Introduction: In recent years, the US healthcare industry has been witnessing significant growth, with several companies making a name for themselves. Among them, Abiomed stands out as a leading player in the market. This article delves into the world of Abiomed US healthcare stocks, exploring their potential, performance, and factors that could impact their future growth.

Understanding Abiomed Abiomed, founded in 1981, is a leading developer and manufacturer of medical devices used in heart failure and cardiovascular care. The company's mission is to save and enhance lives by providing groundbreaking technology to improve patient outcomes. Abiomed's products include the Impella heart pump, a device that helps support the heart during cardiac surgery or when the heart is unable to pump enough blood.

Performance of Abiomed US Healthcare Stocks In the past few years, Abiomed's stock has seen a remarkable rise, reflecting the company's growing market presence and financial strength. According to data from Yahoo Finance, Abiomed's stock price has surged by over 50% in the last year alone. This impressive performance can be attributed to several factors:

Innovative Product Line: Abiomed's cutting-edge products have been a major driver of its stock performance. The company's Impella heart pump, for instance, has gained widespread acceptance in the medical community and has become a crucial tool for treating heart failure patients.

Strong Financial Performance: Abiomed has demonstrated consistent financial growth, with revenue and profit margins increasing year over year. The company's revenue grew by 20% in 2021, reaching $1.8 billion.

Expanding Market: The heart failure market is growing rapidly, with an estimated 6 million patients suffering from the condition in the United States. Abiomed's position as a market leader in this segment has helped the company maintain strong sales growth.

Factors Influencing Abiomed's Stock Several factors could impact the future performance of Abiomed's US healthcare stocks:

Regulatory Approvals: The approval of new medical devices by regulatory authorities is a crucial factor in Abiomed's growth. Any delay in approval could negatively impact the company's stock.

Competitive Landscape: The medical device industry is highly competitive, with several companies vying for market share. Any significant advancements by competitors could pose a threat to Abiomed's market position.

Economic Conditions: Economic downturns can affect healthcare spending, which could, in turn, impact Abiomed's revenue growth.

Case Studies To illustrate the potential of Abiomed's US healthcare stocks, let's look at a couple of case studies:

Impella Heart Pump: The Impella heart pump has become a game-changer in the treatment of heart failure. Since its introduction, the device has been widely adopted by hospitals, leading to increased demand for Abiomed's products.

Partnerships with Hospitals: Abiomed has formed strategic partnerships with several leading hospitals, enhancing its market reach and sales potential.

Conclusion: Abiomed US healthcare stocks offer investors a unique opportunity to invest in a rapidly growing industry. With a strong product portfolio, solid financial performance, and a commitment to innovation, Abiomed is well-positioned to capitalize on the growing demand for advanced medical devices. However, it's important for investors to monitor key factors such as regulatory approvals and competitive landscape to make informed decisions.

new york stock exchange

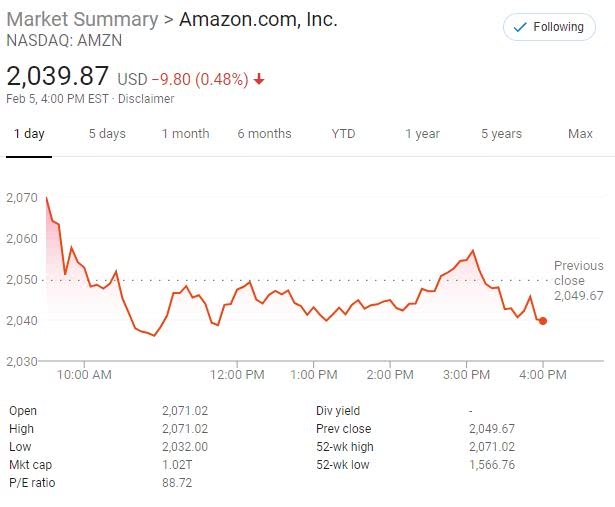

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....