In today's dynamic financial market, US jet stocks have emerged as a significant investment opportunity for investors looking to diversify their portfolios. This article delves into the world of US jet stocks, exploring their potential, market trends, and key factors to consider before investing.

Understanding US Jet Stocks

US jet stocks refer to the shares of companies that are involved in the aviation industry, specifically those related to aircraft manufacturing, leasing, and maintenance. These stocks can offer exposure to a thriving global aviation market that is constantly growing, driven by increased air travel demand and technological advancements.

Market Trends and Growth Opportunities

The aviation industry is expected to experience significant growth in the coming years. According to the International Air Transport Association (IATA), passenger traffic is projected to rise by 4.9% annually over the next two decades. This growth is fueled by factors such as urbanization, rising middle-class populations in emerging markets, and the increasing affordability of air travel.

Several key trends are shaping the US jet stock landscape:

Increased Demand for Single-Aisle Aircraft: Airlines are increasingly turning to single-aisle aircraft, like the Boeing 737 and Airbus A320, due to their fuel efficiency and cost-effectiveness. Companies like Boeing (BA) and Airbus (EADSY) are well-positioned to benefit from this trend.

Growth in Leasing Industry: With airlines focusing on optimizing their fleets, the aircraft leasing industry has seen a surge in demand. Companies such as AerCap (AER) and GE Capital Aviation Services (GEC) are capitalizing on this opportunity.

Expansion of Maintenance, Repair, and Overhaul (MRO) Services: As the aviation industry grows, so does the need for aircraft maintenance. Companies like Honeywell (HON) and Lufthansa (LHA) are investing in MRO services to meet the growing demand.

Key Factors to Consider When Investing in US Jet Stocks

Investing in US jet stocks requires careful consideration of several factors:

Market Sentiment: Monitor the overall market sentiment towards the aviation industry. Economic downturns can negatively impact airlines and aircraft manufacturers, affecting the performance of related stocks.

Technological Advancements: Stay informed about technological innovations in aircraft design and manufacturing. Companies that invest in research and development (R&D) are likely to stay ahead of the curve and benefit from future market trends.

Regulatory Environment: The aviation industry is heavily regulated, with regulations affecting everything from safety standards to environmental policies. Keep an eye on regulatory changes that could impact the industry and its stocks.

Case Studies

Boeing's 787 Dreamliner: Boeing's (BA) 787 Dreamliner was a game-changer in the aviation industry. The aircraft's superior fuel efficiency and spacious cabin design have made it a popular choice among airlines worldwide, contributing to Boeing's strong financial performance.

AerCap's Expansion into New Markets: AerCap (AER), one of the world's largest aircraft leasing companies, has expanded into emerging markets, such as China and Brazil. This strategic move has allowed the company to tap into high-growth regions, driving revenue growth and market share.

Conclusion

Investing in US jet stocks can offer investors exposure to a rapidly growing industry. By staying informed about market trends, technological advancements, and regulatory changes, investors can make informed decisions and potentially benefit from the industry's growth.

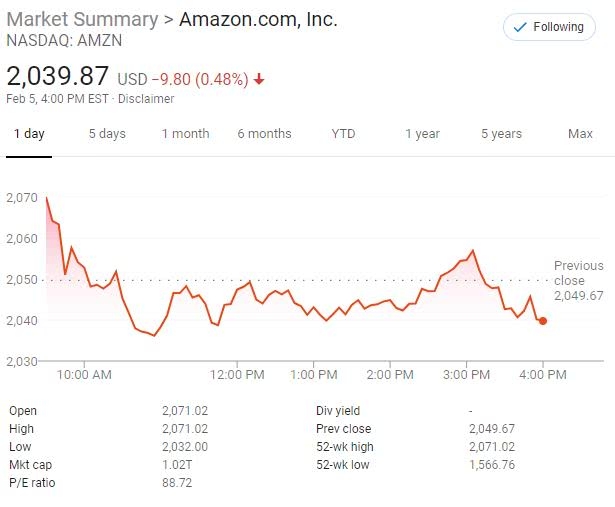

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....