In today's fast-paced financial world, understanding the stock market's future is crucial for investors looking to make informed decisions. The term "stocks future" refers to the projection of stock prices and market trends over time. This article delves into the intricacies of stock market forecasting, offering insights into how to navigate the future of stocks effectively.

Understanding Stock Market Forecasting

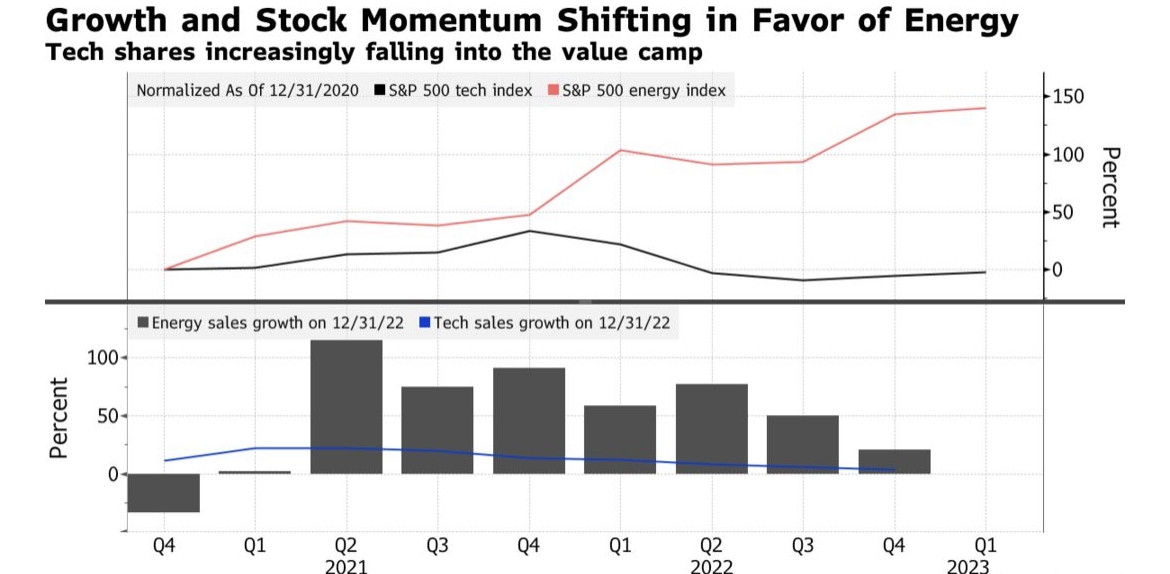

Stock market forecasting involves analyzing various factors such as economic indicators, company fundamentals, and technical analysis to predict future stock prices. By understanding these elements, investors can make more informed decisions and potentially capitalize on market trends.

Economic Indicators

Economic indicators are crucial in predicting the future of stocks. These indicators include unemployment rates, inflation, GDP growth, and consumer spending. For instance, a low unemployment rate and high consumer spending can indicate a strong economy, which may positively impact stock prices.

Company Fundamentals

Company fundamentals, such as revenue, earnings, and debt levels, play a vital role in stock market forecasting. By analyzing these factors, investors can gauge a company's financial health and potential for growth. Companies with strong fundamentals are more likely to see their stock prices rise in the future.

Technical Analysis

Technical analysis involves studying historical stock price and volume data to identify patterns and trends. Traders use various tools and indicators, such as moving averages, RSI, and Fibonacci retracement levels, to make predictions about future stock prices.

Case Study: Apple Inc.

Let's consider a case study involving Apple Inc. (AAPL). In the past, Apple has consistently shown strong fundamentals, with high revenue and earnings growth. By analyzing the company's economic indicators and technical patterns, investors could predict that Apple's stock prices would continue to rise in the future.

The Importance of Diversification

Diversification is a key strategy in navigating the future of stocks. By investing in a variety of stocks across different sectors and industries, investors can reduce their risk and potentially benefit from market trends.

Conclusion

Understanding the future of stocks is essential for investors looking to make informed decisions. By analyzing economic indicators, company fundamentals, and technical analysis, investors can gain valuable insights into market trends and make strategic investments. Remember to diversify your portfolio to mitigate risk and capitalize on potential opportunities.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....