The total US stock market is a vital component of the global financial landscape, representing the collective value of all publicly traded companies within the United States. Understanding the intricacies of this vast market is crucial for investors, analysts, and individuals looking to gain insight into the health and potential growth of the American economy. This article provides a comprehensive overview of the total US stock market, covering key aspects such as market composition, major indices, and historical performance.

Market Composition

The total US stock market is composed of a diverse range of companies across various sectors and industries. This includes technology giants like Apple and Microsoft, energy companies such as ExxonMobil, and consumer goods leaders like Procter & Gamble. Additionally, the market encompasses small-cap and mid-cap companies, which offer investors opportunities for growth and diversification.

Major Indices

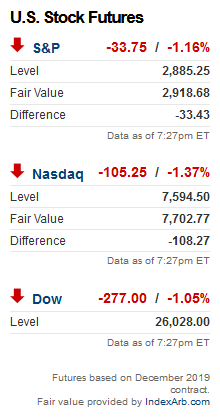

The total US stock market is represented by several major indices, each reflecting a different segment of the market. The S&P 500 is one of the most widely followed indices, representing the top 500 companies by market capitalization. The Dow Jones Industrial Average (DJIA) includes 30 large-cap companies and serves as a benchmark for the overall performance of the stock market. The NASDAQ Composite focuses on technology stocks and has gained significant prominence in recent years.

Historical Performance

The total US stock market has demonstrated strong historical performance, with significant growth over the long term. However, it is important to note that the market is subject to volatility and can experience periods of decline. For example, the dot-com bubble of the late 1990s and the financial crisis of 2008 resulted in significant losses for investors. Despite these setbacks, the market has generally trended upwards, delivering substantial returns over the long term.

Case Studies

To illustrate the performance of the total US stock market, let's consider two notable case studies:

Apple Inc.: Since its initial public offering (IPO) in 1980, Apple has become one of the most valuable companies in the world. Its stock has experienced significant growth, with a total return of over 100,000% since its IPO. This highlights the potential for substantial gains in the total US stock market for companies with strong fundamentals and innovative products.

Amazon.com Inc.: Launched in 1994, Amazon has transformed the retail industry and become a dominant force in the total US stock market. Its stock has experienced remarkable growth, with a total return of over 10,000% since its IPO. This case study underscores the potential for disruptive companies to achieve significant success in the total US stock market.

Conclusion

The total US stock market is a complex and dynamic entity, offering a wide range of investment opportunities and challenges. By understanding the market's composition, major indices, and historical performance, investors can make informed decisions and potentially achieve substantial returns. However, it is important to conduct thorough research and consider risk factors before investing in the total US stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....