In the realm of corporate finance, stock buybacks have become a pivotal strategy for U.S. companies aiming to enhance shareholder value. This article delves into the evolution of stock buybacks over the years, offering a detailed analysis of the trends and implications of this financial practice. By examining stock buybacks by year, we aim to provide a clearer picture of how companies have utilized this tool to manage their capital and drive growth.

Stock Buybacks: An Overview

Stock buybacks, also known as share repurchases, occur when a company purchases its own shares from the market. This can be done through open market purchases or tender offers. The primary motivation behind stock buybacks is to reduce the number of outstanding shares, which in turn increases the earnings per share (EPS) and can boost the stock price.

Trends in Stock Buybacks Over the Years

Early 2000s: A Period of Growth and Mergers

In the early 2000s, stock buybacks were relatively low, as companies focused on expansion and mergers. However, this began to change as the decade progressed, with a surge in buybacks driven by companies looking to enhance shareholder value.

2008 Financial Crisis: A Temporary Halt

The 2008 financial crisis brought a temporary halt to stock buybacks, as companies redirected their capital towards shoring up their balance sheets and meeting regulatory requirements. However, as the economy recovered, buybacks began to pick up once again.

2010s: The Decade of Stock Buybacks

The 2010s saw a significant increase in stock buybacks, with companies utilizing the low interest rates and ample cash reserves to repurchase their shares. This trend continued into the early 2020s, with many companies setting record-high buyback amounts.

Case Studies: Notable Stock Buybacks by Year

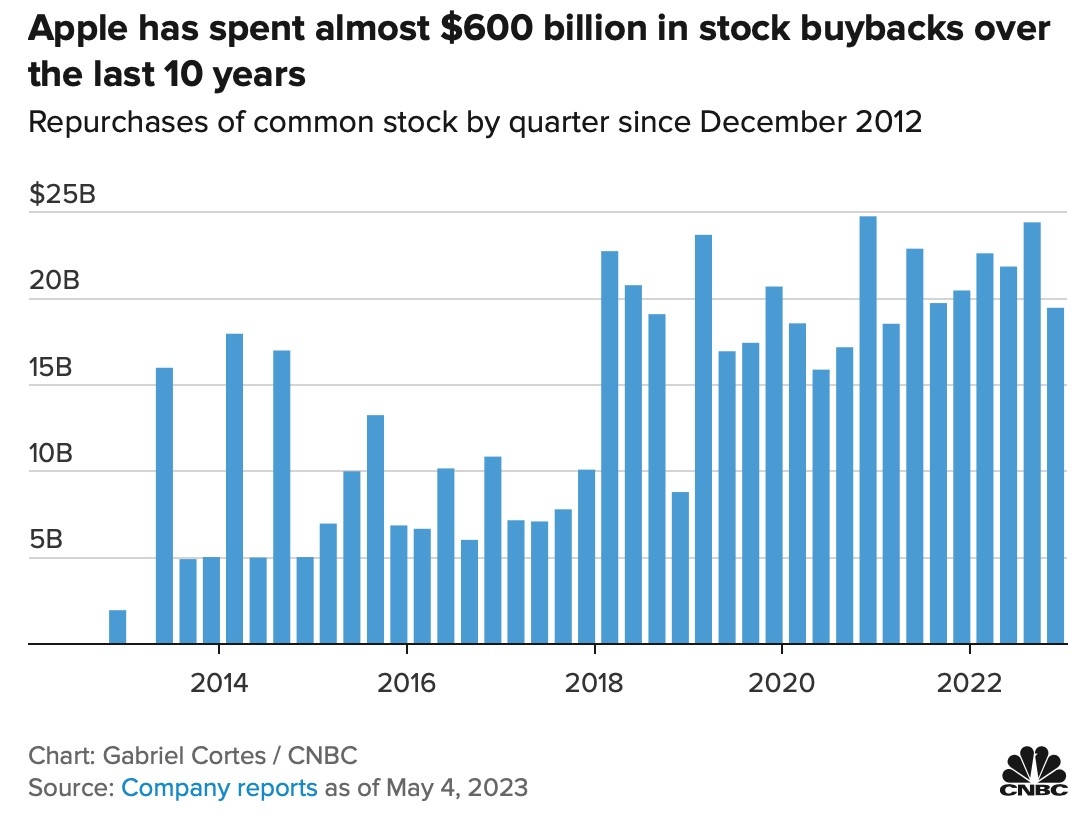

Apple: The King of Stock Buybacks

Apple Inc. has been a leader in stock buybacks, with the company repurchasing billions of dollars worth of shares each year. In 2015, Apple set a new record by announcing a $100 billion stock buyback program, further solidifying its position as a top buyback performer.

Microsoft: A Steady Repurchaser

Microsoft has also been a significant player in stock buybacks, with the company repurchasing tens of billions of dollars worth of shares over the years. In 2016, Microsoft announced a $30 billion stock buyback program, which helped to drive the company's EPS growth.

Implications of Stock Buybacks

While stock buybacks can have several benefits, such as increasing EPS and potentially boosting stock prices, they are not without their drawbacks. Critics argue that stock buybacks can be used as a way to mask underlying financial problems or as a means for executives to benefit from share price increases.

The Future of Stock Buybacks

As interest rates rise and corporate tax reforms take effect, the future of stock buybacks remains uncertain. However, it is clear that this financial practice will continue to be a key component of corporate strategy, as companies seek to enhance shareholder value and drive growth.

In conclusion, the analysis of stock buybacks by year reveals a fascinating story of how companies have utilized this financial tool to manage their capital and drive shareholder value. By examining the trends and implications of stock buybacks, we can better understand the role this practice plays in the world of corporate finance.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....