Are you looking to diversify your investment portfolio and explore opportunities in the US stock market from Australia? Trading US stocks from Australia can be a lucrative venture, but it requires a thorough understanding of the process and the associated risks. In this article, we will delve into the details of trading US stocks in Australia, including the necessary steps, key considerations, and potential benefits.

Understanding the Basics

Before diving into the specifics, it's crucial to understand the basics of trading US stocks from Australia. The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. By trading US stocks from Australia, you can gain exposure to some of the world's most successful companies, including tech giants like Apple, Microsoft, and Google.

Steps to Trading US Stocks in Australia

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm that offers access to the US stock market. Many Australian brokerage firms provide this service, so it's essential to research and compare your options.

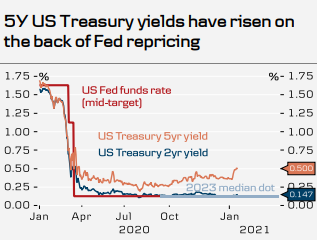

Understand the Exchange Rate: Trading US stocks from Australia involves dealing with currency exchange rates. It's crucial to understand how exchange rates can impact your investments and plan accordingly.

Choose the Right Stocks: Once you have your brokerage account, you can start researching and selecting stocks to trade. Consider factors such as the company's financial health, market trends, and your investment goals.

Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company news. This will help you make informed decisions and adjust your portfolio as needed.

Key Considerations

Regulatory Compliance: Ensure that you comply with all regulatory requirements when trading US stocks from Australia. This includes understanding tax obligations and reporting requirements.

Transaction Costs: Be aware of the transaction costs associated with trading US stocks, including brokerage fees, currency conversion fees, and other potential charges.

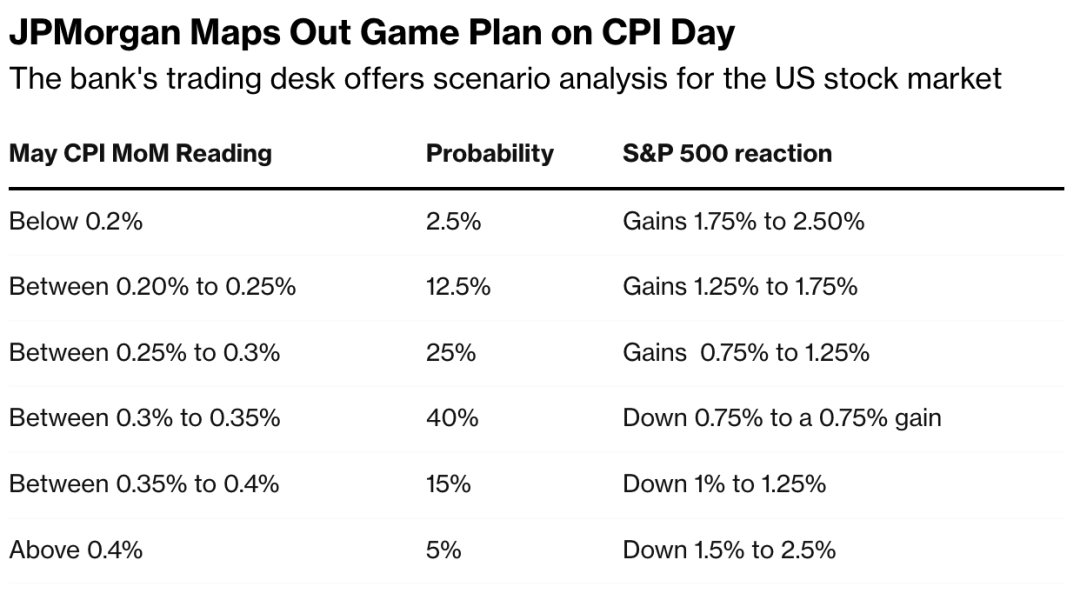

Market Volatility: The US stock market can be highly volatile, so it's crucial to be prepared for potential fluctuations in your investments.

Benefits of Trading US Stocks in Australia

Diversification: Trading US stocks can help diversify your investment portfolio, reducing risk and potentially increasing returns.

Access to Top Companies: Gain exposure to some of the world's most successful companies, including industry leaders in technology, healthcare, and more.

Potential for High Returns: The US stock market has historically offered high returns, making it an attractive option for investors seeking growth opportunities.

Case Study: Investing in Apple from Australia

Consider the case of an Australian investor who decided to invest in Apple (AAPL) from Australia. By opening a brokerage account with a firm that offers access to the US stock market, the investor was able to purchase shares of Apple. Over time, as Apple's stock price increased, the investor's investment grew, resulting in a significant return on investment.

In conclusion, trading US stocks from Australia can be a rewarding investment strategy. By understanding the process, being aware of the associated risks, and conducting thorough research, you can make informed decisions and potentially achieve significant returns.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....