In the ever-evolving landscape of energy, the rise of electric stocks has become a significant trend. These companies are not just contributing to the reduction of carbon emissions but also presenting exciting investment opportunities. This article delves into the world of US electric stocks, highlighting key players, market trends, and potential future growth.

Understanding the Market

Electric stocks encompass a variety of companies, including those involved in renewable energy, electric vehicles (EVs), and energy storage. These companies are at the forefront of the global shift towards sustainability, and as such, they offer investors a chance to be part of a transformative era.

Key Players in the US Electric Stock Market

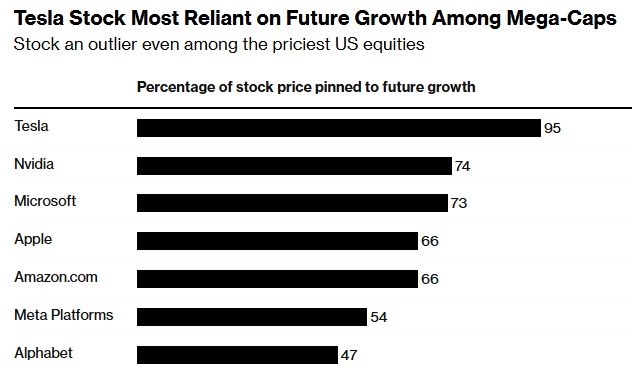

Tesla, Inc. (TSLA)

- As the world's leading manufacturer of electric vehicles, Tesla has become a symbol of innovation and sustainability. With its commitment to producing affordable EVs and expanding its global footprint, Tesla continues to dominate the electric stock market.

- Case Study: Tesla's Model 3 has been a game-changer in the EV market, with its impressive range and performance. The company's recent expansion into solar energy and battery storage further solidifies its position as a leader in the electric sector.

NIO Inc. (NIO)

- NIO is another prominent player in the electric vehicle market, offering a range of luxury EVs. The company's focus on customer experience and cutting-edge technology has helped it carve a niche in the industry.

- Case Study: NIO's partnership with charging infrastructure providers has significantly improved the convenience of owning an electric vehicle, making it a more attractive option for consumers.

Enphase Energy (ENPH)

- Enphase Energy specializes in energy management solutions, including solar microinverters and energy storage systems. The company's products enable homeowners and businesses to maximize the efficiency of their renewable energy systems.

- Case Study: Enphase's microinverters have been installed in over 1 million homes worldwide, demonstrating the company's strong market presence and customer satisfaction.

Market Trends and Future Growth

The electric stock market is expected to grow significantly in the coming years, driven by several factors:

- Government Incentives: Many governments around the world are offering incentives to promote the adoption of electric vehicles and renewable energy sources. These incentives are expected to further boost the electric stock market.

- Technological Advancements: Continuous improvements in battery technology, charging infrastructure, and renewable energy solutions are making electric vehicles more accessible and sustainable.

- Consumer Demand: The increasing awareness of climate change and environmental issues is driving consumer demand for electric vehicles and renewable energy solutions.

Conclusion

Investing in US electric stocks offers a unique opportunity to be part of the global shift towards sustainability. With the right companies and a long-term perspective, investors can potentially reap significant returns while contributing to a cleaner and more sustainable future.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....