In the dynamic world of investing, understanding the nuances of different stock categories is crucial. One such category is cyclical stocks, which are particularly popular among investors in the United States. These stocks tend to perform well during economic upswings and may suffer during downturns. In this article, we'll delve into what cyclical stocks are, how they work, and why they're a significant part of the investment landscape.

What Are Cyclical Stocks?

Cyclical stocks are shares of companies that are directly influenced by the economic cycle. Unlike defensive stocks, which tend to hold their value or even increase in value during economic downturns, cyclical stocks are more sensitive to economic changes. They often perform well when the economy is growing and can experience significant declines when the economy is in a recession.

Key Characteristics of Cyclical Stocks

1. High Correlation with Economic Activity: Cyclical stocks are closely tied to economic growth. They include sectors like consumer discretionary, industrial goods, and technology. These sectors are more likely to see rapid growth during economic expansions.

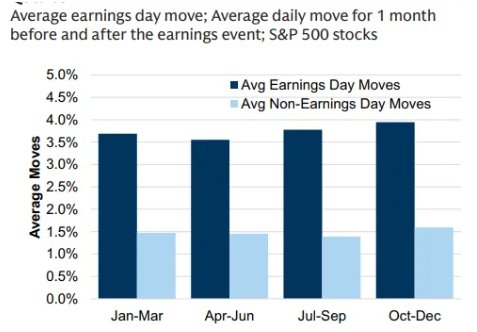

2. Volatility: Due to their close relationship with the economy, cyclical stocks can be highly volatile. This means their prices can fluctuate widely over a short period of time.

3. Higher Risk-Reward Ratio: While cyclical stocks can offer high returns during economic upswings, they also come with higher risk. Investors must be prepared for potential losses during economic downturns.

Why Invest in Cyclical Stocks?

Despite the risks, investing in cyclical stocks can be rewarding. Here are a few reasons why:

1. Potential for High Returns: During economic upswings, cyclical stocks can offer significant returns. Investors who time their investments well can capitalize on these opportunities.

2. Economic Growth: Investing in cyclical stocks allows investors to participate in the growth of the economy. As the economy expands, these stocks can benefit significantly.

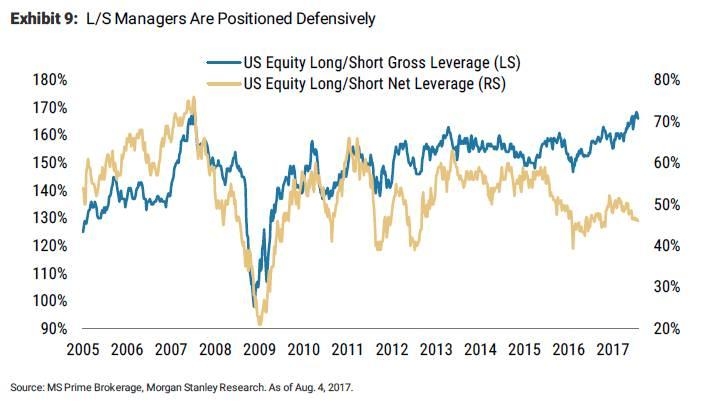

3. Market Diversification: Including cyclical stocks in a diversified portfolio can help mitigate risk. While they may perform poorly during recessions, they can offset the losses in other sectors.

Examples of Cyclical Stocks

Several well-known companies fall into the cyclical stock category. Here are a few examples:

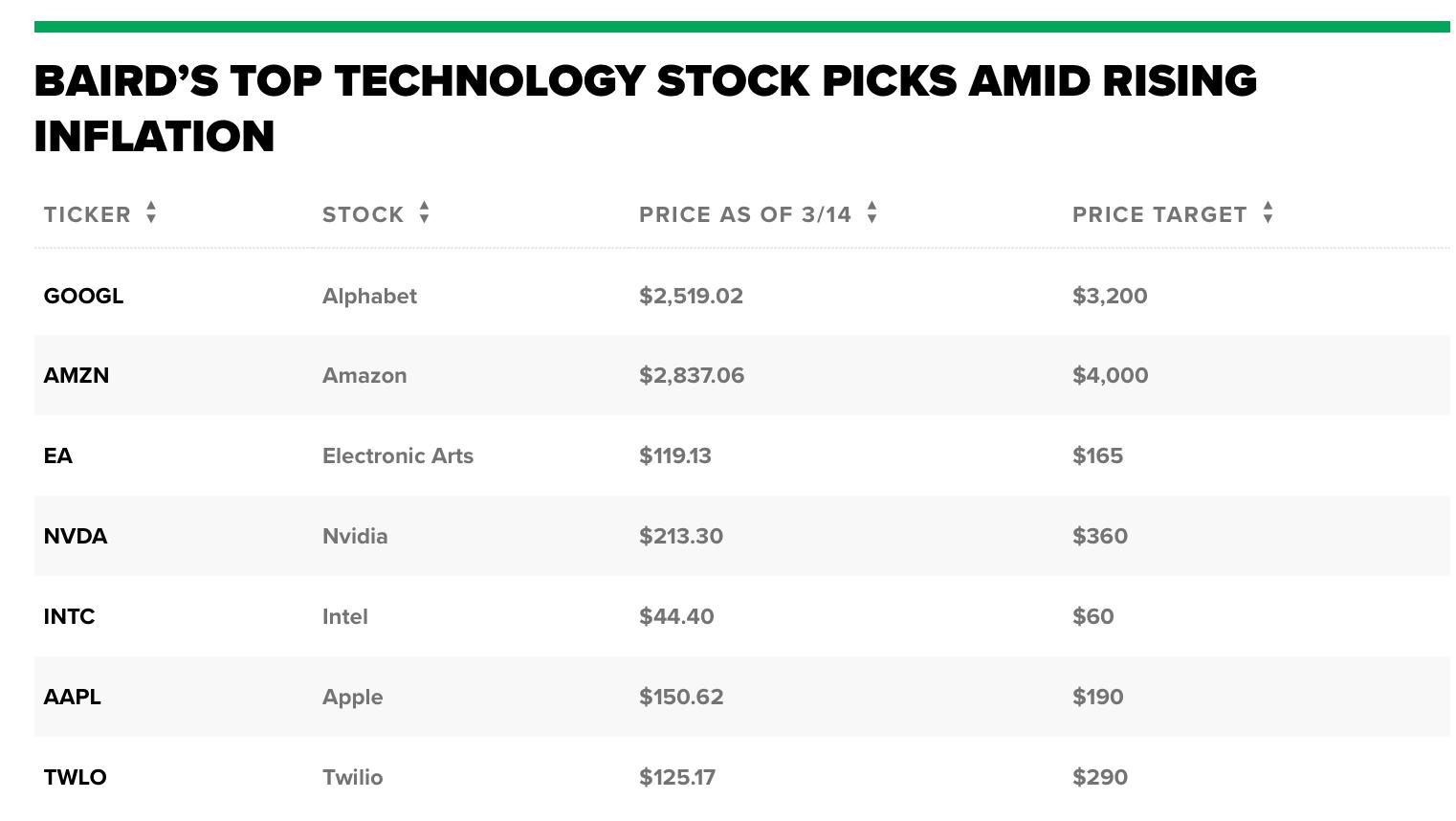

Apple (AAPL): As a leading technology company, Apple's performance is closely tied to the overall health of the economy.

Ford (F): As an automaker, Ford's sales are highly dependent on consumer spending and economic conditions.

Caterpillar (CAT): As a manufacturer of construction and mining equipment, Caterpillar's performance is closely tied to infrastructure spending and economic growth.

Conclusion

Understanding cyclical stocks is essential for any investor looking to navigate the complex world of investing. While they come with higher risk, their potential for high returns during economic upswings makes them a valuable part of any diversified portfolio. By researching and analyzing these stocks, investors can make informed decisions and potentially benefit from the economic cycle.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....