In the world of finance, the US stock market is often likened to a drunken party. This metaphor captures the volatility, unpredictability, and excitement that characterize the stock market's behavior. Just as a party can turn wild and out of control when too much alcohol is consumed, the stock market can experience dramatic shifts in value due to various factors. In this article, we'll explore the reasons behind this comparison and delve into the dynamics that make the US stock market akin to a drunken party.

The Highs and Lows of the Stock Market

One of the primary reasons the stock market is likened to a drunken party is its rollercoaster-like nature. Stock prices can skyrocket in a matter of hours, only to plummet just as quickly. This volatility is often driven by investor sentiment, economic news, and corporate earnings reports. For example, a positive earnings report from a major company can send its stock soaring, while a negative report can cause it to plummet.

The Role of Investor Sentiment

Investor sentiment plays a crucial role in the stock market's behavior. Just as a party can become rowdy and chaotic when too many people are drinking, the stock market can become overheated when investors are overly optimistic or pessimistic. When investors are bullish, they're eager to buy stocks, driving prices up. Conversely, when investors are bearish, they're quick to sell, causing prices to fall.

Economic Factors and Market Manipulation

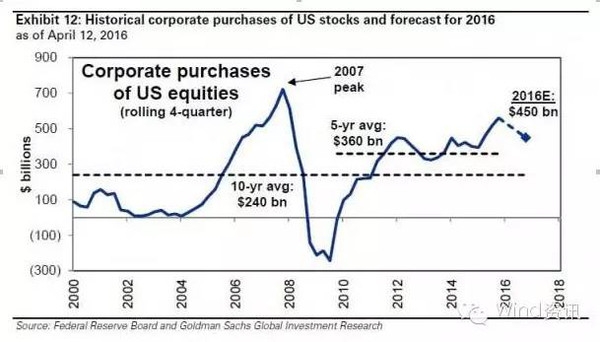

Economic factors, such as interest rates, inflation, and GDP growth, can also influence the stock market's behavior. When the economy is strong, investors tend to be more optimistic, leading to higher stock prices. Conversely, when the economy is weak, investors may become more cautious, causing stock prices to fall.

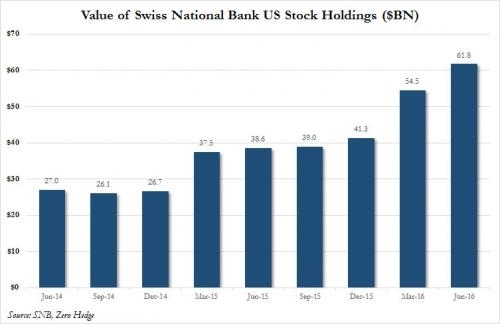

Additionally, market manipulation can contribute to the stock market's volatility. Just as a party can become out of control when someone spikes the punch, the stock market can experience sudden spikes or crashes due to manipulation. Cases of insider trading, pump-and-dump schemes, and other fraudulent activities can cause significant disruptions in the market.

Case Studies: The Dot-Com Bubble and the 2008 Financial Crisis

Two notable examples of the stock market's drunken party-like behavior are the dot-com bubble and the 2008 financial crisis. During the dot-com bubble, investors became overly optimistic about the potential of internet companies, leading to a massive increase in stock prices. However, when the bubble burst, many investors lost a significant amount of money. Similarly, the 2008 financial crisis was triggered by a combination of factors, including the housing market collapse and excessive risk-taking by financial institutions.

Conclusion

In conclusion, the US stock market is indeed like a drunken party. Its volatility, driven by investor sentiment, economic factors, and market manipulation, can lead to dramatic shifts in stock prices. While this metaphor may seem exaggerated, it accurately captures the essence of the stock market's behavior. As investors, it's crucial to remain cautious and informed, as the stock market can be as unpredictable as a wild party.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....