Investing in US stocks from Malaysia can be a smart move for investors looking to diversify their portfolio and gain access to the world's largest and most liquid stock markets. However, navigating the process can seem daunting, especially for those unfamiliar with international trading. This comprehensive guide will walk you through the steps involved in buying US stocks from Malaysia, providing you with the knowledge and tools you need to make informed investment decisions.

Understanding the US Stock Market

The US stock market is one of the most robust and diversified in the world, offering investors a wide range of opportunities. The three major stock exchanges in the US are the New York Stock Exchange (NYSE), the NASDAQ, and the American Stock Exchange (AMEX). Each of these exchanges lists thousands of companies across various industries, providing investors with a broad selection of investment options.

Opening a Brokerage Account

To buy US stocks from Malaysia, you'll need to open a brokerage account with a reputable online brokerage firm. Many online brokers offer international trading services, making it easy for Malaysian investors to access the US stock market. When choosing a brokerage, consider factors such as fees, customer service, and the availability of research tools and resources.

Understanding the Risks

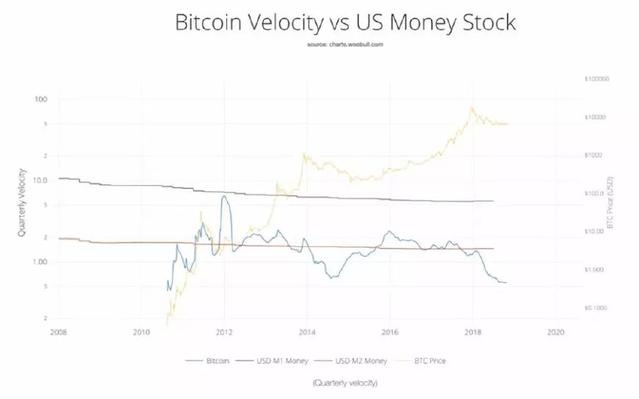

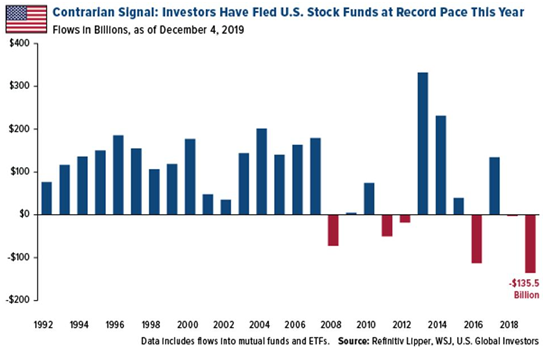

Before diving into the US stock market, it's crucial to understand the risks involved. The US stock market can be volatile, and investing in individual stocks carries the risk of potential losses. Additionally, currency exchange rates can impact your investment returns. It's essential to do your research and understand the risks before investing.

Tax Implications

Investing in US stocks from Malaysia can have tax implications. While capital gains tax is typically not owed on stock sales in Malaysia, you may be required to pay taxes on your US stock investments. It's important to consult with a tax professional to understand your specific tax obligations.

Research and Analysis

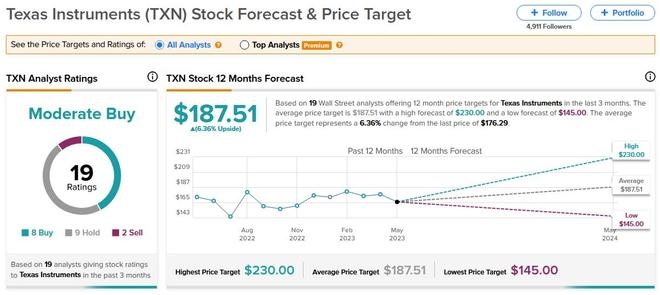

To make informed investment decisions, it's crucial to conduct thorough research and analysis. This includes analyzing financial statements, reading company news and reports, and staying up-to-date with market trends. Many online resources and tools are available to help you research and analyze US stocks, including financial websites, investment forums, and stock screeners.

Using Stop-Loss Orders

To mitigate potential losses, consider using stop-loss orders when buying US stocks. A stop-loss order is an instruction to sell a stock when it reaches a certain price, helping to limit your losses. This can be particularly useful in volatile markets.

Diversifying Your Portfolio

Diversifying your investment portfolio is a key strategy to manage risk and potentially increase returns. Consider investing in a mix of stocks across different industries and market capitalizations. This can help protect your portfolio from the impact of a downturn in any single sector.

Case Study: Apple Inc. (AAPL)

One example of a US stock that has been popular among Malaysian investors is Apple Inc. (AAPL). Apple is a technology giant known for its innovative products and strong financial performance. Over the years, the company has consistently delivered strong returns for investors, making it an attractive option for those looking to invest in the US stock market.

Conclusion

Buying US stocks from Malaysia can be a rewarding investment strategy, but it's important to approach it with knowledge and caution. By understanding the US stock market, opening a brokerage account, conducting thorough research, and managing risks, you can make informed investment decisions and potentially achieve your financial goals.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....