Are you a foreign investor looking to tap into the U.S. stock market? You're not alone. The U.S. stock market is one of the most attractive investment destinations in the world, offering a wide array of opportunities for investors of all backgrounds. In this article, we'll explore whether foreigners can buy U.S. stocks and provide a comprehensive guide to help you navigate this exciting market.

Understanding the Basics

First and foremost, it's important to understand that foreigners can indeed buy U.S. stocks. However, there are certain regulations and requirements that must be met. These regulations vary depending on the country of residence and the type of investment account you choose.

Types of U.S. Stock Market Access

There are several ways for foreigners to invest in U.S. stocks:

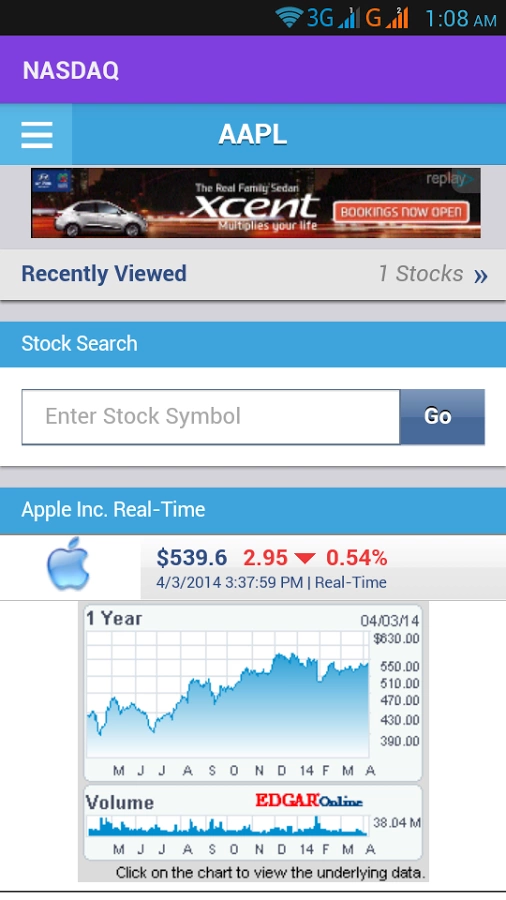

Brokerage Accounts: The most common method is through a brokerage account. This allows you to buy and sell U.S. stocks, ETFs, and other securities. Many online brokers offer accounts specifically for international investors.

Direct Investment: Some companies allow direct investment from foreign investors. This can be done by purchasing shares directly from the company or through an intermediary.

Mutual Funds and ETFs: Investing in U.S. mutual funds or ETFs is another popular option. These funds are managed by professionals and offer exposure to a diversified portfolio of U.S. stocks.

Regulatory Considerations

When investing in U.S. stocks, it's crucial to be aware of the following regulations:

Tax Implications: Foreign investors must pay taxes on any capital gains they earn from U.S. stocks. The specific tax rate depends on the country of residence and the duration of the investment.

Reporting Requirements: Some foreign investors may be required to file a tax return with the IRS, even if they don't owe any taxes.

Exchange Controls: Some countries have restrictions on the movement of capital. It's important to check if your country allows you to invest in foreign stocks.

Choosing the Right Brokerage

Selecting the right brokerage is crucial for a successful investment experience. Here are some factors to consider:

Regulatory Compliance: Ensure that the brokerage is regulated by a reputable financial authority, such as the SEC in the U.S.

Fees and Commissions: Compare fees and commissions from different brokers to find the most cost-effective option.

Customer Support: Look for a broker that offers reliable customer support, especially if you're new to investing.

Case Study: Investing in U.S. Stocks from India

Let's take a look at a hypothetical scenario involving an Indian investor named Raj:

Raj wants to invest in U.S. stocks but is unsure of the process. After researching his options, he decides to open a brokerage account with a reputable U.S. broker. He carefully reviews the fees and commissions and selects a broker that offers competitive rates.

Raj then starts investing in U.S. stocks, focusing on companies in sectors he's familiar with. Over time, his investments grow, and he achieves a significant return on his investment.

Conclusion

Investing in U.S. stocks can be a lucrative opportunity for foreign investors. By understanding the basics, considering regulatory requirements, and choosing the right brokerage, you can navigate the U.S. stock market with confidence. Whether you're looking to diversify your portfolio or seek high-growth opportunities, the U.S. stock market has something to offer.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....