Investing in stocks can be a lucrative venture, but it requires knowledge, patience, and a well-thought-out strategy. Whether you're a beginner or an experienced investor, understanding the steps to invest in stocks in the US is crucial. This guide will walk you through the essential steps to get you started on your investment journey.

1. Educate Yourself

Before diving into the stock market, it's essential to educate yourself about the basics. Familiarize yourself with terms like stocks, bonds, mutual funds, and ETFs. Understand how the stock market operates, the factors that influence stock prices, and the risks involved. Resources like books, online courses, and financial websites can be invaluable in this process.

2. Set Your Investment Goals

Define your investment goals. Are you looking for long-term growth, income, or a mix of both? Your goals will determine the type of stocks you should invest in. For example, if you're looking for long-term growth, you might consider investing in growth stocks, while income-focused investors might prefer dividend-paying stocks.

3. Assess Your Risk Tolerance

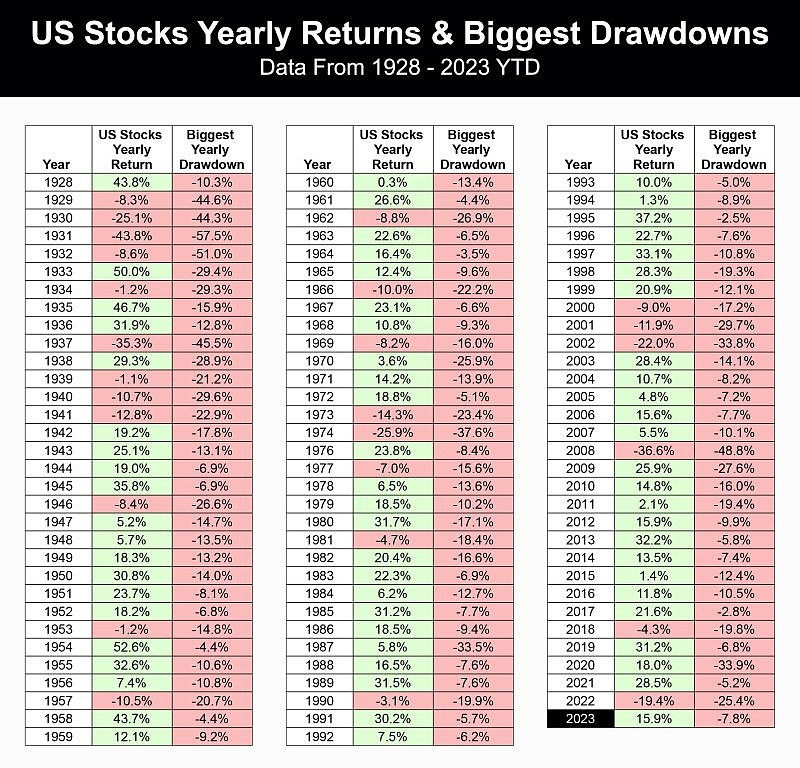

Understanding your risk tolerance is crucial in determining the right investment strategy. Risk tolerance refers to your ability to handle market volatility and potential losses. Generally, younger investors can afford to take on more risk, as they have more time to recover from market downturns.

4. Create a Budget

Determine how much money you can afford to invest. It's important to only invest money that you can afford to lose. Create a budget that allocates a portion of your income to your investment account.

5. Choose a Brokerage Account

To invest in stocks, you'll need a brokerage account. There are many brokerage firms to choose from, each offering different services and fees. Consider factors like fees, customer service, and the types of investments available when choosing a brokerage account.

6. Research and Select Stocks

Research potential stocks to invest in. Look for companies with strong fundamentals, such as a good financial track record, strong management, and a competitive advantage in their industry. Utilize tools like financial ratios, earnings reports, and market analysis to inform your decisions.

7. Diversify Your Portfolio

Diversification is key to managing risk. Don't put all your eggs in one basket. Invest in a variety of stocks across different industries and sectors. This will help protect your portfolio from the volatility of any single stock.

8. Monitor Your Investments

Regularly monitor your investments to ensure they align with your goals and risk tolerance. Stay informed about market trends, company news, and economic indicators. Adjust your portfolio as needed to maintain your desired level of risk and return.

9. Stay Patient and Disciplined

The stock market can be unpredictable, and it's easy to get caught up in the hype or panic during market downturns. Stay patient and disciplined, and avoid making impulsive decisions based on short-term market movements.

Case Study: Apple Inc.

Consider the case of Apple Inc. (AAPL), a tech giant known for its innovative products and strong financial performance. Investors who bought Apple stock in 2010 and held onto it for the long term have seen significant returns. However, those who sold off during market downturns missed out on the subsequent recovery.

By following these steps and staying informed, you can navigate the complexities of the stock market and make informed investment decisions. Remember, investing in stocks is a long-term endeavor, and patience and discipline are key to success.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....