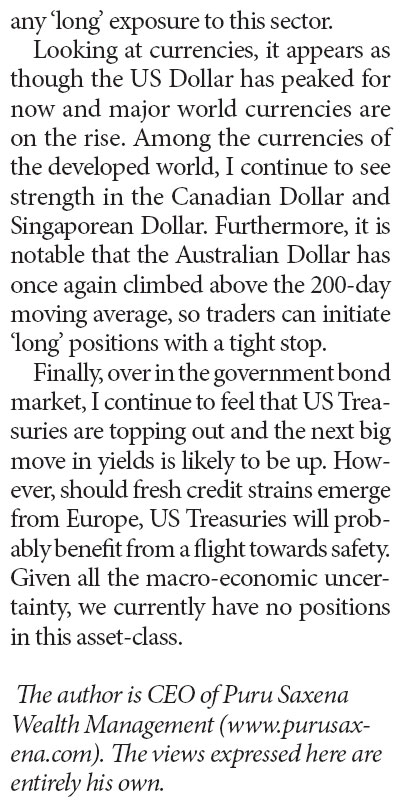

In the bustling world of finance, the United States stands as a global hub for stock trading. Whether you're a seasoned investor or a beginner looking to dive into the stock market, understanding how stocks trade in US exchanges is crucial. This article delves into the various methods through which stocks are traded on US exchanges, ensuring you have a comprehensive understanding of the process.

Understanding US Stock Exchanges

The United States boasts several major stock exchanges, each with its unique characteristics and trading methods. The most prominent ones include the New York Stock Exchange (NYSE), NASDAQ, and the American Stock Exchange (AMEX).

Traditional Stock Trading

The traditional method of stock trading involves the use of stock exchanges. Here’s how it works:

- Brokerage Accounts: Investors need a brokerage account to buy and sell stocks. This account serves as a gateway to the stock market.

- Order Placement: Investors place orders through their brokers. These orders can be market orders (buying or selling at the current market price) or limit orders (buying or selling at a specified price or better).

- Execution: The broker executes the order on the exchange. For example, if an investor places a market order to buy 100 shares of Apple Inc. (AAPL), the broker will buy those shares at the best available price on the NYSE.

- Settlement: Once the trade is executed, the shares are settled. This means the shares are transferred from the seller to the buyer, and the buyer’s brokerage account is debited, while the seller’s account is credited.

Electronic Trading

Electronic trading has revolutionized the stock market, providing faster and more efficient trading methods. Here are some common electronic trading methods:

- Direct Market Access (DMA): DMA allows investors to trade stocks directly on the exchange without the need for a traditional broker. This method offers lower transaction costs and faster execution.

- Algorithmic Trading: Algorithmic trading involves using computer programs to execute trades automatically based on predefined criteria. This method is highly popular among institutional investors.

- Mobile Trading: Many brokerage firms offer mobile trading apps that allow investors to trade stocks from their smartphones or tablets.

Over-the-Counter (OTC) Markets

In addition to exchanges, stocks can also be traded over-the-counter (OTC). The OTC market is a decentralized market where stocks are traded directly between buyers and sellers. Here are some key points about OTC trading:

- No Physical Exchange: Unlike exchanges, the OTC market doesn’t have a physical location. Trading is conducted through a network of dealers.

- Liquidity: OTC markets may offer lower liquidity compared to exchanges, making it challenging to execute large orders.

- Regulation: OTC stocks are subject to less stringent regulation compared to exchange-listed stocks.

Case Study: Amazon.com, Inc. (AMZN)

To illustrate the trading process, let’s consider Amazon.com, Inc. (AMZN), a leading e-commerce company. If an investor wants to buy 100 shares of AMZN, they can do so through their brokerage account by placing a market order. The broker will execute the order on the NASDAQ exchange, where AMZN is listed. Once the trade is executed, the shares will be settled, and the investor’s brokerage account will be debited.

In conclusion, understanding how stocks trade in US exchanges is essential for anyone looking to invest in the stock market. Whether through traditional exchanges, electronic trading, or OTC markets, investors have various options to trade stocks efficiently and effectively.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....