In recent years, the question of whether the US government is purchasing stocks has become a hot topic among investors and financial analysts. This article delves into the potential implications of such actions, exploring the rationale behind the government's involvement in the stock market and the potential impact on investors.

Understanding the Government's Role in the Stock Market

The primary responsibility of the US government is to regulate and oversee the financial markets, ensuring fair and transparent trading practices. However, in certain circumstances, the government may also choose to invest in the stock market, either directly or indirectly.

Direct Investment: The Federal Reserve

One of the most significant examples of direct government investment in stocks is through the Federal Reserve's quantitative easing (QE) program. This program involves the central bank purchasing government securities, mortgage-backed securities, and corporate bonds to stimulate economic growth and lower interest rates.

Indirect Investment: Public-Private Partnerships

Another form of indirect government investment in stocks is through public-private partnerships. In these arrangements, the government partners with private investors to purchase and manage assets, including stocks. This approach is often used in infrastructure projects and other large-scale investments.

The Rationale Behind Government Stock Purchases

There are several reasons why the US government might choose to invest in stocks:

- Stimulating Economic Growth: By purchasing stocks, the government can inject capital into the market, potentially leading to increased investment and economic growth.

- Creating Jobs: Increased investment in the stock market can lead to more jobs, as companies use the capital to expand and hire new employees.

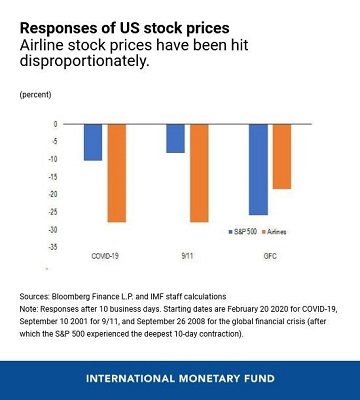

- Stabilizing the Market: In times of market turmoil, the government's involvement can help stabilize the market and prevent a complete collapse.

Potential Implications for Investors

While government stock purchases can have positive effects on the market, there are also potential implications for investors:

- Market Manipulation: Some investors may view government stock purchases as market manipulation, arguing that it creates an uneven playing field.

- Risk of Overvaluation: In some cases, government intervention may lead to overvaluation of stocks, potentially leading to a bubble that could burst in the future.

Case Study: The Federal Reserve's Quantitative Easing

One of the most notable examples of government stock purchases is the Federal Reserve's quantitative easing program. Launched in 2008, this program involved the Fed purchasing $2.3 trillion in government securities, mortgage-backed securities, and corporate bonds.

The program was designed to stimulate economic growth and lower interest rates. While it did lead to a temporary increase in stock prices, it also raised concerns about market manipulation and overvaluation.

Conclusion

The question of whether the US government is buying stocks is a complex one with significant implications for the market and investors. While government involvement can have positive effects on the economy, it also poses potential risks. As investors, it's important to stay informed and understand the potential impact of government actions on the stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....