Are you invested in the US stock market but worried about market volatility? Do you want to protect your investments from potential downturns? If so, learning how to hedge your US stocks is crucial. This comprehensive guide will walk you through the different hedging strategies available to help you mitigate risk and preserve your portfolio's value.

Understanding Hedging

Hedging is a risk management technique used to protect against potential losses in investments. It involves taking an offsetting position to counteract the potential negative impact of a market downturn. By hedging, you can limit your exposure to market volatility and reduce the risk of significant losses.

Strategies for Hedging US Stocks

- Options Contracts

One of the most popular and versatile hedging tools is options contracts. Options allow you to buy or sell a stock at a predetermined price (strike price) within a specific timeframe (expiration date). There are two types of options: call options and put options.

- Call Options: If you expect the stock to increase in value, you can buy call options to profit from the price increase.

- Put Options: If you expect the stock to decrease in value, you can buy put options to profit from the price decrease.

To hedge your US stocks using options, you can:

- Covered Calls: Sell call options on stocks you already own. This generates income and protects against potential price decreases.

- Protective Puts: Buy put options to protect your stock positions against potential declines.

- Stock Dividends

Another way to hedge your US stocks is by investing in companies that pay dividends. Dividends provide a steady stream of income and can offset potential losses. High-dividend stocks often have lower volatility and can act as a buffer against market downturns.

- Exchange-Traded Funds (ETFs)

ETFs are a type of investment fund that tracks a specific index, sector, or asset. By investing in ETFs, you can gain exposure to a diversified portfolio of stocks while hedging against market volatility. Popular hedging ETFs include:

- VIX: Tracks the implied volatility of the S&P 500 index.

- Short-Term Treasury ETFs: Invest in short-term government bonds, which tend to perform well during market downturns.

- Short Selling

Short selling is a technique where you borrow a stock and sell it at the current market price, with the intention of buying it back at a lower price later. This strategy can be used to hedge against potential stock price increases.

- Diversification

Diversifying your portfolio across different asset classes, industries, and geographical regions can help reduce risk and mitigate the impact of market downturns. A well-diversified portfolio can act as a natural hedge against volatility.

Case Studies

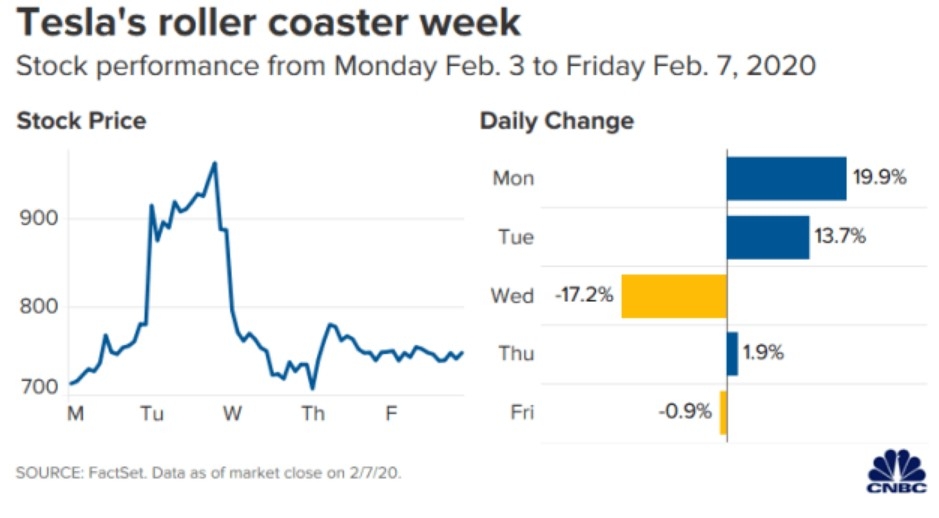

Let's look at a couple of case studies to illustrate how hedging can be effective:

Stock A: A tech stock that has experienced significant volatility. By purchasing put options on Stock A, an investor can protect their position and limit potential losses.

Sector ETF: An investor has a significant portion of their portfolio in the tech sector. By investing in a VIX ETF, they can hedge against market volatility and protect their portfolio from a sector-specific downturn.

In conclusion, hedging your US stocks is an essential strategy for managing risk and preserving your portfolio's value. By utilizing options contracts, dividends, ETFs, short selling, and diversification, you can effectively hedge against market volatility and safeguard your investments.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....