Are you looking to expand your investment portfolio beyond your local market? Investing in US stocks from the Philippines can be a strategic move, offering diverse investment opportunities. This guide will provide you with a comprehensive overview of how to trade US stocks in the Philippines, including the necessary steps, benefits, and potential risks.

Understanding the Basics

Before diving into the world of US stock trading, it's crucial to understand the basics. The US stock market, also known as the New York Stock Exchange (NYSE) and the NASDAQ, is one of the largest and most liquid markets in the world. It features a wide range of companies across various industries, from tech giants like Apple and Google to established brands like Coca-Cola and Johnson & Johnson.

Steps to Trade US Stocks in the Philippines

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to US stocks. Some popular options for Filipino investors include COL Financial, BDO Securities, and First Metro Securities.

Understand the Platform: Familiarize yourself with the trading platform provided by your broker. Most platforms offer a user-friendly interface and a range of tools to help you analyze stocks and make informed decisions.

Research and Analyze: Conduct thorough research on the stocks you're interested in. This includes analyzing financial statements, understanding the company's business model, and keeping an eye on market trends.

Place Your Order: Once you've identified a stock you want to invest in, place your order through your brokerage account. You can choose to buy shares outright or engage in more advanced trading strategies like options and futures.

Monitor Your Investments: Regularly monitor your investments to stay informed about any changes in the market or company performance. This will help you make informed decisions and adjust your portfolio as needed.

Benefits of Trading US Stocks in the Philippines

Diversification: Investing in US stocks allows you to diversify your portfolio beyond local market risks, providing a more stable investment strategy.

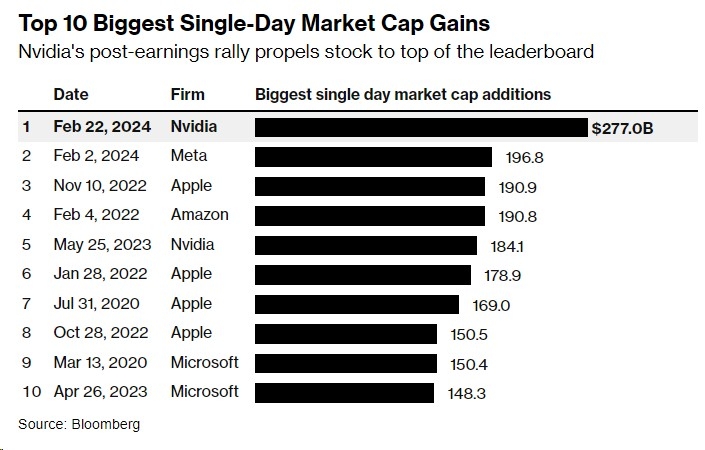

Access to High-Quality Companies: The US stock market features some of the world's most successful and innovative companies, offering potential for long-term growth.

Liquidity: The US stock market is highly liquid, making it easy to buy and sell shares at any time.

Advanced Trading Tools: Many online brokers offer advanced trading tools and resources to help you make informed decisions.

Potential Risks

While trading US stocks can be lucrative, it's important to be aware of the potential risks:

Currency Fluctuations: Exchange rate fluctuations can impact the value of your investments when converted back to the Philippine peso.

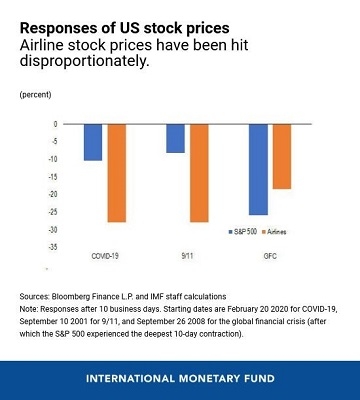

Market Volatility: The US stock market can be highly volatile, leading to significant price fluctuations.

Regulatory Changes: Changes in regulations can impact the performance of individual stocks and the overall market.

Case Study: Investing in Apple Stock

Let's consider a hypothetical scenario where a Filipino investor decides to invest in Apple stock. By researching the company's financials, market trends, and competitive landscape, the investor determines that Apple is a solid investment. After opening a brokerage account and placing an order, the investor monitors the stock's performance and adjusts their portfolio as needed.

Conclusion

Trading US stocks from the Philippines can be a rewarding investment strategy. By following the steps outlined in this guide and staying informed about market trends and company performance, you can make informed decisions and potentially grow your investment portfolio. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....