In the dynamic world of financial markets, the Invesco QQQ ETF Price plays a crucial role in investors' decision-making processes. This article aims to provide a comprehensive guide to understanding the impact of the QQQ ETF price on the market, highlighting key factors that influence it and offering insights for investors looking to make informed decisions.

Understanding the Invesco QQQ ETF

The Invesco QQQ ETF, also known as the PowerShares QQQ, tracks the performance of the纳斯达克-100指数 (NASDAQ-100 Index). This index includes the largest non-financial companies listed on the NASDAQ, representing some of the most innovative and successful companies in the tech industry, such as Apple, Microsoft, and Amazon.

Factors Influencing the Invesco QQQ ETF Price

The price of the Invesco QQQ ETF is influenced by several factors, including:

- Market Conditions: The overall state of the market, including economic indicators, political events, and global events, can significantly impact the QQQ ETF price.

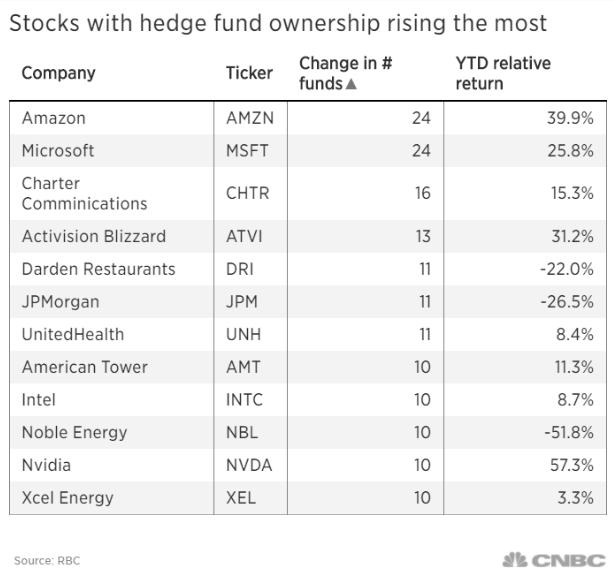

- Company Performance: The performance of the companies included in the NASDAQ-100 Index directly affects the QQQ ETF price. Strong earnings reports or positive news about a particular company can lead to an increase in the ETF price.

- Volatility: The market's volatility can cause fluctuations in the QQQ ETF price. During periods of high volatility, the price may experience significant ups and downs.

Impact of the Invesco QQQ ETF Price on the Market

The Invesco QQQ ETF Price has a significant impact on the market for several reasons:

- Market Sentiment: The QQQ ETF price is often used as a gauge of market sentiment. A rising QQQ ETF price can indicate optimism in the market, while a falling price may signal concerns.

- Investor Behavior: The price movements of the QQQ ETF can influence investor behavior. Investors may be more inclined to buy or sell based on the QQQ ETF price, leading to increased trading volume and market activity.

- Sector Performance: Since the QQQ ETF tracks the tech sector, its price movements can have a significant impact on the overall performance of the tech sector in the market.

Case Studies

Let's take a look at a few case studies to understand the impact of the Invesco QQQ ETF price on the market:

- 2020: The QQQ ETF experienced significant volatility in 2020, mirroring the broader market's reaction to the COVID-19 pandemic. As the market recovered, the QQQ ETF price also rose, reflecting the optimism in the tech sector.

- 2021: The QQQ ETF continued to perform well in 2021, driven by strong earnings reports and positive news from tech companies. This resulted in a steady increase in the ETF price.

Conclusion

The Invesco QQQ ETF Price is a critical indicator of market conditions and investor sentiment. By understanding the factors that influence the QQQ ETF price and its impact on the market, investors can make more informed decisions and better navigate the dynamic financial landscape.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....