In the fast-paced world of finance, understanding the market trading volume chart is crucial for investors and traders alike. This chart provides a visual representation of trading activity, giving insights into market trends and potential investment opportunities. In this article, we'll explore the importance of the market trading volume chart, its components, and how to effectively use it for informed decision-making.

Understanding the Basics

The market trading volume chart is a graphical representation of the total number of shares, units, or contracts bought and sold during a specific time period. It is typically presented as a bar or line graph and can be used to analyze various aspects of the market, such as liquidity, supply and demand, and market sentiment.

Key Components of a Market Trading Volume Chart

Time Frame: The time frame refers to the duration for which the trading volume is recorded. Common time frames include intraday, daily, weekly, monthly, and yearly. Choosing the right time frame is crucial as it affects the interpretation of the chart.

Volume: The volume is represented by the length of the bars or the height of the lines in the chart. A higher volume indicates greater trading activity, while a lower volume suggests less interest or movement in the market.

Price: The price is displayed on the vertical axis of the chart. It is important to note that price and volume are interconnected. For instance, a significant increase in volume with a price rise often indicates a strong bull market, while a decrease in volume with a price decline may signal a bearish trend.

Interpreting the Market Trading Volume Chart

- Accumulation: When volume increases as the price rises, it indicates accumulation, suggesting that buyers are actively participating in the market.

- Distributed: Conversely, if volume increases as the price falls, it indicates distribution, suggesting that sellers are taking profits.

- Support and Resistance: High trading volume at certain price levels can indicate strong support or resistance. For example, if a stock repeatedly encounters resistance at a specific price with high volume, it may signify a significant obstacle to further price increases.

Case Study: Apple Inc. (AAPL)

To illustrate the use of a market trading volume chart, let's consider the case of Apple Inc. (AAPL). During the past year, AAPL has experienced several instances where the trading volume increased significantly. Notably, when the stock reached a new high with high volume, it indicated a strong bull market and a favorable investment opportunity. On the other hand, when volume decreased as the price fell, it suggested that the stock may have reached a temporary low, providing an entry point for investors.

Conclusion

The market trading volume chart is an invaluable tool for investors and traders to gain insights into market trends and make informed decisions. By understanding the key components and interpreting the chart correctly, one can identify potential opportunities and avoid potential pitfalls in the market. Always remember that the trading volume chart should be used in conjunction with other analytical tools and indicators to form a comprehensive understanding of the market.

new york stock exchange

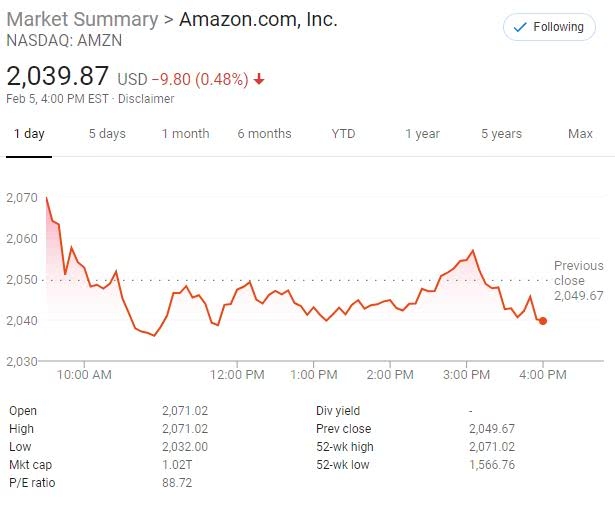

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....