The stock market has always been a reflection of the economic climate and investor sentiment. Lately, there has been a growing debate about whether the US stock market is currently in a bubble. In this article, we delve into the factors contributing to this debate and examine the historical context to provide a clearer picture.

Understanding Market Bubbles

A stock market bubble refers to a situation where the price of stocks becomes detached from their intrinsic value. This often occurs when investors are driven by optimism or speculation rather than fundamental analysis. When the bubble bursts, stock prices can plummet, leading to significant financial losses.

Factors Contributing to the Bubble Debate

Record High Valuations: The S&P 500 has been trading at record highs, with price-to-earnings (P/E) ratios well above their historical averages. This has led some experts to argue that the market is overvalued and due for a correction.

Low Interest Rates: The Federal Reserve has kept interest rates low to stimulate economic growth. While this has helped the stock market by making borrowing cheaper, it has also discouraged investors from seeking returns in fixed-income investments, pushing them towards stocks.

Speculative Trading: The rise of retail investors, particularly through platforms like Robinhood, has increased speculative trading. This has led to rapid price movements and concerns about the sustainability of these gains.

Economic Recovery Expectations: The expectation of a strong economic recovery post-pandemic has driven investor optimism, which may be contributing to the bubble debate.

Historical Context

To understand whether the current stock market is in a bubble, it's important to look at historical patterns. The dot-com bubble of the late 1990s and the housing bubble of the mid-2000s serve as cautionary tales. In both cases, excessive optimism and speculation led to market crashes.

However, it's also worth noting that the current market environment is different from these past bubbles. For instance, the tech sector is not driving the market as it did during the dot-com bubble, and there is no evidence of widespread lending and borrowing practices that contributed to the housing bubble.

Case Study: Tech Stocks

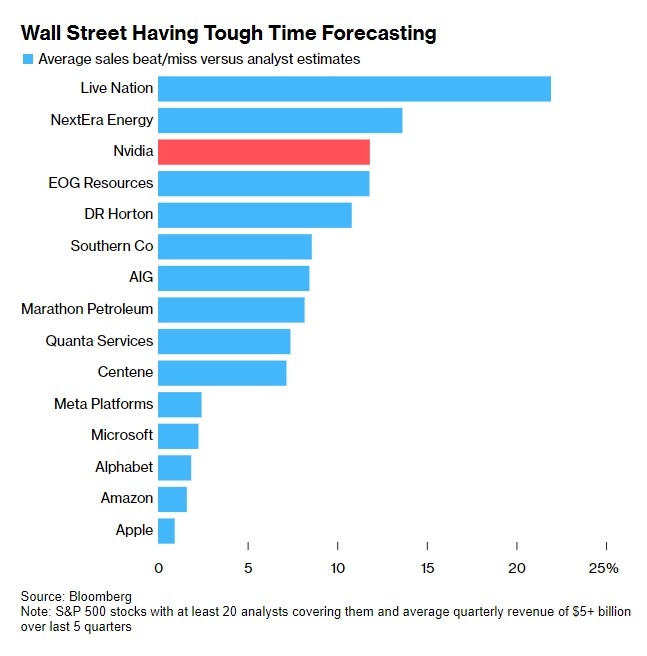

One area that has drawn particular attention is the tech sector. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar to unprecedented levels. While some argue that these companies are overvalued, others point to their strong fundamentals and potential for continued growth.

Conclusion

While there are concerns that the US stock market may be in a bubble, it's important to consider the unique factors at play. While valuations may be high, the current market environment is different from past bubbles. Investors should conduct thorough research and consider their risk tolerance before making investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....