Introduction

The interconnectedness of global financial markets is a well-known fact. The performance of the US stock market often influences other markets around the world. The question that arises is: do international stocks drop when US stocks decline? In this article, we delve into this correlation and analyze the reasons behind it.

Understanding the Correlation

The correlation between the US stock market and international stocks is quite evident. When the US stock market experiences a downturn, it often leads to a decline in international stocks. This correlation can be attributed to several factors:

- Economic Interdependence: The US is one of the largest economies in the world, and its economic health has a significant impact on other countries. A decline in the US stock market can indicate economic uncertainty, which can affect international markets as well.

- Investor Sentiment: When investors lose confidence in the US stock market, they may also lose confidence in other markets. This can lead to a sell-off in international stocks.

- Currency Fluctuations: The value of the US dollar often affects the value of other currencies. A weaker US dollar can make international stocks more expensive for US investors, leading to a decrease in demand and, consequently, a decline in prices.

Historical Evidence

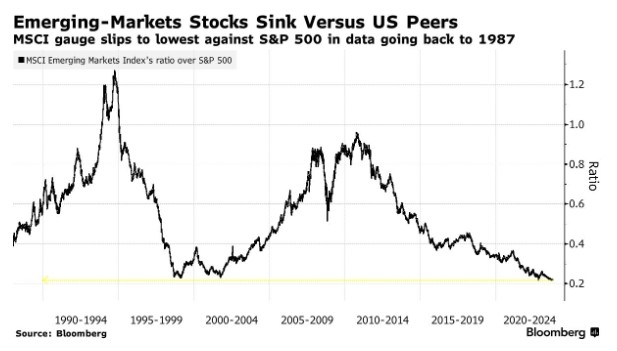

Historical data supports the notion that international stocks tend to drop when US stocks decline. For example, during the 2008 financial crisis, the US stock market crashed, and international stocks followed suit. Similarly, during the early stages of the COVID-19 pandemic, when the US stock market experienced significant volatility, international stocks were also affected.

Case Studies

Here are a few case studies that illustrate the correlation between the US stock market and international stocks:

- 2018 Stock Market Crash: In late 2018, the US stock market experienced a significant downturn. This was followed by a decline in international stocks, with the MSCI ACWI Index dropping by nearly 11% over a period of three months.

- COVID-19 Pandemic: During the early stages of the COVID-19 pandemic, when the US stock market was in turmoil, international stocks also suffered. The MSCI ACWI Index fell by nearly 30% between February and March 2020.

Conclusion

In conclusion, it is evident that there is a correlation between the US stock market and international stocks. When the US stock market declines, international stocks tend to follow suit. This correlation can be attributed to economic interdependence, investor sentiment, and currency fluctuations. As investors, it is crucial to be aware of this correlation and its potential impact on their portfolios.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....