In the ever-evolving world of technology, Hon Hai Precision Industry Co., Ltd. (also known as Foxconn) has established itself as a leading player. With its extensive portfolio of electronics manufacturing services, Hon Hai's stock has garnered significant attention from investors worldwide. This article delves into the Hon Hai stock price in US dollars, providing insights into its performance and future prospects.

Understanding the Hon Hai Stock Price

The Hon Hai stock price in US dollars is a crucial indicator of the company's financial health and market performance. As of the latest data, the stock is trading at approximately $20 per share. However, it's important to note that stock prices are subject to volatility, influenced by various factors such as market trends, economic conditions, and company-specific developments.

Factors Influencing the Hon Hai Stock Price

Several factors contribute to the fluctuation of the Hon Hai stock price in US dollars. Here are some key influencers:

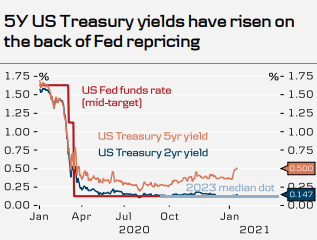

Economic Conditions: The global economic landscape plays a significant role in determining stock prices. Factors such as inflation, interest rates, and currency exchange rates can impact Hon Hai's financial performance and, subsequently, its stock price.

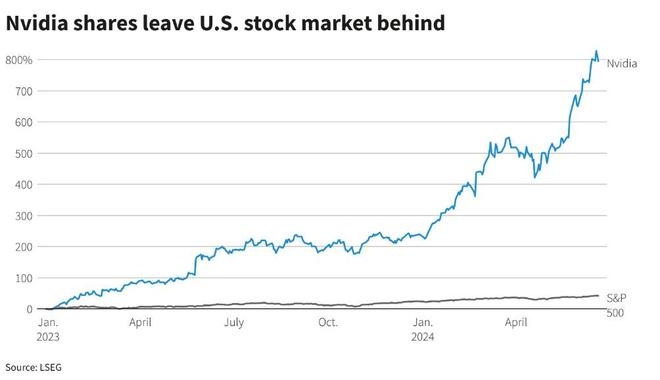

Market Trends: The technology industry, in which Hon Hai operates, is characterized by rapid innovation and changing consumer preferences. Keeping up with these trends is crucial for the company's growth, and any deviation from market expectations can lead to stock price fluctuations.

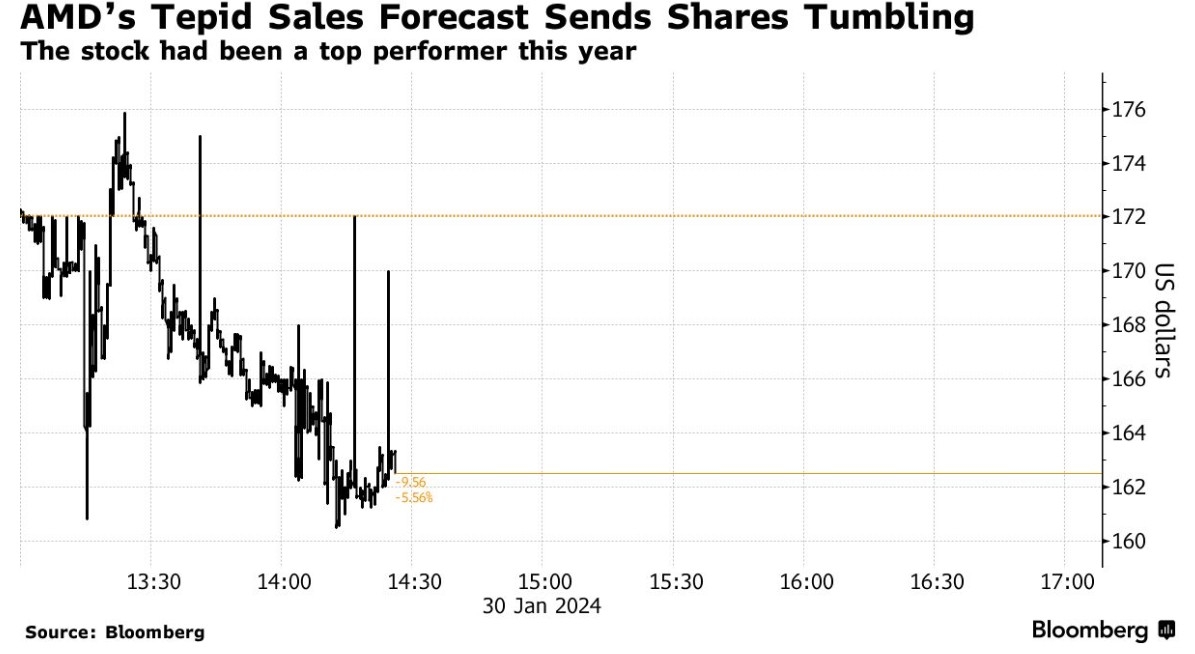

Company Performance: Hon Hai's financial results, including revenue, earnings, and growth prospects, are closely monitored by investors. Positive results can drive up the stock price, while negative news or underperformance can lead to a decline.

Supply Chain Issues: As a major manufacturer, Hon Hai's supply chain is vulnerable to disruptions. Factors such as trade tensions, geopolitical events, and natural disasters can impact the company's ability to meet demand, affecting its stock price.

Recent Developments and Future Prospects

In recent years, Hon Hai has faced several challenges, including increased competition and supply chain disruptions. However, the company has shown resilience and adaptability, investing in new technologies and expanding its business portfolio.

One notable development is Hon Hai's push into the automotive industry, where it has partnered with several major car manufacturers. This strategic move is expected to contribute significantly to the company's growth in the coming years.

Looking ahead, the Hon Hai stock price in US dollars is poised for potential growth. The company's diversification into new markets and its focus on innovation position it well for long-term success.

Case Study: Apple's Impact on Hon Hai Stock Price

A prime example of how market trends can influence Hon Hai's stock price is its relationship with Apple Inc. As Apple's primary manufacturing partner, Hon Hai's financial performance is closely tied to Apple's sales and product launches.

When Apple releases a new product, such as the iPhone or iPad, Hon Hai's order volume tends to increase, driving up the stock price. Conversely, if Apple's sales decline or faces challenges, Hon Hai's stock price may be negatively impacted.

Conclusion

The Hon Hai stock price in US dollars is a dynamic indicator of the company's performance and market outlook. By understanding the factors influencing its price and considering recent developments, investors can make informed decisions regarding their investments in Hon Hai. As the technology industry continues to evolve, Hon Hai's future prospects remain promising, making it an intriguing investment opportunity.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....