In today's interconnected global market, the concept of stock splits has become increasingly popular among investors. For those looking to delve into the world of international stock trading, understanding how stock splits work in the United States and across the globe is crucial. This article aims to provide a comprehensive guide to the stock US international split, covering key concepts, benefits, and potential risks.

What is a Stock Split?

A stock split occurs when a company decides to increase the number of its outstanding shares while proportionally decreasing the price of each share. This move is typically made to make the stock more accessible to a wider range of investors and can also be used as a signal of confidence in the company's future prospects.

How Does a Stock Split Work?

When a stock split occurs, the ratio of the split is determined by the company. For example, a 2-for-1 stock split means that for every share you own, you will receive an additional share. This effectively doubles the number of shares outstanding while halving the price per share.

Benefits of a Stock Split

- Increased Liquidity: A lower share price can make the stock more accessible to retail investors, increasing liquidity in the market.

- Increased Visibility: A stock with a lower price per share may receive more attention from the media and investors, potentially boosting the company's profile.

- Psychological Effect: Some investors may perceive a lower share price as a better value, which can lead to increased demand for the stock.

Risks of a Stock Split

- Short-Term Volatility: In the short term, a stock split can lead to increased volatility as investors react to the new share price.

- No Fundamental Change: While a stock split can have psychological benefits, it does not change the underlying fundamentals of the company or its financial health.

- Dividend Adjustments: In some cases, dividends may be adjusted to reflect the stock split, which could affect the income received by shareholders.

Stock US International Split: A Global Perspective

Understanding how stock splits work in the United States is essential, but it's also important to consider how they differ in other countries. For instance, some international markets may not recognize stock splits in the same way as the US, leading to potential discrepancies in share prices and valuation.

Case Studies

To illustrate the impact of stock splits, let's look at a couple of case studies:

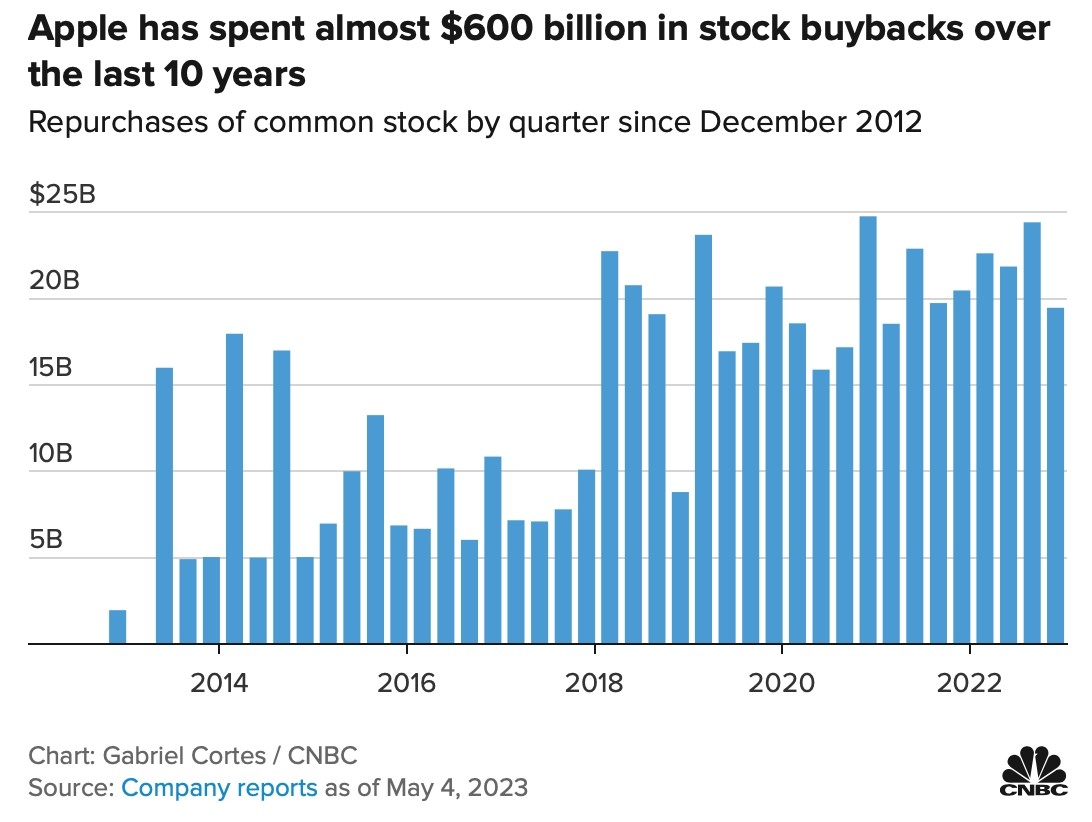

- Apple Inc.: In 2014, Apple announced a 7-for-1 stock split, reducing the share price from around

100 to 17. The split was well-received by investors, and the stock has since soared to new highs. - Amazon.com Inc.: In 2022, Amazon announced a 20-for-1 stock split, reducing the share price from around

3,000 to 150. The stock has continued to perform well since the split, with many investors viewing the lower share price as an opportunity to invest in one of the world's largest companies.

Conclusion

In conclusion, understanding the stock US international split is crucial for investors looking to navigate the complex world of international stock trading. While stock splits can offer several benefits, it's important to be aware of the potential risks and consider the broader context of the market. By staying informed and making informed decisions, investors can position themselves for success in the global market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....