In the world of finance, the United States is often seen as the epicenter of stock trading. However, for investors looking beyond American borders, the question arises: Can you trade stocks outside the US? The answer is a resounding yes, and this article will delve into the exciting opportunities that global stock markets offer.

Understanding International Stock Trading

To trade stocks outside the US, you need to understand the basics of international stock trading. This involves opening a brokerage account that allows you to trade on foreign exchanges. While this process may seem daunting, it's actually quite straightforward. Many online brokers offer international trading capabilities, making it easier than ever to invest in stocks from around the world.

Benefits of Trading Stocks Outside the US

There are several compelling reasons to consider trading stocks outside the US:

Diversification: Investing in stocks from different countries can help diversify your portfolio, reducing your exposure to market-specific risks. For example, if the US stock market experiences a downturn, your investments in other markets may help offset the losses.

Access to Different Sectors: Different countries have different strengths in various sectors. By trading stocks outside the US, you can gain access to emerging markets and invest in sectors that may not be as well-represented in the US.

Higher Growth Potential: Some countries, particularly emerging markets, offer higher growth potential compared to the US. This can lead to significant returns for investors who are willing to take on more risk.

How to Get Started

To trade stocks outside the US, follow these steps:

Choose a Broker: Research and select a brokerage firm that offers international stock trading. Look for brokers with low fees, a user-friendly platform, and a strong reputation.

Open an Account: Once you've chosen a broker, open an account and fund it with the desired amount of capital.

Research and Analyze: Conduct thorough research on the stocks you're interested in. Consider factors such as the company's financial health, market trends, and geopolitical risks.

Place Your Trade: Use your broker's platform to place your trade. Be sure to understand the fees and potential risks associated with your investment.

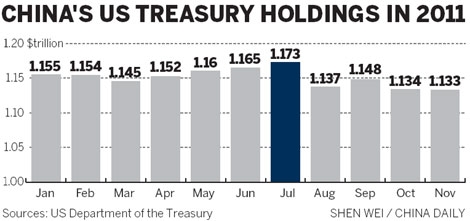

Case Study: Investing in China

One compelling example of international stock trading is investing in China. The Chinese stock market has seen significant growth over the past decade, offering investors substantial opportunities. By investing in companies like Alibaba and Tencent, you can gain exposure to the rapidly growing Chinese consumer market.

However, it's important to note that investing in China also comes with its own set of risks. Political and regulatory uncertainties, as well as currency fluctuations, can impact your investment. Therefore, it's crucial to conduct thorough research and consider your risk tolerance before investing in Chinese stocks.

Conclusion

Trading stocks outside the US is a viable option for investors looking to diversify their portfolios and gain access to global markets. By following the steps outlined in this article and conducting thorough research, you can successfully navigate the world of international stock trading and potentially achieve significant returns.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....