Introduction:

The US stock market, often regarded as the most influential and dynamic in the world, has long been a subject of extensive research and analysis. An empirical study on the US stock market aims to uncover patterns, trends, and behaviors that can inform investors and policymakers alike. This article delves into the key findings of such a study, highlighting the critical aspects that shape the US stock market and providing valuable insights for those looking to navigate this complex landscape.

Market Performance and Returns

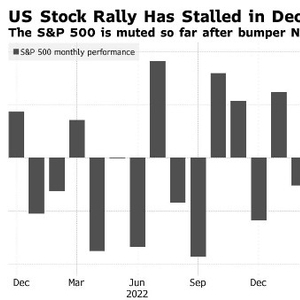

One of the primary focuses of empirical studies on the US stock market is to analyze market performance and returns. The study reveals that over the long term, the US stock market has consistently delivered positive returns, making it an attractive investment option for many. However, it is essential to note that these returns are not uniform and can be influenced by various factors, such as economic conditions, market sentiment, and geopolitical events.

Market Efficiency

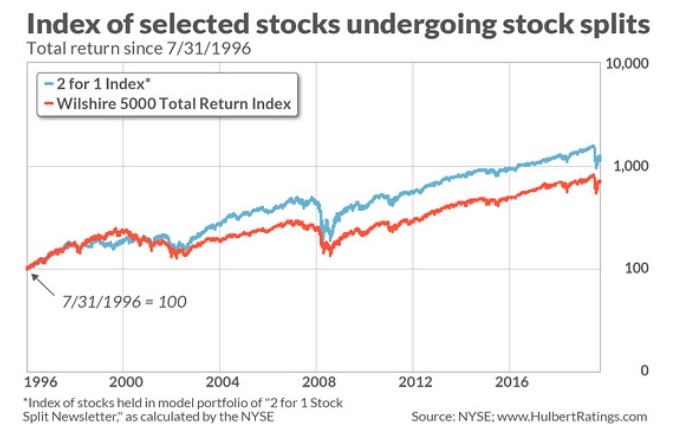

Another crucial aspect of empirical studies is the assessment of market efficiency. Market efficiency refers to the degree to which stock prices reflect all available information. The study finds that while the US stock market is generally considered efficient, there are instances where inefficiencies can be exploited. This highlights the importance of thorough research and analysis when making investment decisions.

Factors Influencing Stock Prices

Several factors influence stock prices in the US stock market. These include:

- Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, play a significant role in shaping stock prices. An empirical study shows that positive economic indicators tend to drive stock prices higher, while negative indicators can lead to declines.

- Company Performance: The financial performance of individual companies is a key driver of stock prices. Factors such as revenue growth, profit margins, and earnings per share are closely monitored by investors and can significantly impact stock prices.

- Market Sentiment: Market sentiment refers to the overall outlook and mood of investors in the market. It can be influenced by various factors, such as news events, political developments, and economic forecasts. An empirical study finds that market sentiment can have a substantial impact on stock prices.

Case Studies

To illustrate the impact of these factors on stock prices, we can look at two case studies:

- Apple Inc.: When Apple reported strong revenue and earnings growth, its stock price soared. Conversely, when the company faced criticism over labor practices and environmental concerns, its stock price suffered.

- Tesla Inc.: Tesla's stock price has been highly volatile, driven by factors such as CEO Elon Musk's tweets and the company's ambitious expansion plans. An empirical study shows that these factors can have a significant impact on stock prices.

Conclusion:

An empirical study on the US stock market provides valuable insights into the factors that shape this dynamic market. By understanding these factors, investors and policymakers can make more informed decisions and better navigate the complexities of the US stock market. While the market is not without its risks, the study's findings underscore the potential for long-term growth and profitability for those who approach it with a well-informed strategy.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....