The U.S. stock market is one of the largest and most diverse in the world, offering a vast array of investment opportunities. If you're considering investing in the stock market, it's important to understand the sheer number of stocks available. In this article, we'll explore the vast array of stocks in the U.S. market and how they can impact your investment strategy.

The U.S. Stock Market Overview

The U.S. stock market is divided into several major exchanges, including the New York Stock Exchange (NYSE), the NASDAQ, and the American Stock Exchange (AMEX). These exchanges are home to a wide range of companies, from small startups to multinational corporations.

Number of Stocks in the U.S. Market

As of 2021, there are approximately 3,700 stocks listed on the NYSE and another 3,700 stocks listed on the NASDAQ. When you include other exchanges like the AMEX, the number of stocks available for investment reaches a staggering 8,000+.

Types of Stocks Available

The U.S. stock market offers a diverse range of stocks, categorized by industry, market capitalization, and geographical location. Here are some of the types of stocks you can find:

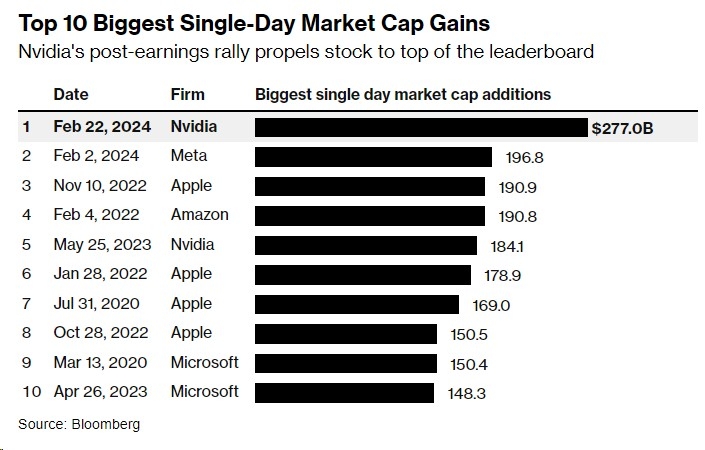

- Large-Cap Stocks: These are stocks of companies with a market capitalization of over $10 billion. They are considered stable and less volatile.

- Mid-Cap Stocks: These stocks belong to companies with a market capitalization between

2 billion and 10 billion. They offer a balance between stability and growth potential. - Small-Cap Stocks: These are stocks of companies with a market capitalization between

300 million and 2 billion. They are more volatile but can offer higher growth potential. - Micro-Cap Stocks: These stocks are associated with companies with a market capitalization below $300 million. They are highly speculative and can be more volatile.

Impact on Investment Strategy

Understanding the number of stocks available in the U.S. market can help you develop a well-rounded investment strategy. Here are a few key points to consider:

- Diversification: Investing in a diverse portfolio of stocks can help reduce your risk. By spreading your investments across different industries and market capitalizations, you can mitigate the impact of any single stock's performance on your overall portfolio.

- Research and Due Diligence: With thousands of stocks to choose from, it's crucial to conduct thorough research and due diligence before investing. Look for companies with strong fundamentals, a solid business model, and a competitive advantage in their industry.

- Market Trends: Keep an eye on market trends and economic indicators to identify potential opportunities and risks. For example, certain sectors may outperform others during different economic cycles.

Case Studies

To illustrate the diversity of stocks in the U.S. market, let's consider a few case studies:

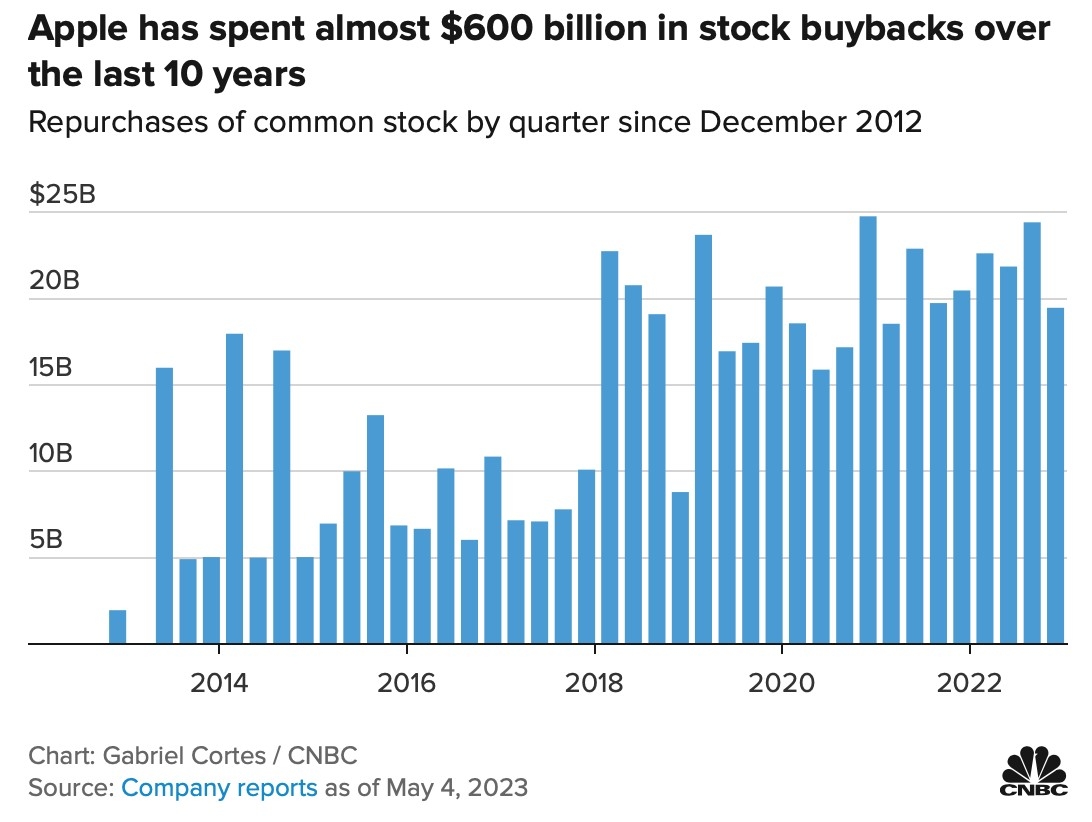

- Apple Inc. (AAPL): A large-cap stock in the technology sector, Apple is known for its innovative products and strong financial performance.

- Tesla, Inc. (TSLA): A small-cap stock in the automotive industry, Tesla has become a leader in electric vehicles and renewable energy.

- Amazon.com, Inc. (AMZN): A large-cap stock in the e-commerce sector, Amazon has revolutionized the way we shop and has a vast ecosystem of services and products.

In conclusion, the U.S. stock market offers a wide array of investment opportunities across various industries and market capitalizations. By understanding the number of stocks available and developing a well-rounded investment strategy, you can maximize your chances of success in the stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....