Are you interested in investing in Tencent, one of the world's leading tech companies, but unsure how to get started? Buying Tencent stock in the US can be a great way to diversify your portfolio and gain exposure to the fast-growing Chinese market. In this article, we'll guide you through the process of purchasing Tencent stock in the US, step by step.

Understanding Tencent

Before diving into the buying process, it's important to have a basic understanding of Tencent and its business. Tencent is a Chinese multinational technology company that operates in various sectors, including social media, gaming, and online advertising. The company is known for its popular social media platform, WeChat, and its gaming division, which owns popular titles like Honor of Kings and PUBG Mobile.

Step 1: Open a Brokerage Account

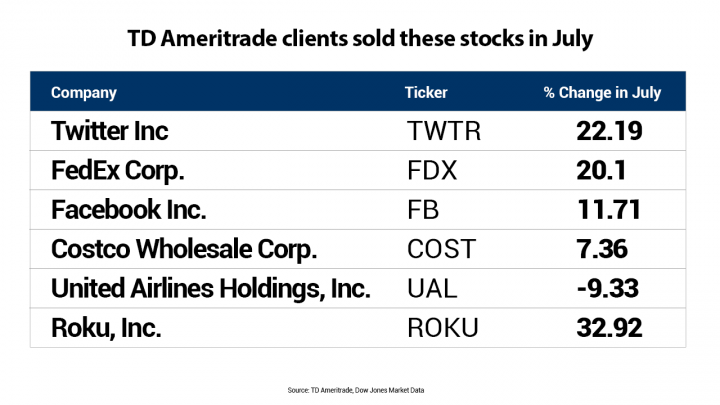

The first step in buying Tencent stock is to open a brokerage account. There are many brokerage firms available in the US, each offering different fees, trading platforms, and research tools. Some popular options include TD Ameritrade, E*TRADE, and Fidelity.

When choosing a brokerage firm, consider factors such as fees, customer service, and the availability of research tools. Many brokers offer a free trial or demo account, which can help you get a feel for their platform before making a decision.

Step 2: Fund Your Brokerage Account

Once you've opened your brokerage account, you'll need to fund it. You can do this by transferring funds from your bank account or by using a credit card. Be aware that some brokers may charge fees for depositing funds, so it's important to read the terms and conditions carefully.

Step 3: Research Tencent

Before purchasing Tencent stock, it's crucial to conduct thorough research. This includes analyzing the company's financial statements, reading news articles, and staying updated on the latest market trends. Some key factors to consider include:

- Financial Performance: Look at Tencent's revenue, profit margins, and growth rates over the past few years.

- Market Trends: Stay informed about the Chinese tech industry and how it's evolving.

- Regulatory Changes: Keep an eye on any regulatory changes that may impact Tencent's business.

Step 4: Place Your Order

Once you've completed your research and are confident in your decision, it's time to place your order. Most brokers offer online trading platforms that allow you to easily buy and sell stocks. Simply enter the number of shares you wish to purchase and click "buy."

Step 5: Monitor Your Investment

After purchasing Tencent stock, it's important to monitor your investment regularly. This includes reviewing your portfolio, staying updated on market news, and adjusting your strategy as needed. Remember that investing in stocks always involves risks, so it's crucial to stay informed and make informed decisions.

Case Study: Tencent's Stock Performance

In 2018, Tencent's stock experienced a significant decline due to regulatory concerns and a slowing Chinese economy. However, the company managed to recover and ended the year with a strong performance. This case study highlights the importance of staying informed and adapting your investment strategy as market conditions change.

Conclusion

Buying Tencent stock in the US can be a great way to diversify your portfolio and gain exposure to the fast-growing Chinese market. By following these steps and conducting thorough research, you can make informed decisions and potentially achieve strong returns on your investment.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....