Introduction: In the world of finance, the idea of the US government controlling stock prices is a topic that has sparked much debate and speculation. Some believe that the government has the power to influence stock markets, while others argue that such control is merely a myth. This article delves into the complexities of this topic, providing a balanced perspective and exploring the evidence behind the claim that the US government controls stock prices.

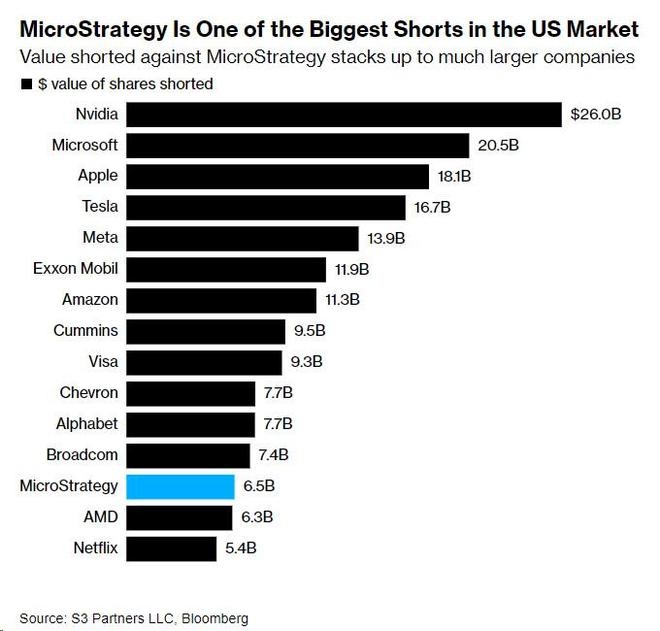

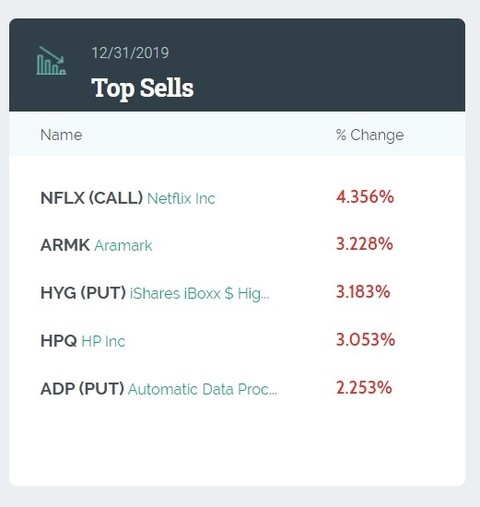

Understanding Stock Prices and Market Dynamics To grasp the issue at hand, it is essential to understand how stock prices are determined. Stock prices are influenced by various factors, including the company's financial performance, market sentiment, economic indicators, and investor behavior. The stock market is a reflection of the collective opinions and expectations of market participants.

Government Influence on Stock Markets While the US government does not directly control stock prices, it plays a significant role in shaping the overall market dynamics. Here are some ways in which the government exerts influence:

Regulatory Measures: The government implements regulations and oversight to ensure fair and transparent trading practices. Agencies such as the Securities and Exchange Commission (SEC) monitor stock exchanges and enforce rules to prevent fraud and manipulation.

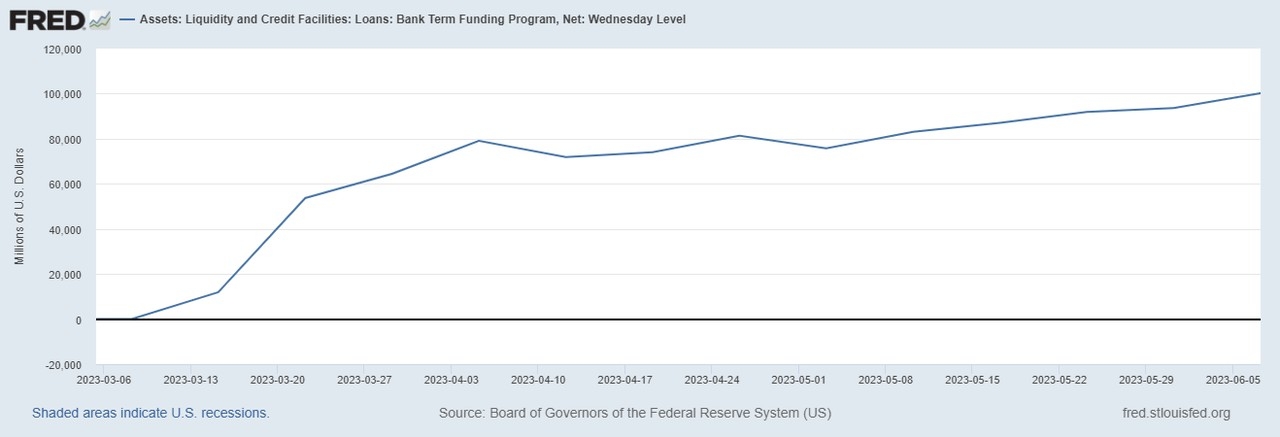

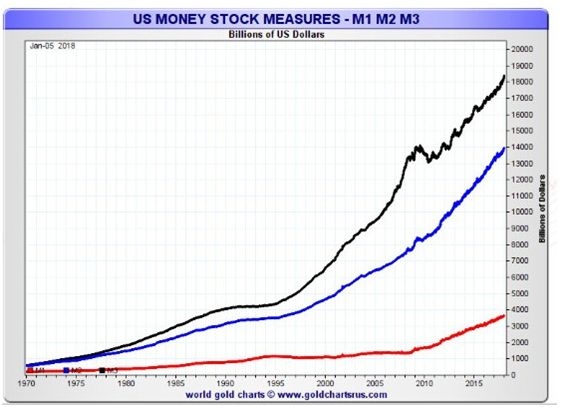

Monetary Policy: The Federal Reserve, the central banking system of the United States, controls monetary policy. By adjusting interest rates and controlling the money supply, the Federal Reserve can influence inflation, economic growth, and ultimately, stock prices.

Fiscal Policy: The government's fiscal policies, including taxation and government spending, can impact the overall economic landscape. These policies can influence corporate earnings, consumer confidence, and investor sentiment, which, in turn, can affect stock prices.

Policy Decisions: Government decisions on trade, tariffs, and regulations can have a direct impact on specific sectors or companies, leading to fluctuations in stock prices.

Market Operations: The government occasionally intervenes in the stock market through various operations, such as the purchase of securities or the sale of assets, to stabilize the market during times of crisis.

Evidence and Analysis While the government's influence on stock prices is undeniable, the extent of control remains a subject of debate. Here are some examples that support the argument:

Market Volatility: During times of economic uncertainty, the government's response can lead to significant market volatility. For instance, the government's response to the COVID-19 pandemic, including stimulus packages and monetary support, caused fluctuations in stock prices.

Historical Events: There have been instances where government actions, such as the 2008 financial crisis, led to dramatic shifts in stock prices.

Correlation Studies: Some studies have shown a correlation between government policies and stock market movements, suggesting that the government does have some influence on stock prices.

Conclusion: While the US government does not have direct control over stock prices, its influence on the market is undeniable. Through regulatory measures, monetary and fiscal policies, and policy decisions, the government plays a crucial role in shaping market dynamics. However, the extent of control remains a topic of debate, and the true impact of government actions on stock prices is a complex and multifaceted issue.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....