In the dynamic world of finance, understanding the long-term performance of US stocks is crucial for investors seeking sustainable growth. This article delves into the factors influencing the long-term success of stocks in the United States, providing insights into the strategies that can lead to substantial returns.

Historical Performance

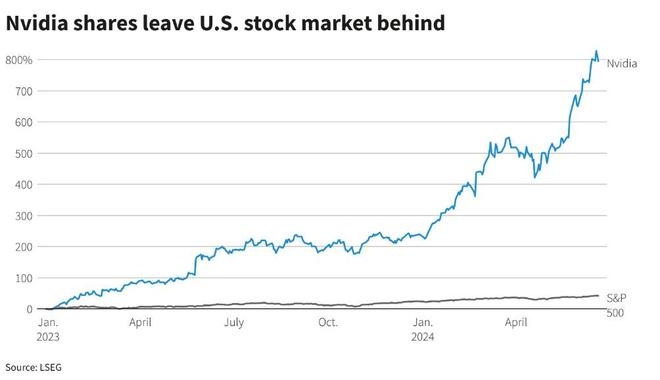

Over the past century, US stocks have demonstrated impressive long-term performance. The S&P 500, a widely followed index, has returned an average of around 10% annually since its inception in 1923. This consistent growth has made investing in US stocks a compelling option for long-term investors.

Key Factors Influencing Long-Term Performance

Several factors contribute to the long-term performance of US stocks:

- Economic Growth: The US economy has experienced steady growth over the years, leading to increased corporate earnings and stock prices.

- Dividends: Companies that consistently pay dividends tend to outperform those that do not. Dividends provide investors with a steady income stream and can contribute significantly to long-term returns.

- Quality of Management: Companies with strong management teams are more likely to make strategic decisions that drive growth and profitability.

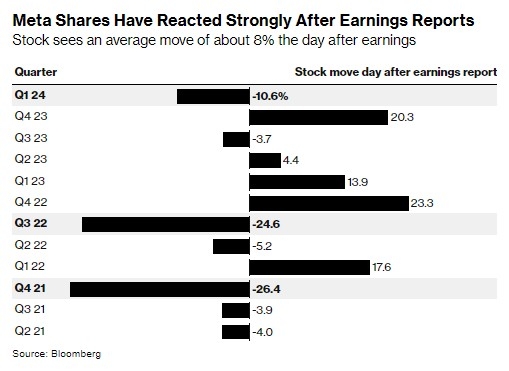

- Market Conditions: While market conditions can fluctuate, long-term investors should focus on the overall trend rather than short-term volatility.

Strategies for Long-Term Success

To achieve long-term success in US stocks, investors should consider the following strategies:

- Diversification: Diversifying your portfolio across different sectors and industries can help mitigate risk and maximize returns.

- Value Investing: Investing in companies that are undervalued relative to their intrinsic value can lead to significant gains over time.

- Long-Term Perspective: Avoiding short-term market fluctuations and focusing on long-term growth potential is crucial for successful investing.

Case Studies

Several companies have demonstrated exceptional long-term performance in the US stock market:

- Apple Inc.: Since its initial public offering in 1980, Apple has grown into one of the world's most valuable companies. Its focus on innovation and strong management has driven its remarkable growth.

- Microsoft Corporation: Another tech giant, Microsoft, has consistently delivered strong returns for investors. Its diversification into various industries, including cloud computing and gaming, has contributed to its success.

- Procter & Gamble: As a consumer goods company, Procter & Gamble has demonstrated long-term stability and growth. Its focus on innovation and brand loyalty has helped it maintain a strong market position.

Conclusion

The long-term performance of US stocks can be influenced by various factors, including economic growth, dividends, and management quality. By adopting a long-term perspective and implementing effective strategies, investors can achieve sustainable growth in their portfolios. Remember to stay diversified, focus on value investing, and maintain a long-term perspective to maximize your returns in the US stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....