The US stock market has been a cornerstone of global financial markets, attracting investors from around the world. In this US stock market briefing, we delve into the latest trends, key insights, and analysis to help you stay ahead of the curve.

Market Overview

As of the latest data, the US stock market has been experiencing a mix of growth and volatility. The S&P 500, a widely followed index, has been on an upward trend, reflecting the overall strength of the US economy. However, there have been periods of volatility, driven by various factors such as geopolitical tensions, economic data, and corporate earnings reports.

Key Trends

Tech Stocks: Tech stocks have been a major driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have seen significant gains, contributing to the overall market performance. However, there have been concerns about valuations and potential regulatory challenges.

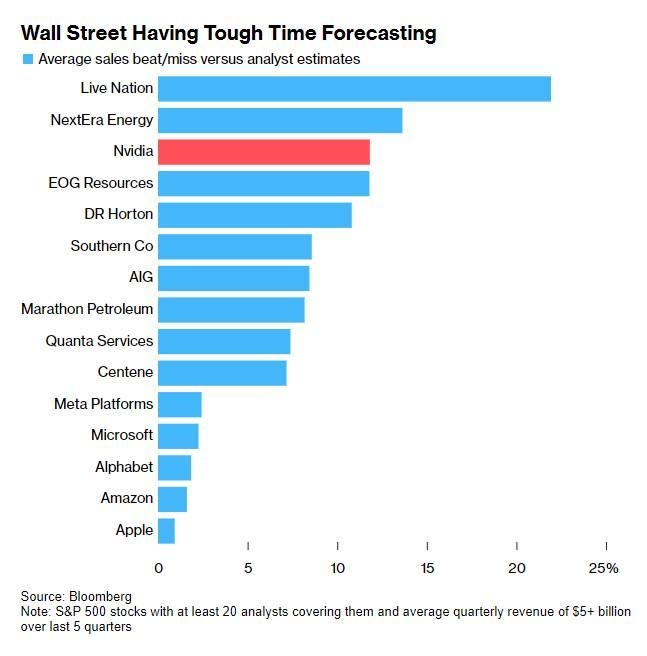

Earnings Reports: Corporate earnings reports have been a key factor in the market's movement. Positive earnings reports from major companies have supported the market's upward trend, while negative reports have caused volatility.

Interest Rates: The Federal Reserve's interest rate decisions have a significant impact on the stock market. With the Fed expected to continue raising rates, investors are closely watching for any indication of a potential slowdown in the economy.

Analysis

Valuations: The current valuations of US stocks are a topic of concern for many investors. With the market at record highs, some analysts believe that stocks may be overvalued. However, others argue that the strong economic fundamentals and potential for growth justify the current valuations.

Geopolitical Tensions: Geopolitical tensions, particularly those involving China and Russia, have been a source of uncertainty in the market. These tensions could lead to increased volatility and impact the global economy.

Inflation: Inflation remains a key concern for investors. The Federal Reserve's efforts to control inflation could lead to higher interest rates, which could negatively impact the stock market.

Case Studies

Apple: Apple's strong earnings report and continued innovation have contributed to its significant growth. The company's strong position in the tech industry and its diverse product line have helped it weather market volatility.

Tesla: Tesla's rapid growth and leadership in the electric vehicle market have made it a key player in the US stock market. However, the company's high valuations and potential regulatory challenges remain a concern.

Conclusion

The US stock market remains a complex and dynamic environment. Understanding the key trends, analysis, and case studies can help investors make informed decisions. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....