The stock market is a dynamic place where investors and traders buy and sell shares of publicly traded companies. One of the key metrics that investors closely monitor is the daily turnover of US stocks. This figure represents the total value of shares traded on a given day and provides valuable insights into market activity. In this article, we will delve into the concept of daily turnover, its importance, and how it impacts the US stock market.

What is Daily Turnover?

Daily turnover refers to the total value of shares traded on a stock exchange over a specific period, typically one day. It is calculated by multiplying the number of shares traded by the average price of those shares. This figure is often expressed in millions or billions of dollars.

Why is Daily Turnover Important?

Understanding daily turnover is crucial for several reasons:

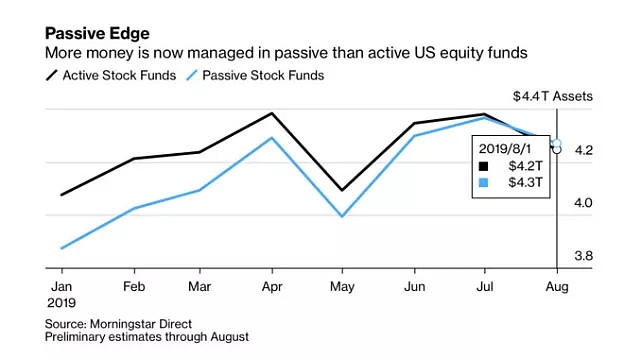

Market Activity: A high daily turnover indicates significant market activity, suggesting that investors are actively buying and selling shares. Conversely, a low turnover may indicate a lack of interest or a bearish market.

Volume: Daily turnover is closely linked to trading volume, which is the number of shares traded. High volume often correlates with high turnover, indicating strong market sentiment.

Market Confidence: A high daily turnover can reflect market confidence, as investors are willing to engage in transactions. Conversely, a low turnover may indicate uncertainty or skepticism.

Price Fluctuations: Daily turnover can influence price fluctuations. High turnover can lead to increased volatility, as more buyers and sellers enter the market, potentially pushing prices up or down.

How Does Daily Turnover Impact the US Stock Market?

The daily turnover of US stocks has a significant impact on the overall market:

Market Performance: A high daily turnover can lead to increased market performance, as more shares are being traded. This can result in higher prices and overall market growth.

Market Efficiency: High turnover suggests a more efficient market, as more investors are participating in trading. This can lead to better price discovery and reduced information asymmetry.

Market Manipulation: High turnover can make it more difficult for market manipulators to influence prices, as there are more participants in the market.

Case Study: The Impact of Daily Turnover on the S&P 500

A notable example of the impact of daily turnover on the US stock market is the S&P 500 index. During the 2020 stock market crash, daily turnover reached record highs. This high turnover reflected the intense trading activity and volatility during that period. While the market experienced significant declines, the high turnover also indicated a high level of participation, which helped stabilize the market in the long run.

Conclusion

Understanding the daily turnover of US stocks is essential for investors and traders to gain insights into market activity and sentiment. By analyzing this metric, investors can make more informed decisions and better understand the dynamics of the stock market. Whether you are a seasoned investor or just starting out, keeping an eye on daily turnover can provide valuable information to help you navigate the complex world of stocks.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....