. This led to a widespread sell-off in the stock market, with the S&P 500 falling by more than 10% in a matter of days.

Another example is the 2020 stock market crash triggered by the COVID-19 pandemic. The Nasdaq 100 futures dropped significantly as investors sold off heavily valued technology stocks, leading to a widespread sell-off in the stock market.

How to Trade US Stock Futures Indices

Trading US stock futures indices involves opening a futures trading account with a broker and understanding the associated risks. Investors can choose to go long (buy) or short (sell) the futures contracts based on their market outlook.

Conclusion

Understanding US stock futures indices is crucial for investors looking to gain insight into the potential direction of the stock market. By keeping an eye on these indices, investors can make informed decisions and manage their portfolios more effectively. Whether you are a seasoned investor or just starting out, familiarizing yourself with US stock futures indices can help you navigate the complexities of the financial markets.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....