Are you a foreign investor looking to diversify your portfolio by investing in U.S. stocks? You're not alone. The U.S. stock market is one of the largest and most liquid in the world, attracting investors from all corners of the globe. In this article, we'll explore the steps and considerations for foreign investors to buy U.S. stocks, ensuring a smooth and successful investment journey.

Understanding the Basics

Before diving into the process, it's essential to understand the basics of U.S. stocks. A stock represents a share of ownership in a company. When you buy a stock, you become a partial owner of that company, entitled to a portion of its profits and voting rights in certain matters.

Opening a Brokerage Account

The first step for foreign investors is to open a brokerage account. A brokerage account is a secure account that allows you to buy and sell stocks. Several online brokers offer brokerage accounts specifically tailored for foreign investors, including Charles Schwab, TD Ameritrade, and E*TRADE.

To open an account, you'll need to provide personal information, including your name, address, and tax identification number. Some brokers may also require additional documentation, such as a passport or driver's license.

Understanding U.S. Tax Implications

Foreign investors must be aware of the tax implications of owning U.S. stocks. The U.S. government levies a 30% tax on dividends paid to foreign investors. However, many countries have tax treaties with the U.S. that reduce or eliminate this tax.

It's crucial to consult with a tax professional or financial advisor to understand the specific tax obligations and ensure compliance with both U.S. and your home country's tax laws.

Choosing U.S. Stocks

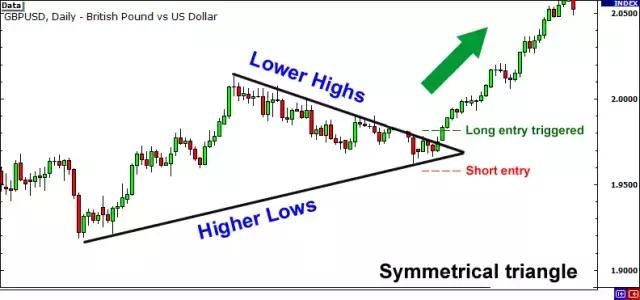

Once you have your brokerage account set up, it's time to choose U.S. stocks to invest in. Here are some popular investment strategies:

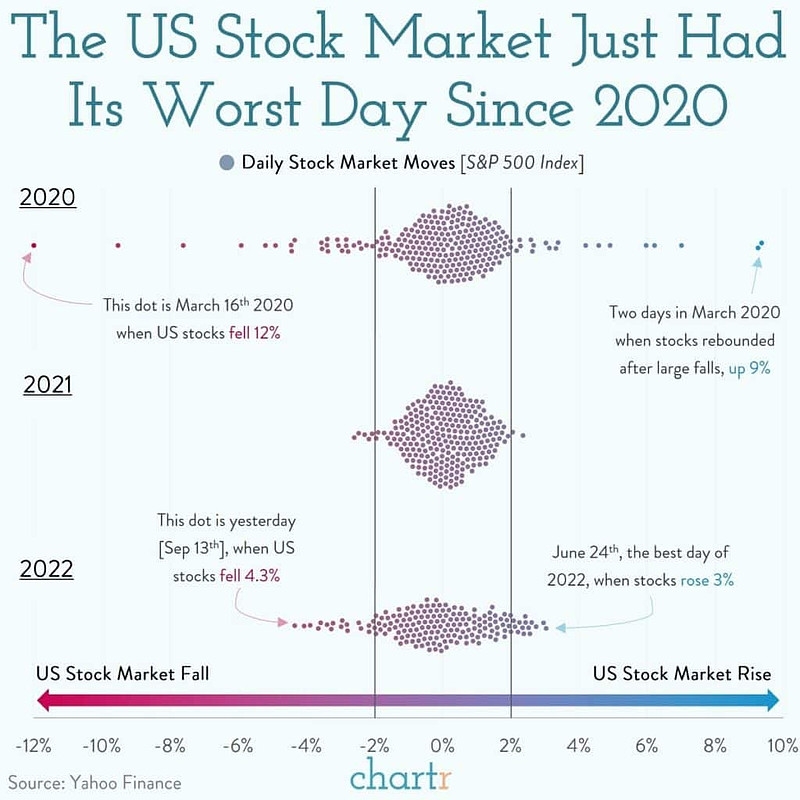

- Index Funds: Index funds track the performance of a specific market index, such as the S&P 500. They offer diversification and lower fees compared to individual stocks.

- Sector Funds: Sector funds focus on specific industries, such as technology or healthcare. They can provide exposure to specific market trends.

- Individual Stocks: Some foreign investors prefer to invest in individual stocks, selecting companies they believe will perform well over time.

Using a Foreign Currency

When buying U.S. stocks, you'll need to convert your home currency to U.S. dollars. The exchange rate will affect the amount of U.S. stocks you can purchase. It's essential to keep an eye on exchange rates and consider the potential impact on your investment returns.

Monitoring Your Investment

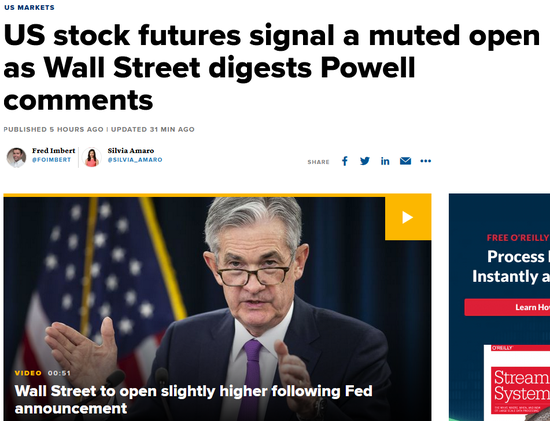

Once you've invested in U.S. stocks, it's crucial to monitor your investment regularly. Keep an eye on the company's financial performance, market trends, and economic indicators that may affect your investment.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where a foreign investor decides to invest in Apple Inc. (AAPL). After opening a brokerage account and converting their home currency to U.S. dollars, the investor purchases 100 shares of Apple at

Over the next year, Apple's stock price increases to

In this case, the investor successfully invested in a U.S. stock and earned a profit. However, it's essential to note that stock prices can fluctuate significantly, and investing in the stock market involves risks.

By following these steps and considerations, foreign investors can successfully buy U.S. stocks and diversify their investment portfolios. Remember to do thorough research, consult with financial professionals, and stay informed about market trends and economic indicators.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....