Are you considering investing in stocks but unsure if you can do so within a Tax-Free Savings Account (TFSA)? If so, you're not alone. Many individuals are curious about the investment options available within a TFSA, and whether they can trade stocks within this tax-advantaged account. In this article, we'll explore the ins and outs of trading stocks in a TFSA, including the benefits, limitations, and key considerations to keep in mind.

Understanding TFSA and Stock Trading

A TFSA is a registered account in Canada that allows individuals to invest tax-free. Contributions to a TFSA are not tax-deductible, but any income or capital gains earned within the account are tax-free. This makes it an attractive option for long-term saving and investing.

When it comes to trading stocks within a TFSA, the answer is yes, you can do so. However, there are some important factors to consider before making your first trade.

Benefits of Trading Stocks in a TFSA

Tax-Free Growth: One of the primary benefits of trading stocks in a TFSA is the tax-free growth. This means that any dividends, capital gains, or interest earned on your investments will not be subject to income tax, allowing your investments to grow faster over time.

Long-Term Investing: A TFSA is an excellent vehicle for long-term investing. Since you won't have to pay taxes on the gains, you can reinvest the earnings back into the account, allowing your investments to compound over time.

Flexibility: Trading stocks in a TFSA gives you the flexibility to invest in a wide range of companies and sectors. This allows you to diversify your portfolio and potentially increase your chances of achieving higher returns.

Limitations of Trading Stocks in a TFSA

Contribution Limits: It's important to note that you have a yearly contribution limit for your TFSA. As of 2023, the annual contribution limit is $6,000. This means you need to be mindful of your contributions to avoid over-contributing and potentially incurring penalties.

Withdrawals: While withdrawals from a TFSA are tax-free, it's important to remember that once you withdraw funds, you cannot contribute to your TFSA again until the following year. This can impact your ability to reinvest and potentially grow your investments.

Account Maturity: A TFSA matures at the age of 71, at which point you must convert it into a Registered Retirement Income Fund (RRIF) or withdraw the funds. This is something to consider when planning your long-term investments.

Key Considerations for Trading Stocks in a TFSA

Diversification: Diversifying your investments within your TFSA can help reduce risk and potentially increase your returns. Consider investing in a mix of stocks, bonds, and other asset classes to achieve a well-rounded portfolio.

Risk Tolerance: When trading stocks in a TFSA, it's important to consider your risk tolerance. While stocks have the potential for high returns, they also come with higher risk. Make sure you're comfortable with the level of risk you're taking on.

Research and Due Diligence: Before investing in stocks within your TFSA, it's crucial to conduct thorough research and due diligence. This includes analyzing financial statements, understanding the company's business model, and assessing its competitive position in the market.

Case Study: Investing in Tech Stocks in a TFSA

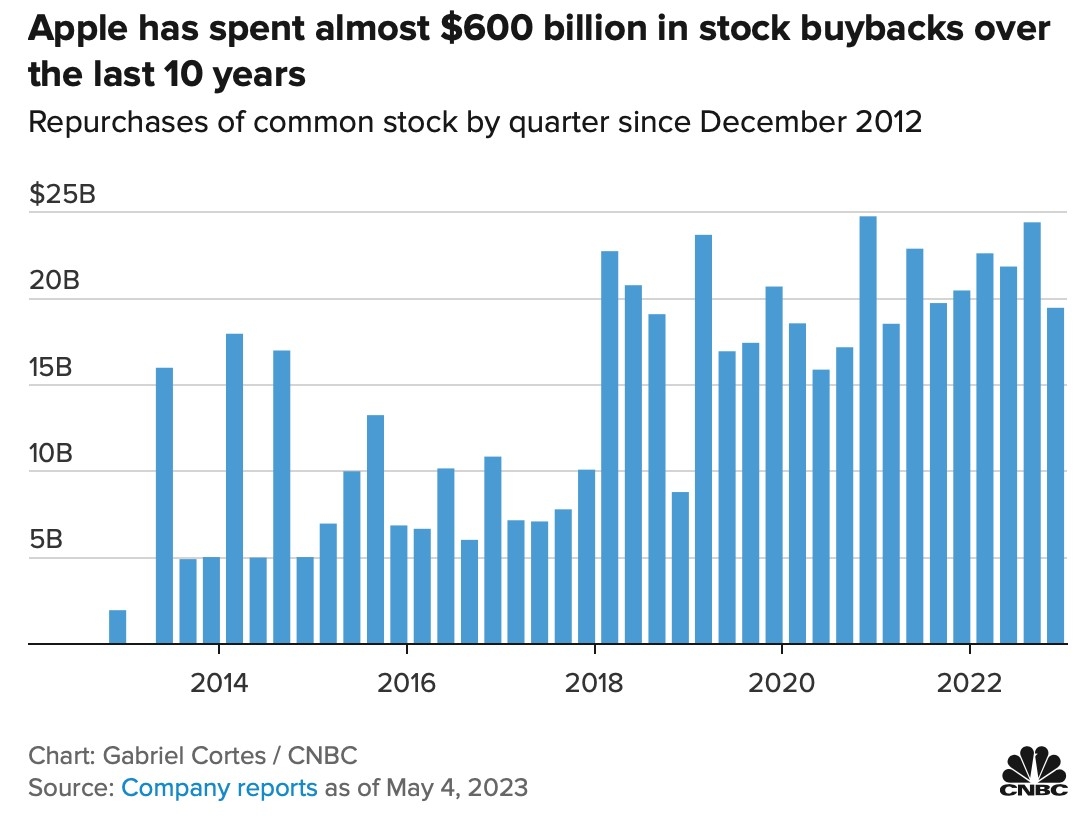

Imagine you're interested in investing in tech stocks within your TFSA. One company you're considering is Apple Inc. (AAPL). Before making the investment, you conduct thorough research, including analyzing the company's financial statements, growth prospects, and market trends.

After careful consideration, you decide to allocate a portion of your TFSA to Apple Inc. Over the next few years, the stock appreciates significantly, and you earn a substantial return on your investment. By utilizing your TFSA for this investment, you were able to benefit from the tax-free growth, allowing your investments to compound over time.

In conclusion, trading stocks within a TFSA can be a valuable investment strategy for many individuals. By understanding the benefits, limitations, and key considerations, you can make informed decisions and potentially achieve higher returns on your investments. Remember to conduct thorough research, diversify your portfolio, and stay mindful of your contribution limits to maximize the benefits of your TFSA.

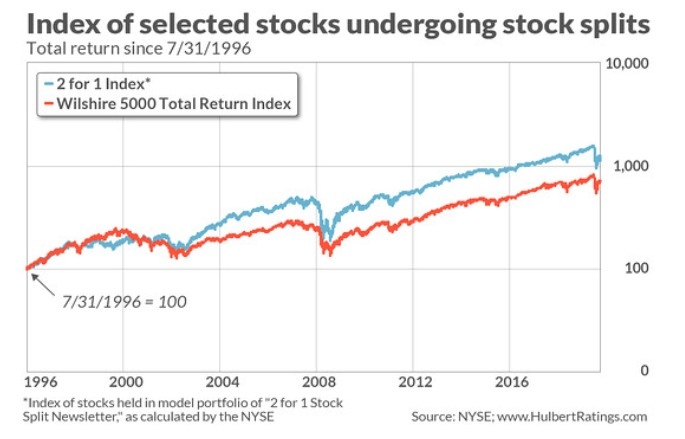

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....