In the ever-evolving world of technology, one company has consistently stood out as a leader in the field of screen reader software: NVDA (NVIDIA Corporation). As an investor, understanding the nuances of NVDA's stock performance is crucial. This article delves into the key aspects of NVDA's US stock, providing investors with a comprehensive guide to make informed decisions.

Understanding NVDA's Stock

NVDA is a renowned tech company known for its cutting-edge graphics processing units (GPUs). The stock, listed on the NASDAQ exchange, has seen significant growth over the years. To understand NVDA's stock, it's essential to consider several factors:

1. Financial Performance

NVDA's financial performance has been impressive. The company has reported strong revenue growth and profitability. Its diversified business model, encompassing gaming, professional visualization, data center, and automotive markets, has contributed to its robust financial health.

2. Market Trends

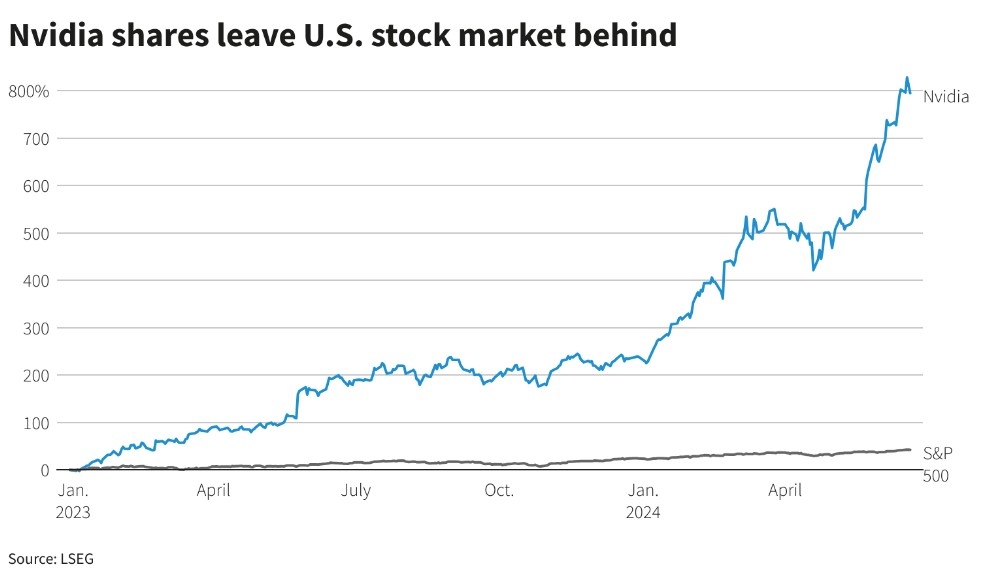

The tech industry, particularly the GPU market, is experiencing rapid growth. NVDA's position as a leader in this sector has allowed it to capitalize on this trend. The increasing demand for high-performance GPUs in gaming, AI, and autonomous vehicles has been a significant driver of NVDA's stock growth.

3. Competitive Landscape

NVDA faces stiff competition from companies like AMD and Intel. However, its unique product offerings and strategic partnerships have given it a competitive edge. NVDA's commitment to innovation and continuous improvement has helped it maintain its market dominance.

Investing Strategies

When considering an investment in NVDA's stock, it's crucial to adopt a well-thought-out strategy. Here are some key strategies to consider:

1. Long-Term Investment

NVDA's long-term prospects are promising. As the tech industry continues to grow, NVDA's position as a leader in the GPU market is likely to strengthen. Investing in NVDA's stock for the long term can be a wise decision.

2. Diversification

To mitigate risk, consider diversifying your investment portfolio. While NVDA offers significant potential for growth, incorporating other stocks into your portfolio can help balance your risk exposure.

3. Monitoring Stock Performance

Regularly monitor NVDA's stock performance to stay informed about market trends and potential risks. Utilize financial news, stock analysis, and other resources to make informed decisions.

Case Studies

Several case studies highlight the potential of investing in NVDA's stock:

1. Investment in 2016

Investors who purchased NVDA stock in 2016 have seen significant returns. The stock price has more than doubled since then, showcasing the potential of long-term investments in NVDA.

2. Partnership with Google

NVDA's partnership with Google for AI and cloud computing projects has been a positive catalyst for the stock. This collaboration has opened up new opportunities for NVDA, contributing to its growth.

Conclusion

Investing in NVDA's stock requires careful consideration of various factors. Understanding the company's financial performance, market trends, and competitive landscape is crucial for making informed decisions. By adopting a well-thought-out investment strategy and staying informed about stock performance, investors can capitalize on NVDA's potential for growth.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....