Are you an Indian investor looking to diversify your portfolio by investing in the US stock market? With its vast array of companies and potential for high returns, the US stock market is an attractive option for international investors. But how can an Indian buy stocks in the US? In this article, we will explore the steps and considerations involved in purchasing stocks in the US from India.

Understanding the Basics

Before diving into the process, it's essential to have a basic understanding of the US stock market. The US stock market is home to some of the world's largest and most successful companies, including tech giants like Apple, Microsoft, and Google. The primary exchanges where stocks are traded in the US are the New York Stock Exchange (NYSE) and the NASDAQ.

Choosing a Broker

The first step in buying stocks in the US is to choose a reliable and reputable broker. There are several brokerage firms that offer services to international investors, including TD Ameritrade, E*TRADE, and Charles Schwab. When selecting a broker, consider factors such as fees, customer service, and the range of investment options available.

Opening an Account

Once you have chosen a broker, you will need to open an account. This process typically involves providing personal information, proof of identity, and proof of address. Some brokers may also require you to provide financial information, such as bank statements or tax returns.

Understanding the Risks

It's crucial to understand the risks involved in investing in the US stock market. The stock market can be volatile, and there is always a risk of losing your investment. Additionally, exchange rates can impact the value of your investment when converted back to Indian rupees.

Funding Your Account

To buy stocks in the US, you will need to fund your brokerage account. You can do this by transferring funds from your Indian bank account to your US brokerage account. Some brokers offer wire transfers, while others may require you to use a foreign currency exchange service.

Purchasing Stocks

Once your account is funded, you can start purchasing stocks. To do this, simply log in to your brokerage account, search for the stock you want to buy, and enter the desired amount. You can also set up automatic reinvestment plans, known as dividend reinvestment plans (DRIPs), to reinvest your dividends back into the company.

Monitoring Your Investment

After purchasing stocks, it's essential to monitor your investment regularly. This involves reviewing your portfolio, staying informed about market trends, and adjusting your investment strategy as needed.

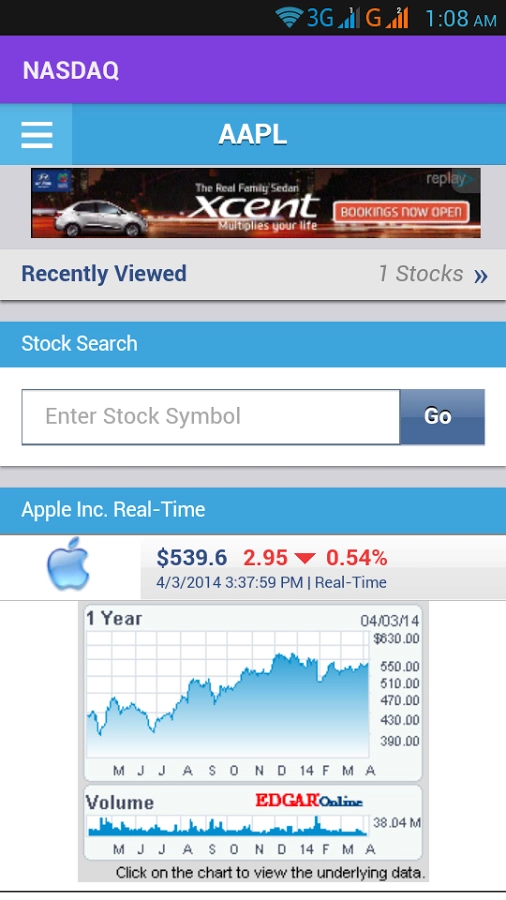

Case Study: Investing in Apple

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple Inc. (AAPL) using a US brokerage firm. The investor follows the steps outlined above, opens an account, funds it, and purchases 100 shares of Apple at $150 per share. Over the next few years, the investor monitors the stock's performance and decides to reinvest the dividends received back into the company.

By following these steps, the Indian investor successfully buys stocks in the US and gains exposure to one of the world's most successful companies.

In conclusion, buying stocks in the US from India is a feasible option for international investors looking to diversify their portfolios. By understanding the process, choosing a reliable broker, and managing the risks, you can invest in the US stock market and potentially achieve high returns.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....