In recent years, the concept of stock inflation has become a topic of significant interest among investors and financial analysts. Stock inflation refers to the rise in the prices of stocks, often driven by various economic and market factors. This article aims to delve into the causes, effects, and implications of stock inflation in the United States.

Causes of Stock Inflation

The primary cause of stock inflation is the increase in demand for stocks. This can be attributed to several factors:

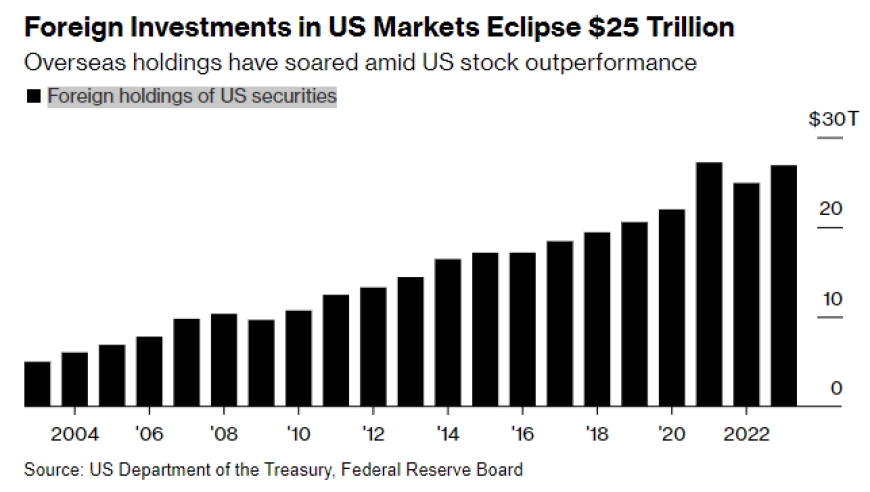

Low-interest rates: When interest rates are low, investors tend to seek higher returns in other asset classes, such as stocks. This increased demand drives up stock prices.

Economic growth: A strong economy often translates into higher corporate earnings, which can lead to higher stock prices.

Purchasing power of money: As the value of the dollar decreases over time, the purchasing power of money decreases. This prompts investors to invest in stocks to preserve their wealth.

Effects of Stock Inflation

The effects of stock inflation can be both positive and negative:

Positive effects: Stock inflation can lead to capital gains for investors, as the value of their stocks increases. It can also result in higher dividends for shareholders.

Negative effects: On the other hand, stock inflation can lead to overvaluation of stocks, making them less attractive for long-term investment. It can also cause speculative bubbles, where stock prices become disconnected from their underlying fundamentals.

Implications of Stock Inflation

The implications of stock inflation are vast and can affect various stakeholders:

Investors: Investors need to be aware of the risks associated with stock inflation, such as overvaluation and speculative bubbles.

Corporate executives: Companies need to ensure that their valuations are in line with their fundamentals to avoid negative consequences.

Economic policymakers: Policymakers need to monitor stock inflation and take appropriate measures to prevent excessive volatility and speculative bubbles.

Case Studies

To illustrate the impact of stock inflation, let's consider a few case studies:

Tech Bubble (2000): The dot-com bubble of the late 1990s was a prime example of stock inflation. Many tech stocks became overvalued, leading to a market crash in 2000.

Real Estate Bubble (2007-2008): The real estate bubble, which was fueled by low-interest rates, had a significant impact on the stock market. When the bubble burst, it led to the 2008 financial crisis.

In conclusion, understanding the impact of stock inflation is crucial for investors, corporate executives, and policymakers. By being aware of the causes, effects, and implications of stock inflation, stakeholders can make informed decisions and mitigate potential risks.

Note: This article is for informational purposes only and does not constitute professional financial advice.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....