On June 26, 2025, the US stock market experienced a tumultuous day, marked by significant fluctuations and a mix of gains and losses across various sectors. This article provides a comprehensive summary of the key developments and insights from the day's trading activities.

Market Overview

The day began with a cautious opening, as investors awaited the release of several important economic reports. The Dow Jones Industrial Average started the day with a modest gain, but soon faced downward pressure from the S&P 500 and the NASDAQ Composite.

Sector Performance

Technology stocks* were among the worst performers, with the NASDAQ Composite falling more than 1%. Companies like Apple, Microsoft, and Amazon experienced significant losses, driven by concerns about slowing growth and increasing competition.

On the other hand, energy stocks were the standout performers, with the S&P 500 Energy Sector Index rising by nearly 2%. This was largely due to rising oil prices and strong earnings reports from major oil companies like ExxonMobil and Chevron.

Economic Reports

The day's trading was also influenced by several important economic reports. The Consumer Price Index (CPI) for May came in slightly higher than expected, raising concerns about inflation. However, the Unemployment Rate remained at a low of 3.6%, indicating a strong labor market.

Market Sentiment

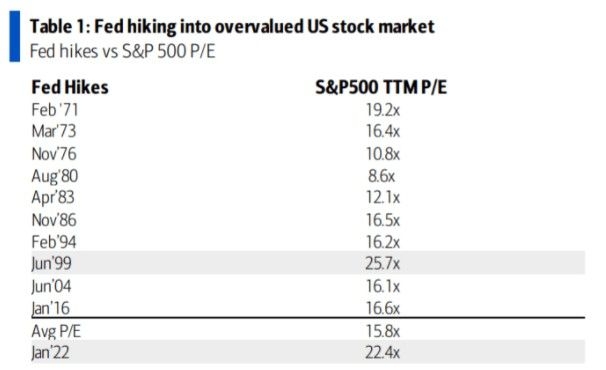

The overall market sentiment remained cautious throughout the day. Investors were concerned about the potential impact of rising inflation on the economy and the Federal Reserve's policy response. This uncertainty led to volatility in the market, with several sectors experiencing significant ups and downs.

Key Developments

- Tesla: Shares of Tesla experienced a significant drop after the company reported lower-than-expected earnings. This was driven by concerns about the company's ability to meet its production targets and rising costs.

- Bank of America: The bank reported strong earnings, driven by strong performance across its various business segments. This helped to offset some of the losses in the broader market.

- Fed Chairman Jerome Powell: In a speech later in the day, Chairman Powell emphasized the importance of maintaining price stability and expressed optimism about the economy's outlook.

Conclusion

The US stock market on June 26, 2025, was marked by significant volatility and a mix of gains and losses across various sectors. While technology stocks faced downward pressure, energy stocks and some financial companies performed well. Investors remain cautious, with concerns about inflation and the Federal Reserve's policy response. As the market continues to navigate these challenges, investors should stay informed and remain focused on the long-term outlook.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....