In the ever-evolving world of commodities trading, Glencore PLC stands as a behemoth, commanding a significant presence in the global market. For investors looking to capitalize on the commodities sector, understanding Glencore's US stock performance is crucial. This article delves into the details of Glencore's US stock, providing insights into its market trends, financial health, and investment potential.

Understanding Glencore PLC

Glencore PLC is a Swiss-based global commodities company that operates in more than 50 countries. The company is involved in the production, marketing, and trading of over 90 commodities, including metals, energy, and agricultural products. Glencore's diverse portfolio makes it a key player in the global commodities market, with a significant presence in the United States.

Glencore US Stock Performance

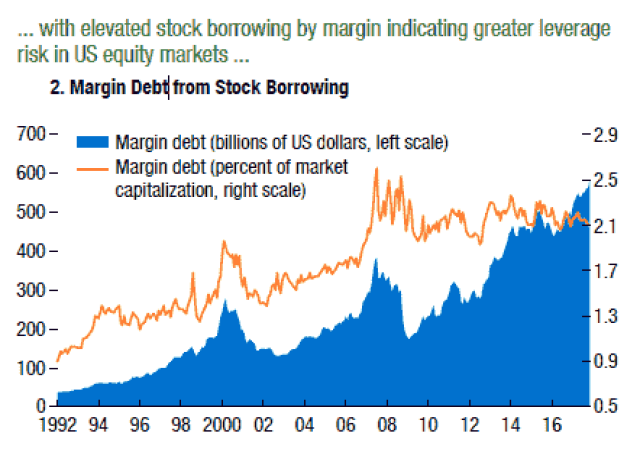

The performance of Glencore's US stock is a reflection of the company's global operations and market dynamics. Over the years, the stock has experienced periods of volatility, influenced by factors such as commodity prices, economic conditions, and regulatory changes.

Market Trends

One of the key factors that influence Glencore's US stock performance is the trend in commodity prices. For instance, during periods of strong demand and limited supply, commodity prices tend to rise, positively impacting Glencore's revenue and profitability. Conversely, during economic downturns or oversupply situations, commodity prices may decline, affecting the company's financial performance.

Financial Health

Analyzing Glencore's financial health is crucial for investors considering investing in its US stock. The company's financial statements, including its income statement, balance sheet, and cash flow statement, provide valuable insights into its financial position. Key financial metrics such as revenue, earnings per share (EPS), and debt levels can help investors gauge the company's performance and stability.

Investment Potential

Investing in Glencore's US stock offers several potential benefits. Firstly, the company's diversified portfolio provides a level of stability that may be attractive to investors seeking exposure to the commodities sector. Secondly, Glencore's strong market position and global reach make it a compelling investment opportunity for those looking to capitalize on long-term growth trends in the commodities market.

Case Study: Glencore's Acquisition of Xstrata

One notable case study in Glencore's history is its acquisition of Xstrata, a British-based mining company, in 2013. The acquisition, valued at approximately $46 billion, was one of the largest in the mining industry at the time. The merger created a powerful global commodities company with a broader portfolio and increased market share. This acquisition highlights Glencore's strategic focus on growth and expansion, a factor that may continue to drive its US stock performance.

Conclusion

Investing in Glencore's US stock requires a thorough understanding of the company's market trends, financial health, and investment potential. By analyzing these factors, investors can make informed decisions about their investments in the global commodities giant. Whether you are a seasoned investor or just starting out, understanding Glencore's US stock performance is essential for navigating the dynamic commodities market.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....