The US stock market has been a beacon of economic strength and stability for decades. However, as with any financial market, there's always a possibility of a crash. This article aims to explore the potential factors that could lead to a US stock market crash, while also examining the current state of the market and its resilience.

Historical Stock Market Crashes: A Quick Overview

To understand the possibility of a future stock market crash, it's essential to look at past crashes. One of the most infamous crashes was the Black Tuesday of October 29, 1929, which marked the beginning of the Great Depression. The Dot-com Bubble in 2000 and the Financial Crisis of 2008 were other significant market downturns that served as reminders of the volatility of the stock market.

Current State of the US Stock Market

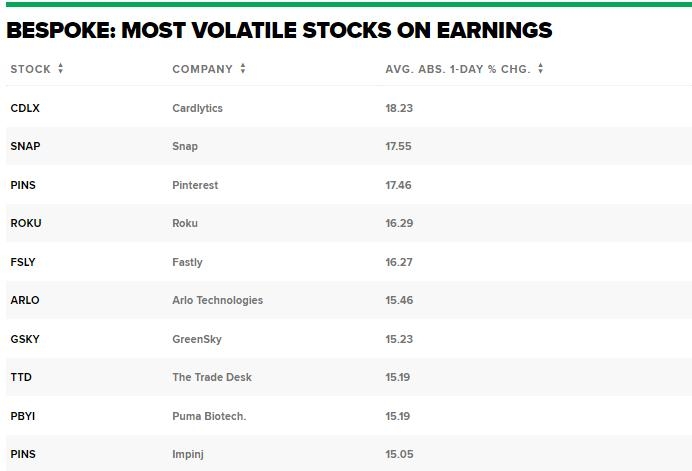

Currently, the US stock market is facing various challenges. The Federal Reserve has been raising interest rates to combat inflation, which has caused uncertainty among investors. Additionally, the COVID-19 pandemic has caused disruptions in supply chains and economic growth, further contributing to market volatility.

Factors That Could Lead to a Stock Market Crash

Several factors could potentially lead to a US stock market crash:

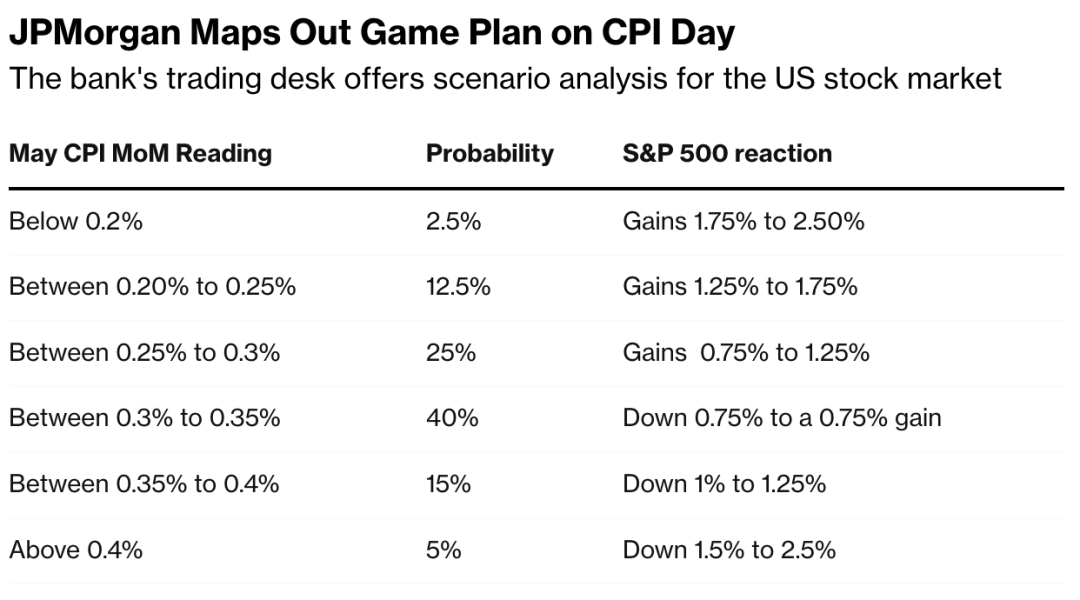

- Inflation: Persistent high inflation can erode purchasing power and lead to a decrease in stock prices.

- Interest Rates: Rising interest rates can make borrowing more expensive and impact corporate earnings.

- Economic Downturn: A recession or economic downturn can lead to a decrease in consumer spending and corporate profits.

- Political Factors: Political instability or changes in government policies can cause uncertainty and impact the stock market.

Resilience of the US Stock Market

Despite these challenges, the US stock market has shown remarkable resilience. The market has recovered from previous downturns and has continued to grow over the long term. This resilience can be attributed to several factors:

- Diversification: The US stock market is one of the most diversified markets in the world, which helps to mitigate risks.

- Strong Economic Foundation: The US economy is strong and has a stable political system.

- Innovative Companies: The US is home to many innovative companies that drive economic growth and create jobs.

Case Studies

To illustrate the potential for a stock market crash, let's look at two case studies:

- Dot-com Bubble: In the late 1990s, many investors believed that the internet would lead to rapid economic growth. As a result, technology stocks surged. However, when the bubble burst in 2000, many technology companies saw their stock prices plummet.

- Financial Crisis: In 2008, the global financial system was on the brink of collapse. Many financial institutions faced insolvency, and the stock market crashed. However, the market recovered relatively quickly, thanks to government intervention and the resilience of the economy.

Conclusion

While the possibility of a US stock market crash cannot be discounted, the market has shown remarkable resilience in the face of past challenges. Investors should be aware of potential risks but also recognize the long-term potential of the market. As always, diversifying your portfolio and consulting with a financial advisor can help you navigate the complexities of the stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....